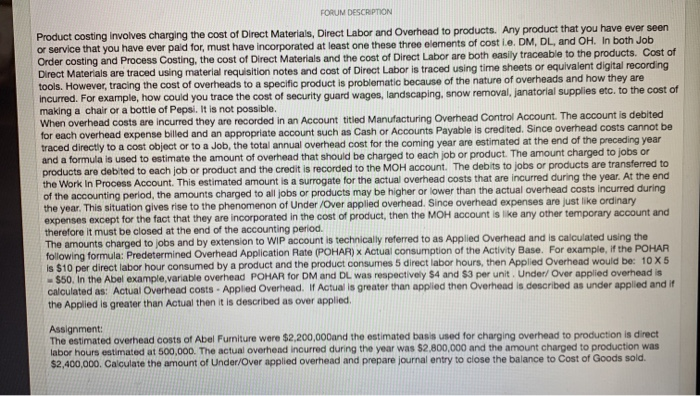

FORUM DESCRIPTION Product costing involves charging the cost of Direct Materials, Direct Labor and Overhead to products. Any product that you have ever seen or service that you have ever paid for, must have incorporated at least one these three elements of cost le. DM, DL, and OH. In both Job Order costing and Process Costing, the cost of Direct Materials and the cost of Direct Labor are both easily traceable to the products. Cost of Direct Materials are traced using material requisition notes and cost of Direct Labor is traced using time sheets or equivalent digital recording tools. However, tracing the cost of overheads to a specific product is problematic because of the nature of overheads and how they are incurred. For example, how could you trace the cost of security guard wages, landscaping, snow removal, janatorial supplies etc. to the cost of making a chair or a bottle of Pepsi. It is not possible. When overhead costs are incurred they are recorded in an Account titled Manufacturing Overhead Control Account. The account is debited for each overhead expense billed and an appropriate account such as Cash or Accounts Payable is credited. Since overhead costs cannot be traced directly to a cost object or to a Job, the total annual overhead cost for the coming year are estimated at the end of the preceding year and a formula is used to estimate the amount of overhead that should be charged to each job or product. The amount charged to jobs or products are debited to each job or product and the credit is recorded to the MOH account. The debits to jobs or products are transferred to the Work In Process Account. This estimated amount is a surrogate for the actual overhead costs that are incurred during the year. At the end of the accounting period, the amounts charged to all jobs or products may be higher or lower than the actual overhead costs incurred during the year. This situation gives rise to the phenomenon of Under/Over applied overhead. Since overhead expenses are just like ordinary expenses except for the fact that they are incorporated in the cost of product, then the MOH account is like any other temporary account and therefore it must be closed at the end of the accounting period. The amounts charged to jobs and by extension to WIP account is technically referred to as Applied Overhead and is calculated using the following formula: Predetermined Overhead Application Rate (POHAR) Actual consumption of the Activity Base. For example, if the POHAR is $10 per direct labor hour consumed by a product and the product consumes 5 direct labor hours, then Applied Overhead would be: 10 X 5 - $50. In the Abel example,variable overhead POHAR for DM and DL was respectively S4 and $3 per unit. Under/Over applied overhead is calculated as: Actual Overhead costs. Applied Overhead. If Actual is greater than applied then Overhead is described as under applied and it the Applied is greater than Actual then it is described as over applied Assignment: The estimated overhead costs of Abel Furniture were $2,200,000 and the estimated basis used for charging overhead to production is direct labor hours estimated at 500,000. The actual overhead incurred during the year was $2,800,000 and the amount charged to production was $2,400,000. Calculate the amount of Under/Over applied overhead and prepare journal entry to close the balance to Cost of Goods sold