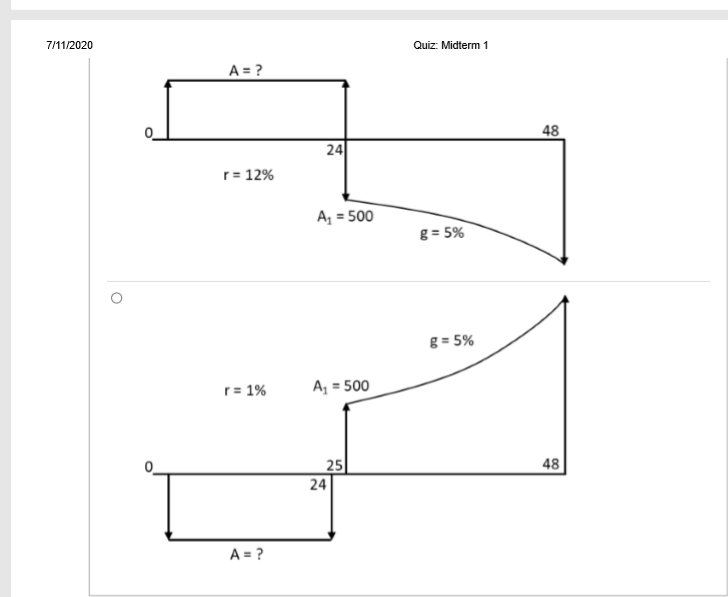

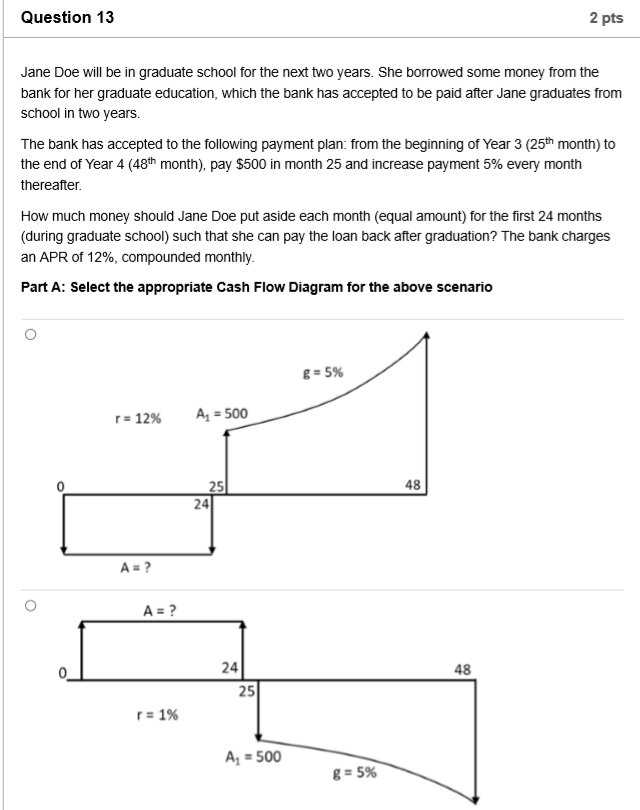

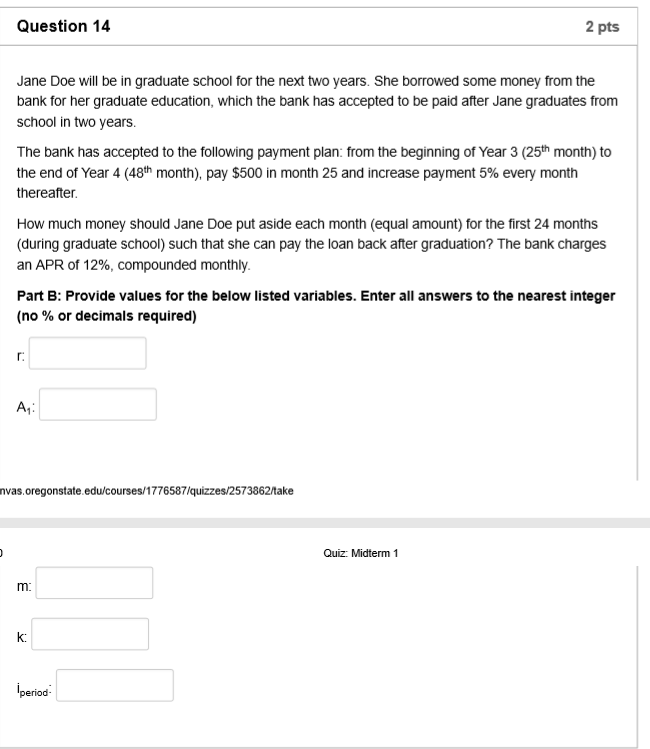

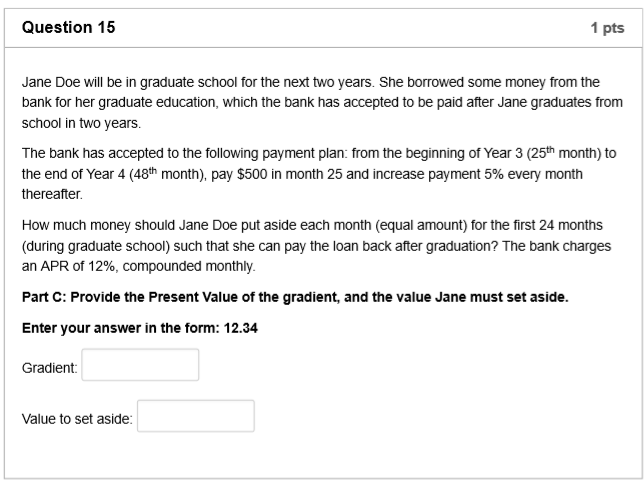

\fQuestion 1 3 2 pts Jane Doe will he in graduate school for the next two years. She borrowed some money from the bank for her graduate education, which the bank has accepted to be paid after Jane graduates from school in two years. The bani: has accepted to the following payment plan: from the beginning of Year 3 {25"1 month] to the end of Year 4 {43\" month}. pay $5111] in month 25 and increase payment 5% every month thereatter. HOW much money should Jane Doe put aside each month [equal amount} for the rst 24 months {during graduate school} such that she can pay the loan back atter graduation? The bank charges an APR of 12%, compounded monthly. Part A: Select the appropriate Gash FlowI Diagram for the above scenario CI Question 14 2 pts Jane Doe will be in graduate school for the next two years. She borrowed some money from the bank for her graduate education, which the bank has accepted to be paid after Jane graduates from school in two years. The bank has accepted to the following payment plan: from the beginning of Year 3 (25th month) to the end of Year 4 (48th month), pay $500 in month 25 and increase payment 5% every month thereafter. How much money should Jane Doe put aside each month (equal amount) for the first 24 months (during graduate school) such that she can pay the loan back after graduation? The bank charges an APR of 12%, compounded monthly. Part B: Provide values for the below listed variables. Enter all answers to the nearest integer (no % or decimals