Answered step by step

Verified Expert Solution

Question

1 Approved Answer

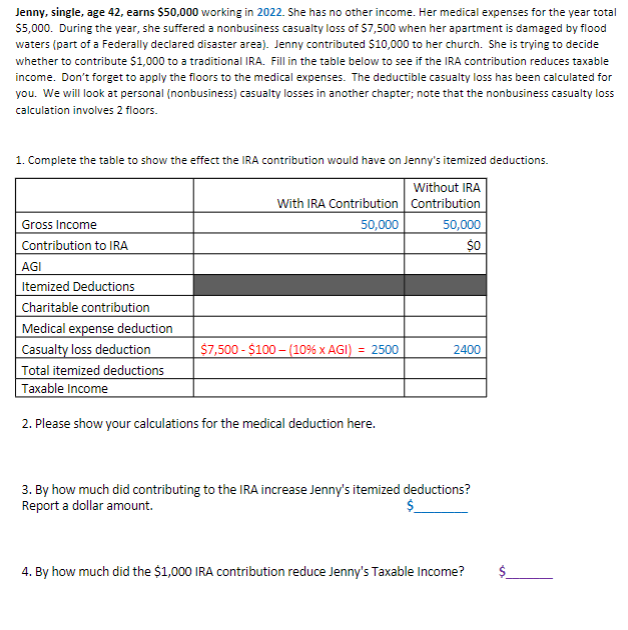

Jenny, single, age 4 2 , earns $ 5 0 , 0 0 0 working in 2 0 2 2 . She has no other

Jenny, single, age earns $ working in She has no other income. Her medical expenses for the year total

$ During the year, she suffered a nonbusiness casualty loss of $ when her apartment is damaged by flood

waters part of a Federally declared disaster area Jenny contributed $ to her church. She is trying to decide

whether to contribute $ to a traditional IRA. Fill in the table below to see if the IRA contribution reduces taxable

income. Don't forget to apply the floors to the medical expenses. The deductible casualty loss has been calculated for

you. We will look at personal nonbusiness casualty losses in another chapter; note that the nonbusiness casualty loss

calculation involves floors.

Complete the table to show the effect the IRA contribution would have on Jenny's itemized deductions.

Please show your calculations for the medical deduction here.

By how much did contributing to the IRA increase Jenny's itemized deductions?

Report a dollar amount.

By how much did the $ IRA contribution reduce Jenny's Taxable Income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started