Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Friedown Inc., a Canadian company is assessing the construction of a new potato processing facility. To date $1.5 million has been spent to identify this

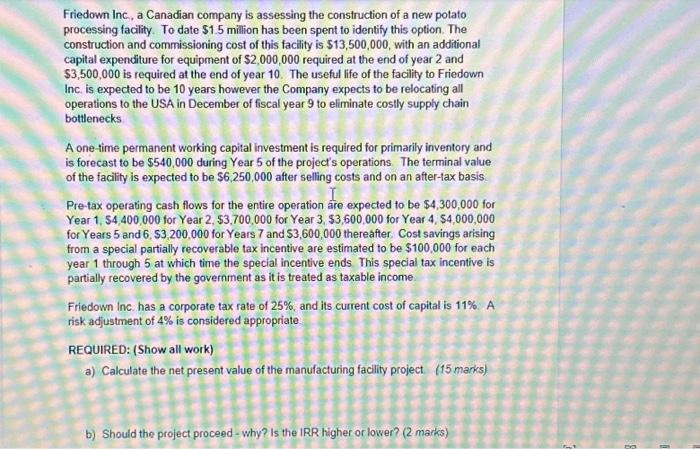

Friedown Inc., a Canadian company is assessing the construction of a new potato processing facility. To date $1.5 million has been spent to identify this option. The construction and commissioning cost of this facility is $13,500,000, with an additional capital expenditure for equipment of $2,000,000 required at the end of year 2 and $3,500,000 is required at the end of year 10. The useful life of the facility to Friedown Inc. is expected to be 10 years however the Company expects to be relocating all operations to the USA in December of fiscal year 9 to eliminate costly supply chain bottlenecks A one-time permanent working capital investment is required for primarily inventory and is forecast to be $540,000 during Year 5 of the project's operations. The terminal value of the facility is expected to be $6,250,000 after selling costs and on an after-tax basis. I Pre-tax operating cash flows for the entire operation are expected to be $4,300,000 for Year 1, $4,400,000 for Year 2, $3,700,000 for Year 3, $3,600,000 for Year 4, $4,000,000 for Years 5 and 6, $3,200,000 for Years 7 and $3,600,000 thereafter. Cost savings arising from a special partially recoverable tax incentive are estimated to be $100,000 for each year 1 through 5 at which time the special incentive ends This special tax incentive is partially recovered by the government as it is treated as taxable income. Friedown Inc. has a corporate tax rate of 25%, and its current cost of capital is 11%. A risk adjustment of 4% is considered appropriate. REQUIRED: (Show all work) a) Calculate the net present value of the manufacturing facility project. (15 marks) b) Should the project proceed - why? Is the IRR higher or lower? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started