Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the following independent situations, answer the following questions: Required: Situation 1 Kerry received property from an aunt with a FMV of $45,800 on

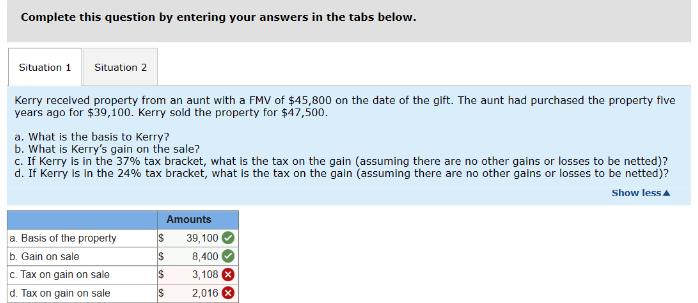

Using the following independent situations, answer the following questions: Required: Situation 1 Kerry received property from an aunt with a FMV of $45,800 on the date of the gift. The aunt had purchased the property five years ago for $39,100. Kerry sold the property for $47,500. a. What is the basis to Kerry? b. What is Kerry's gain on the sale? c. If Kerry is in the 37% tax bracket, what is the tax on the gain (assuming there are no other gains or losses to be netted)? d. If Kerry is in the 24% tax bracket, what is the tax on the gain (assuming there are no other gains or losses to be netted)? Situation 2 Kerry received property from an aunt with a FMV of $30,600 on the date of the gift. The aunt had purchased the property five years ago for $37,300. a. If Kerry sold the property for $45,500, what is the gain or loss on the sale? b. If Kerry sold the property for $35,180, what is the gain or loss on the sale? c. If Kerry sold the property for $28,480, what is the gain or loss on the sale? Complete this question by entering your answers in the tabs below. Situation 1 Situation 2 Kerry received property from an aunt with a FMV of $45,800 on the date of the gift. The aunt had purchased the property five years ago for $39,100. Kerry sold the property for $47,500. a. What is the basis to Kerry? b. What is Kerry's gain on the sale? c. If Kerry is in the 37% tax bracket, what is the tax on the gain (assuming there are no other gains or losses to be netted)? d. If Kerry is in the 24% tax bracket, what is the tax on the gain (assuming there are no other gains or losses to be netted)? Show less A Amounts a. Basis of the property b. Gain on sale $ 39,100 $ 8,400 c. Tax on gain on sale $ 3,108 d. Tax on gain on sale S 2,016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started