Question

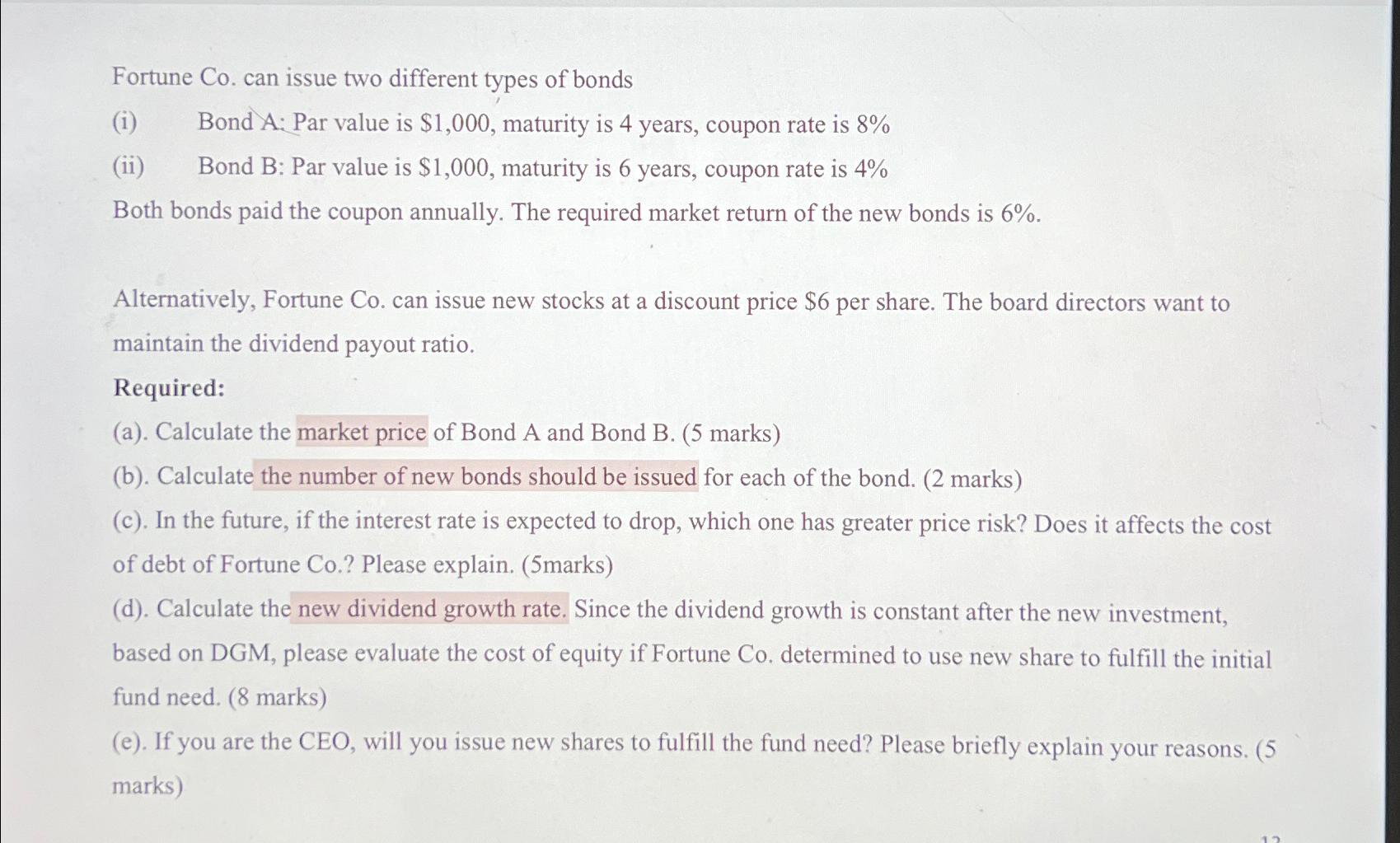

Fortune Co. can issue two different types of bonds (i) Bond A: Par value is $1,000 , maturity is 4 years, coupon rate is 8%

Fortune Co. can issue two different types of bonds\ (i) Bond A: Par value is

$1,000, maturity is 4 years, coupon rate is

8%\ (ii) Bond B: Par value is

$1,000, maturity is 6 years, coupon rate is

4%\ Both bonds paid the coupon annually. The required market return of the new bonds is

6%.\ Alternatively, Fortune Co. can issue new stocks at a discount price

$6per share. The board directors want to maintain the dividend payout ratio.\ Required:\ (a). Calculate the market price of Bond A and Bond B. (5 marks)\ (b). Calculate the number of new bonds should be issued for each of the bond. ( 2 marks)\ (c). In the future, if the interest rate is expected to drop, which one has greater price risk? Does it affects the cost of debt of Fortune Co.? Please explain. (5marks)\ (d). Calculate the new dividend growth rate. Since the dividend growth is constant after the new investment, based on DGM, please evaluate the cost of equity if Fortune Co. determined to use new share to fulfill the initial fund need. (8 marks)\ (e). If you are the CEO, will you issue new shares to fulfill the fund need? Please briefly explain your reasons. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started