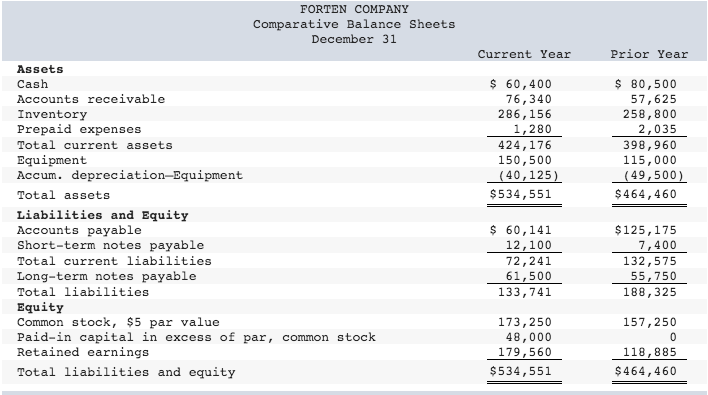

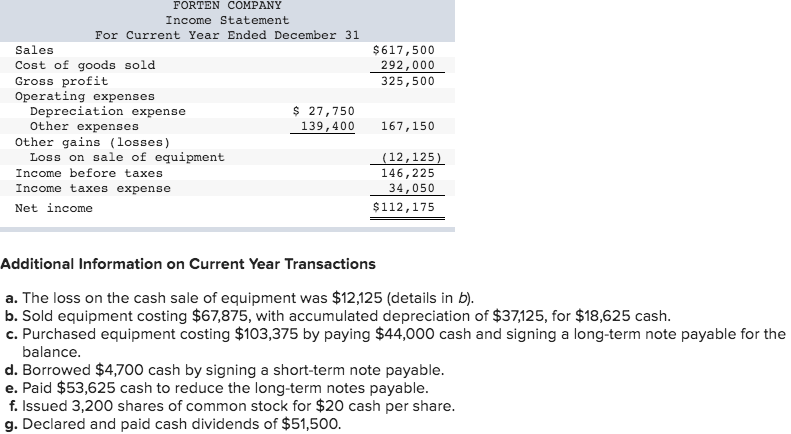

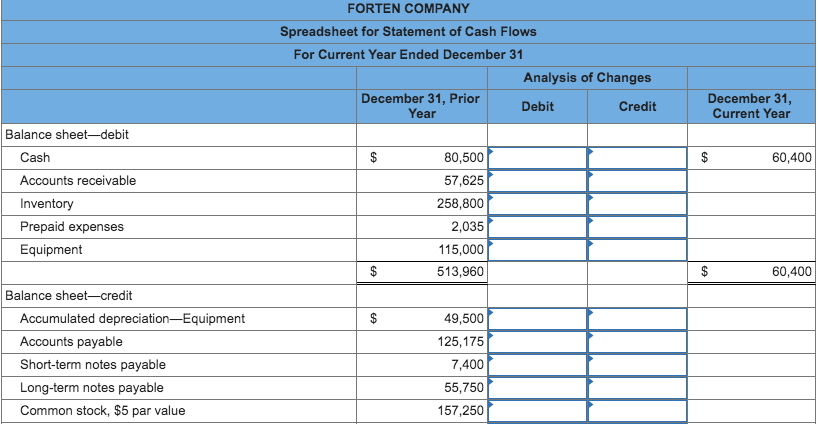

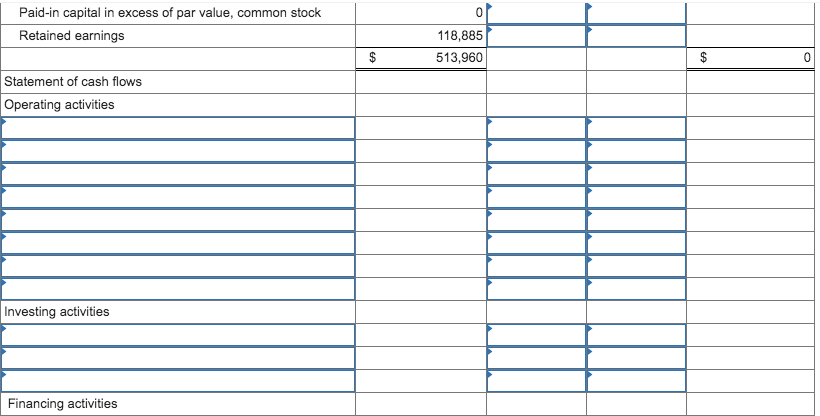

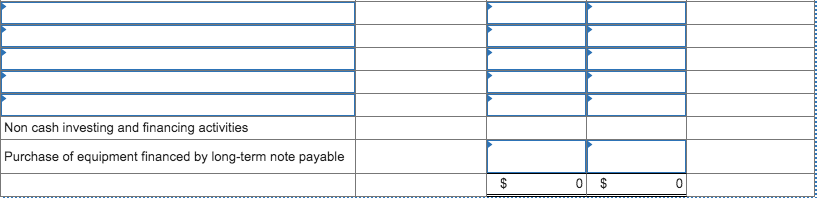

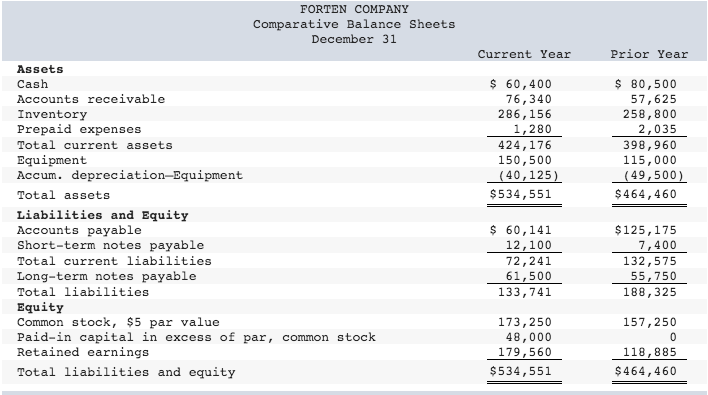

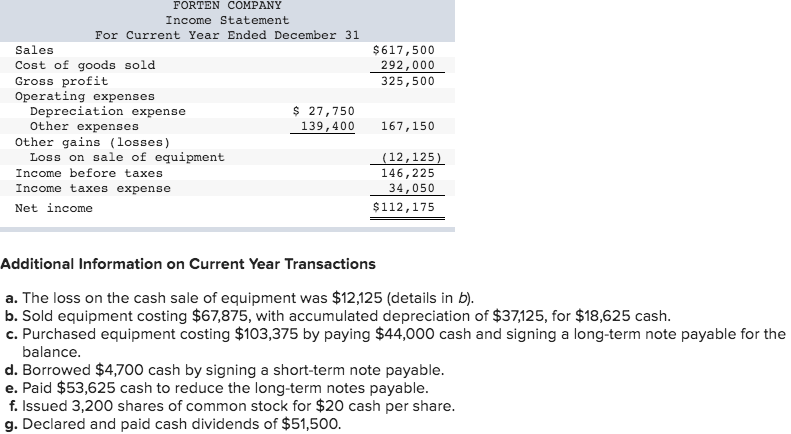

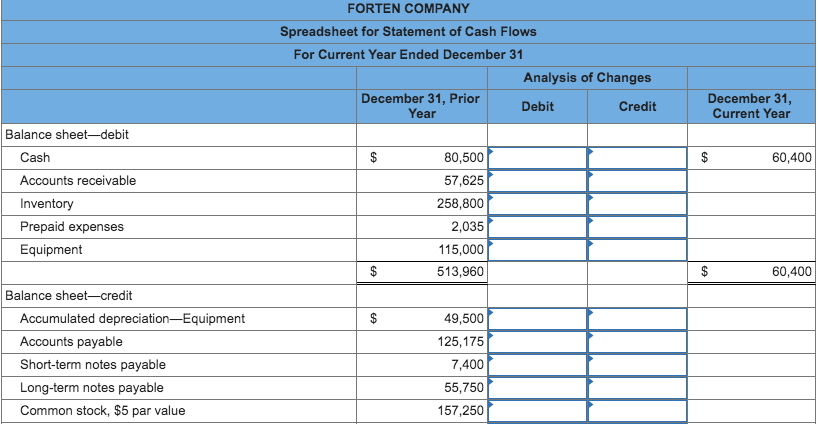

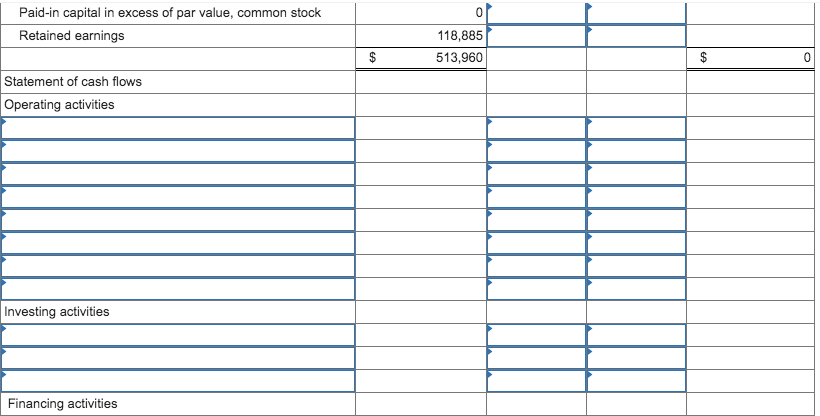

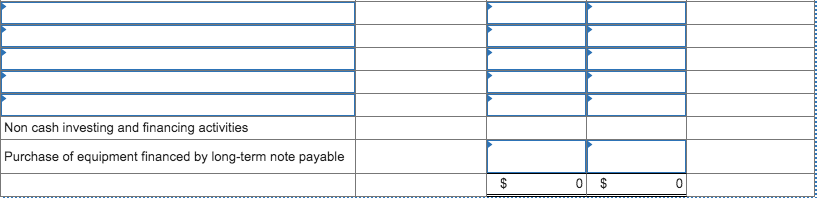

FORTEN COMPANY Comparative Balance Sheets December 31 Current Year Prior Year $ 60,400 76,340 286,156 1,280 424,176 150,500 (40,125) $534,551 $ 80,500 57,625 258,800 2,035 398,960 115,000 (49,500) $ 464,460 Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accum. depreciation-Equipment Total assets Liabilities and Equity Accounts payable Short-term notes payable Total current liabilities Long-term notes payable Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity $ 60,141 12,100 72,241 61,500 133, 741 $125, 175 7,400 132,575 55,750 188,325 173,250 48,000 179,560 $534,551 157, 250 0 118,885 $ 464,460 $617,500 292,000 325,500 FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $ 27,750 Other expenses 139,400 Other gains (losses) Loss on sale of equipment Income before taxes Income taxes expense Net income 167,150 (12,125) 146,225 34,050 $112,175 Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $12,125 (details in b). b. Sold equipment costing $67,875, with accumulated depreciation of $37,125, for $18,625 cash. c. Purchased equipment costing $103,375 by paying $44,000 cash and signing a long-term note payable for the balance. d. Borrowed $4,700 cash by signing a short-term note payable. e. Paid $53,625 cash to reduce the long-term notes payable. f. Issued 3,200 shares of common stock for $20 cash per share. g. Declared and paid cash dividends of $51,500. FORTEN COMPANY Spreadsheet for Statement of Cash Flows For Current Year Ended December 31 Analysis of Changes December 31, Prior Debit Credit Year December 31, Current Year $ $ 60,400 Balance sheet-debit Cash Accounts receivable Inventory Prepaid expenses Equipment 80,500 57,625 258,800 2,035 115,000 513,960 $ $ 60,400 $ $ Balance sheet-credit Accumulated depreciation-Equipment Accounts payable Short-term notes payable Long-term notes payable Common stock, $5 par value 49,500 125,175 7,400 55,750 157,250 0 Paid-in capital in excess of par value, common stock Retained earnings 118,885 513,960 $ $ 0 Statement of cash flows Operating activities Investing activities Financing activities Non cash investing and financing activities Purchase of equipment financed by long-term note payable $ 0 $ 0