required) nvas. oregonstate.edu/courses/1776587/quizzes/2573862/take Quiz: Midterm 1 m: K Iperiod-Question 15 1 pts Jane Doe will be in graduate school for the next two years. She borrowed some money from the bank for her graduate education, which the bank has accepted to be paid after Jane graduates from school in two years. The bank has accepted to the following payment plan: from the beginning of Year 3 (25th month) to the end of Year 4 (48th month), pay $500 in month 25 and increase payment 5% every month thereafter. How much money should Jane Doe put aside each month (equal amount) for the first 24 months (during graduate school) such that she can pay the loan back after graduation? The bank charges an APR of 12%, compounded monthly. Part C: Provide the Present Value of the gradient, and the value Jane must set aside. Enter your answer in the form: 12.34 Gradient: Value to set aside:Question 16 1 pts Jane Doe will be in graduate school for the next two years. She borrowed some money from the bank for her graduate education, which the bank has accepted to be paid after Jane graduates from school in two years. The bank has accepted to the following payment plan: from the beginning of Year 3 (25th month) to the end of Year 4 (48th month), pay $500 in month 25 and increase payment 5% every month thereafter. How much money should Jane Doe put aside each month (equal amount) for the first 24 months (during graduate school) such that she can pay the loan back after graduation? The bank charges an APR of 12%, compounded monthly. Part D: Provide a statement for the answer to Part C. was. oregonstate.edu/courses/1776587/quizzes/2573862/take Quiz: Midterm 1 HTML Editors AT 1 12pt Paragraph Y 0 words