Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Four years ago, Phutki Corp. issued a $1,000 par value, 11 percent (annual payment) coupon bond. At the time the bond was issued it had

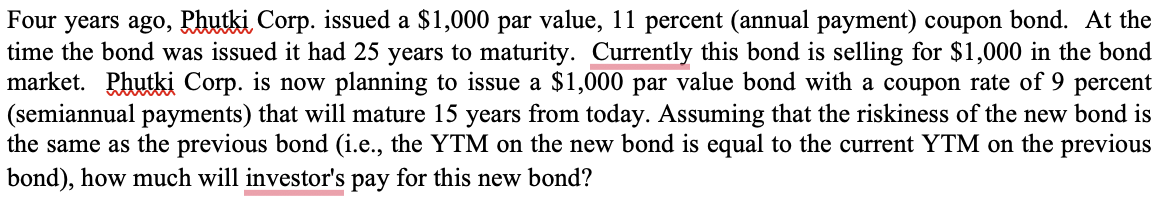

Four years ago, Phutki Corp. issued a $1,000 par value, 11 percent (annual payment) coupon bond. At the time the bond was issued it had 25 years to maturity. Currently this bond is selling for $1,000 in the bond market. Phutki Corp. is now planning to issue a $1,000 par value bond with a coupon rate of 9 percent (semiannual payments) that will mature 15 years from today. Assuming that the riskiness of the new bond is the same as the previous bond (i.e., the YTM on the new bond is equal to the current YTM on the previous bond), how much will investor's pay for this new bond

Four years ago, Phutki Corp. issued a $1,000 par value, 11 percent (annual payment) coupon bond. At the time the bond was issued it had 25 years to maturity. Currently this bond is selling for $1,000 in the bond market. Phutki Corp. is now planning to issue a $1,000 par value bond with a coupon rate of 9 percent (semiannual payments) that will mature 15 years from today. Assuming that the riskiness of the new bond is the same as the previous bond (i.e., the YTM on the new bond is equal to the current YTM on the previous bond), how much will investor's pay for this new bond Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started