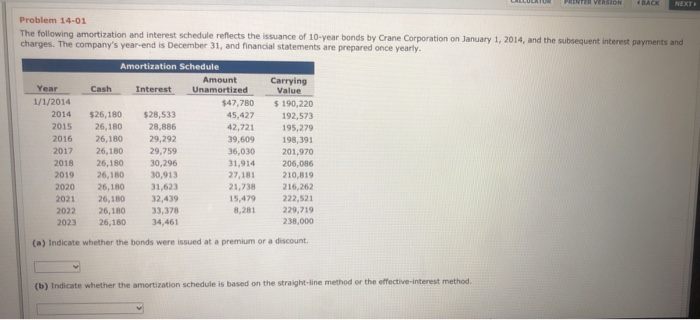

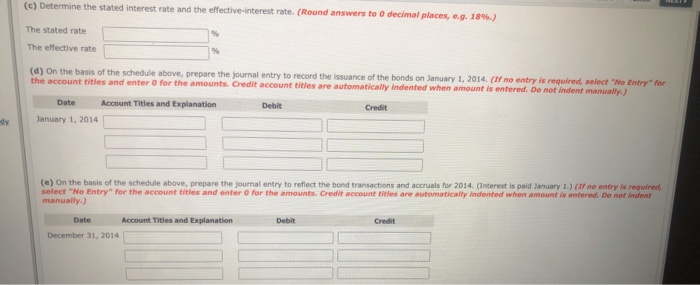

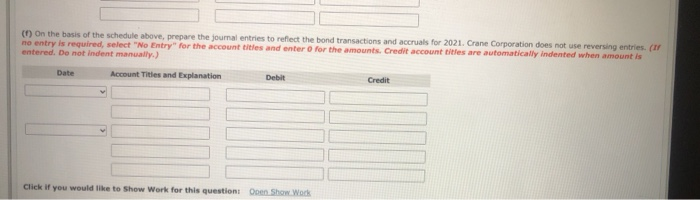

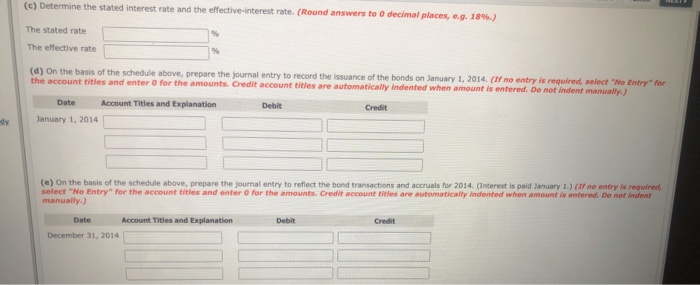

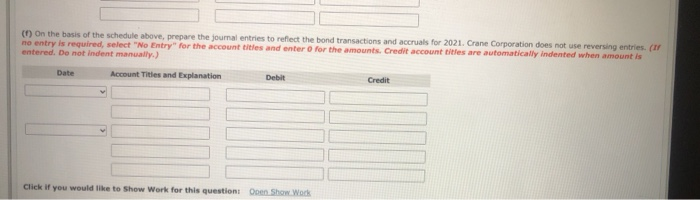

FRENTER VERSION BACK NEXT Problem 14-01 The following amortization and interest schedule reflects the issuance of 10-year bonds by Crane Corporation on January 1, 2014, and the subsequent interest payments and charges. The company's year-end is December 31, and financial statements are prepared once yearly Year 1/1/2014 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Amortization Schedule Amount Cash Interest Unamortized $47,780 $26,180 $28,533 45,427 26,180 28,886 42,721 26,180 29,292 39,609 26,180 29,759 36,030 26,180 30,296 31,914 26,180 30,913 27,181 26,180 31.623 21,738 26,180 32,439 15,479 26,180 33,378 8,281 26,180 34,461 Carrying Value $ 190,220 192,573 195,279 198,391 201,970 206,086 210,819 216,262 222,521 229,719 238,000 (a) Indicate whether the bonds were issued at a premium or a discount (b) Indicate whether the amortization schedule is based on the straight-line method or the effective interest method. (c) Determine the stated interest rate and the effective interest rate. (Round answers to decimal places, e.g. 18%.) The stated rate The effective rate (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2014. (If no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Tities and Explanation Debit Credit ody January 1, 2014 (e) On the basis of the schedule above, prepare the journal entry to reflect the bond transactions and accruals for 2014. (Interest is paid January 1.) (If no entry is required select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation December 31, 2014 (1) On the basis of the schedule above, prepare the journal entries to reflect the bond transactions and accruals for 2021. Crane Corporation does not use reversing entries. (I no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. De not indent manually.) Date Account Tities and Explanation Debit Credit Click if you would like to show Work for this question Open Show Work