Frances Newberry is the payroll accountant for Pack-It Services of Jackson, Arizona. The employees of Pack-It Services are paid semimonthly. An employee, Glen Riley, comes to her on November 6 and requests a pay advance of $1,300, which he will pay back in equal parts on the November 15 and December 15 paychecks. Glen is married with eight withholding allowances and is paid $55,280 per year. He contributes 3 percent of his pay to a 401(k) and has $25 per paycheck deducted for a Section 125 plan. Required: Compute his net pay on his November 15 paycheck. The state income tax rate is 2.88 percent. Use the Wage Bracket Method Tables for Income Tax Withholding in Appendix C. (Round your intermediate calculations and final answer to 2 decimal places.)

What is the Net Pay?

Can someone please show a step-by-step process how to obtain the net pay?

For some reason, I cannot get the right calculations for medicare and social security tax.

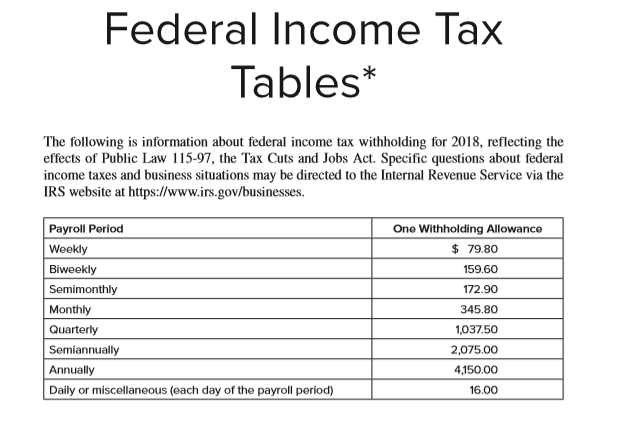

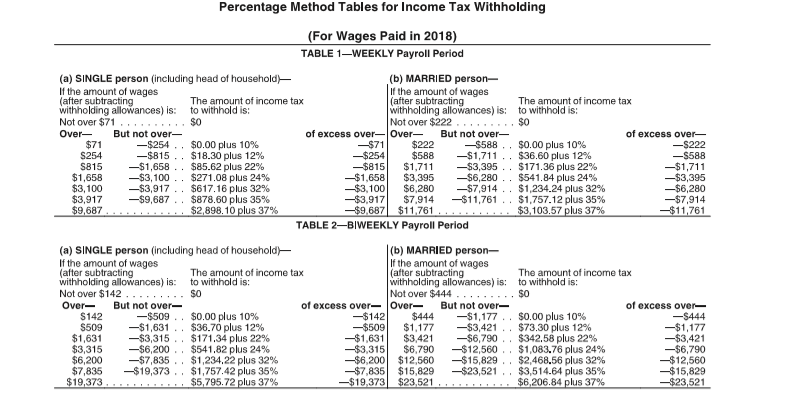

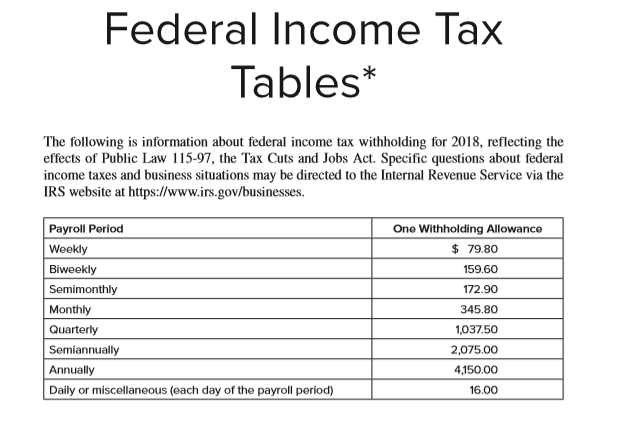

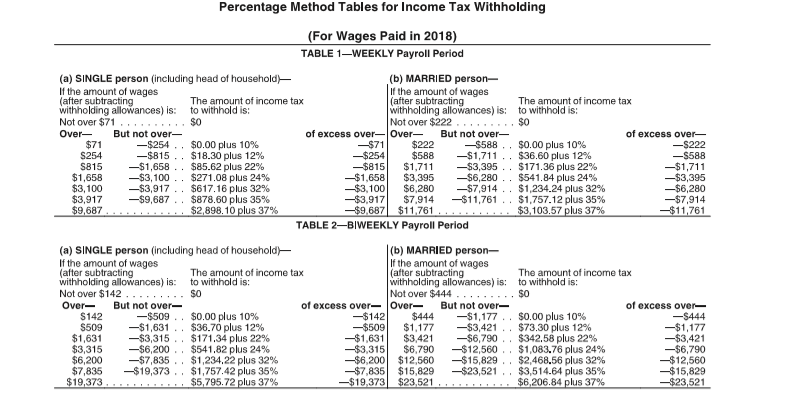

Federal Income Tax Tables* The following is information about federal income tax withholding for 2018, reflecting the effects of Public Law 115-97, the Tax Cuts and Jobs Act. Specific questions about federal income taxes and business situations may be directed to the Internal Revenue Service via the IRS website at https://www.irs.gov/businesses. One Withholding Allowance $ 79.80 159.60 172.90 Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) 345.80 1,037.50 2,075.00 4,150.00 16.00 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2018) TABLE 1WEEKLY Payroll Period SO (a) SINGLE person (including head of household (b) MARRIED person- If the amount of wages of the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $71... Not over $222.. . Over- But not over- of excess over-over- But not over- of excess over- $71 -$254 .. $0.00 plus 10% -$71 $222 $588.. $0.00 plus 10% -$222 S254 -$815 .. $18.30 plus 12% -$254 $588 -$1,711 . . $36.60 plus 12% -$588 S815 -$1,658 .. $85.62 plus 22% -$815 $1,711 -$3,395 . . $171.36 plus 22% -$1,711 $1,658 -$3,100.. $271.08 plus 24% -$1,658 $3,395 - $6,280 .. $541.84 plus 24% - $3,395 $3,100 - $3,917 .. $617.16 plus 32% -$3,100 $6,280 -$7,914 .. $1,234.24 plus 32% - $6,280 $3,917 -$9,687 .. $878.60 plus 35% -$3,917 $7.914 $11,761 .. $1,757.12 plus 35% -$7,914 $9,687 $2,898.10 plus 37% -$9.687 $11.761. ALLE $3.103.57 plus 37% $11,761 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $142 ..... $0 Not over $444......... SO Over But not over- of excess over-Over- But not over- of excess over- S142 -$509 .. $0.00 plus 