Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fort Company issued 5,700 of its $1,000 par value bonds for $1,530, providing total cash proceeds of $8,721,000. The market price of Fort's common

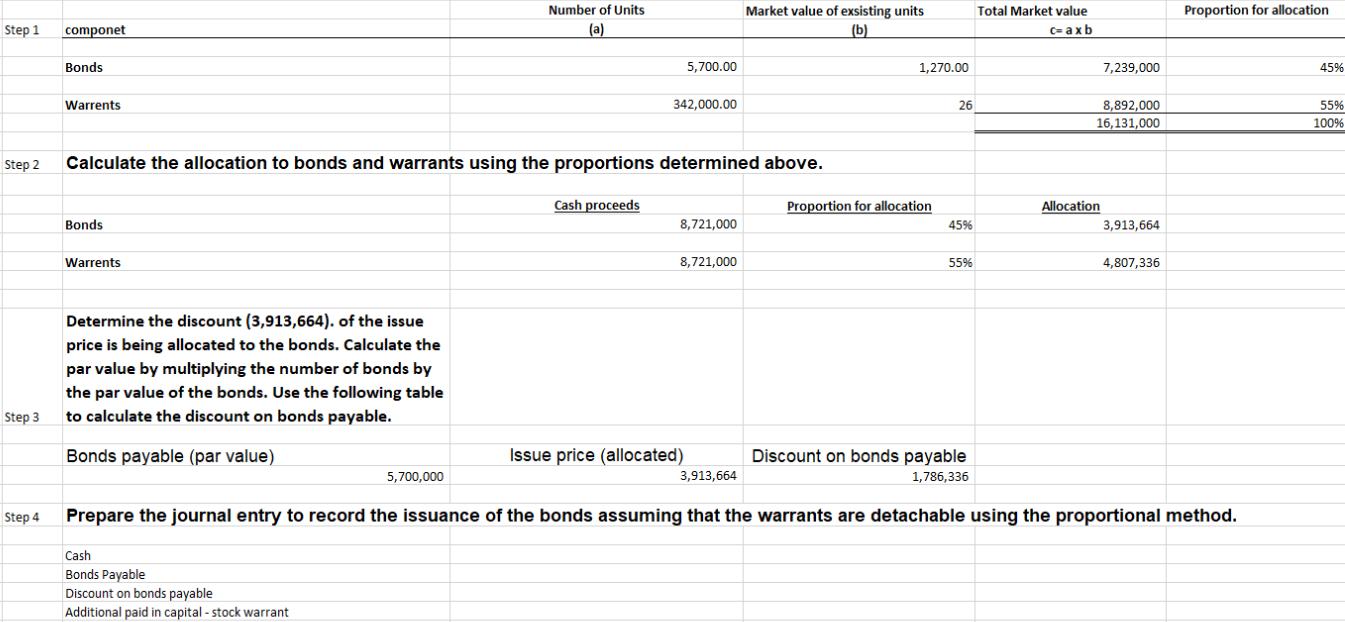

Fort Company issued 5,700 of its $1,000 par value bonds for $1,530, providing total cash proceeds of $8,721,000. The market price of Fort's common shares on the date that it issued the bonds was $26 per share. It sold the bonds with 342,000 detachable warrants to acquire 342,000 shares of the company's $2 par value common stock for $26 per share. That is, each bond carried 60 warrants x 5,700 bonds = 342,000 shares. Fort had existing bonds outstanding that trade without warrants at $1,270. There were other Fort Company warrants outstanding that trade for $26 each. Prepare the journal entry to record the issuance of the bonds assuming that the proportional method is used. (Record debits first, then credits. Exclude explanations from any journal entries. Round any intermediary calculations to the nearest hundredth of a percent, X.XX%. Round the amount you enter into the input cell to the nearest whole dollar.) Account Date of Issue Step 1 componet Bonds Warrents Number of Units (a) 5,700.00 342,000.00 Market value of exsisting units (b) Total Market value c= axb 1,270.00 7,239,000 Proportion for allocation 45% 26 8,892,000 16,131,000 55% 100% Step 2 Calculate the allocation to bonds and warrants using the proportions determined above. Cash proceeds Proportion for allocation Allocation Bonds 8,721,000 45% 3,913,664 Warrents 8,721,000 55% 4,807,336 Step 3 Determine the discount (3,913,664). of the issue price is being allocated to the bonds. Calculate the par value by multiplying the number of bonds by the par value of the bonds. Use the following table to calculate the discount on bonds payable. Bonds payable (par value) 5,700,000 Issue price (allocated) Discount on bonds payable 3,913,664 1,786,336 Prepare the journal entry to record the issuance of the bonds assuming that the warrants are detachable using the proportional method. Step 4 Cash Bonds Payable Discount on bonds payable Additional paid in capital-stock warrant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started