Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FORUM DESCRIPTION Instructions and Mechanics about Discussion Forum: We are going to explore one question per Discussion Forum and two comments in two different cases

FORUM DESCRIPTION

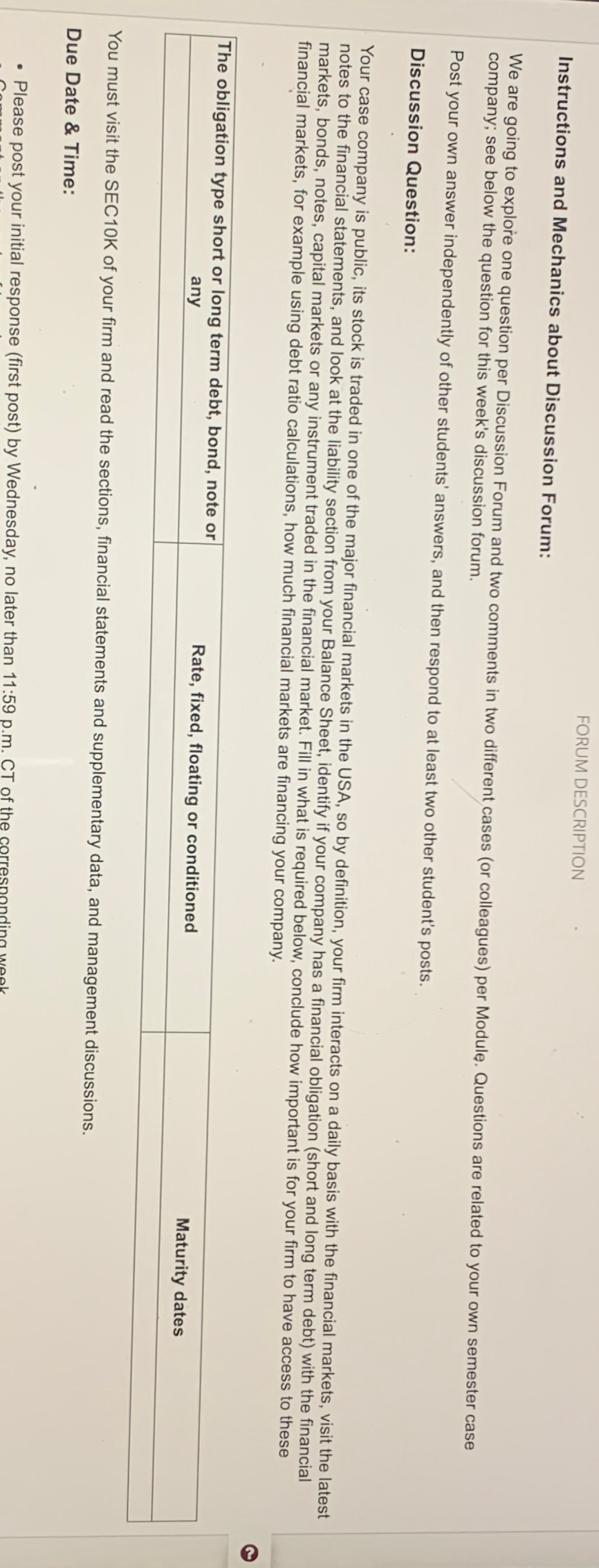

Instructions and Mechanics about Discussion Forum:

We are going to explore one question per Discussion Forum and two comments in two different cases or colleagues per Module. Questions are related to your own semester case company; see below the question for this week's discussion forum.

Post your own answer independently of other students' answers, and then respond to at least two other student's posts.

Discussion Question:

Your case company is public, its stock is traded in one of the major financial markets in the USA, so by definition, your firm interacts on a daily basis with the financial markets, visit the latest notes to the financial statements, and look at the liability section from your Balance Sheet, identify if your company has a financial obligation short and long term debt with the financial markets, bonds, notes, capital markets or any instrument traded in the financial market. Fill in what is required below, conclude how important is for your firm to have access to these financial markets, for example using debt ratio calculations, how much financial markets are financing your company.

tabletableThe obligation type short or long term debt, bond, note oranyRate, fixed, floating or conditioned,Maturity dates

You must visit the SECOK of your firm and read the sections, financial statements and supplementary data, and management discussions.

Due Date & Time:

Please post your initial response first post by Wednesday, no later than : pm CT of the corresponding wook

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started