10% -$142 $444 -$1,177 $0.00 plus 10% -S444 $509 $1,631.. $36.70 plus 12% $509 $1,177 $3,421 .. $73.30 plus 12% -$1,177 $1,631 $3,315 .. $171.34 plus 22% -$1,631 $3,421 $6,790 .. $342.58 plus 22% -$3,421 $3,315 $6,200 $541.82 plus 24% -$3,315 $6,790 $12,560.. $1,083.76 plus 24% $6,790 $6,200 $7,835 .. $1,234.22 plus 32% -$6,200 $12,560 $ 15,829.. $2,468.56 plus 32% -$12,560 $7,835 $19,373 . . $1,757.42 plus 35% -$7,835 $15,829 $23,521 .. $3,514.64 plus 35% -$15,829 $19,373. . .... $5,795.72 plus 37% -$19.3731 $23,521. .... ... $6,206.84 plus 37% -$23,521 Federal Income Tax Tables* The following is information about federal income tax withholding for 2018, reflecting the effects of Public Law 115-97, the Tax Cuts and Jobs Act. Specific questions about federal income taxes and business situations may be directed to the Internal Revenue Service via the IRS website at https://www.irs.gov/businesses. One Withholding Allowance $ 79.80 159.60 172.90 Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) 345.80 1,037.50 2,075.00 4,150.00 16.00 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2018) TABLE 1WEEKLY Payroll Period SO (a) SINGLE person (including head of household (b) MARRIED person- If the amount of wages of the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $71... Not over $222.. . Over- But not over- of excess over-over- But not over- of excess over- $71 -$254 .. $0.00 plus 10% -$71 $222 $588.. $0.00 plus 10% -$222 S254 -$815 .. $18.30 plus 12% -$254 $588 -$1,711 . . $36.60 plus 12% -$588 S815 -$1,658 .. $85.62 plus 22% -$815 $1,711 -$3,395 . . $171.36 plus 22% -$1,711 $1,658 -$3,100.. $271.08 plus 24% -$1,658 $3,395 - $6,280 .. $541.84 plus 24% - $3,395 $3,100 - $3,917 .. $617.16 plus 32% -$3,100 $6,280 -$7,914 .. $1,234.24 plus 32% - $6,280 $3,917 -$9,687 .. $878.60 plus 35% -$3,917 $7.914 $11,761 .. $1,757.12 plus 35% -$7,914 $9,687 $2,898.10 plus 37% -$9.687 $11.761. ALLE $3.103.57 plus 37% $11,761 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $142 ..... $0 Not over $444......... SO Over But not over- of excess over-Over- But not over- of excess over- S142 -$509 .. $0.00 plus 10% -$142 $444 -$1,177 $0.00 plus 10% -S444 $509 $1,631.. $36.70 plus 12% $509 $1,177 $3,421 .. $73.30 plus 12% -$1,177 $1,631 $3,315 .. $171.34 plus 22% -$1,631 $3,421 $6,790 .. $342.58 plus 22% -$3,421 $3,315 $6,200 $541.82 plus 24% -$3,315 $6,790 $12,560.. $1,083.76 plus 24% $6,790 $6,200 $7,835 .. $1,234.22 plus 32% -$6,200 $12,560 $ 15,829.. $2,468.56 plus 32% -$12,560 $7,835 $19,373 . . $1,757.42 plus 35% -$7,835 $15,829 $23,521 .. $3,514.64 plus 35% -$15,829 $19,373. . .... $5,795.72 plus 37% -$19.3731 $23,521. .... ... $6,206.84 plus 37% -$23,521