Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Friendly Finance Company categorizes its loans into five categories, as follows: Category 1: Loan paid in full. Category 2: Loan defaulted (bad debts). Category

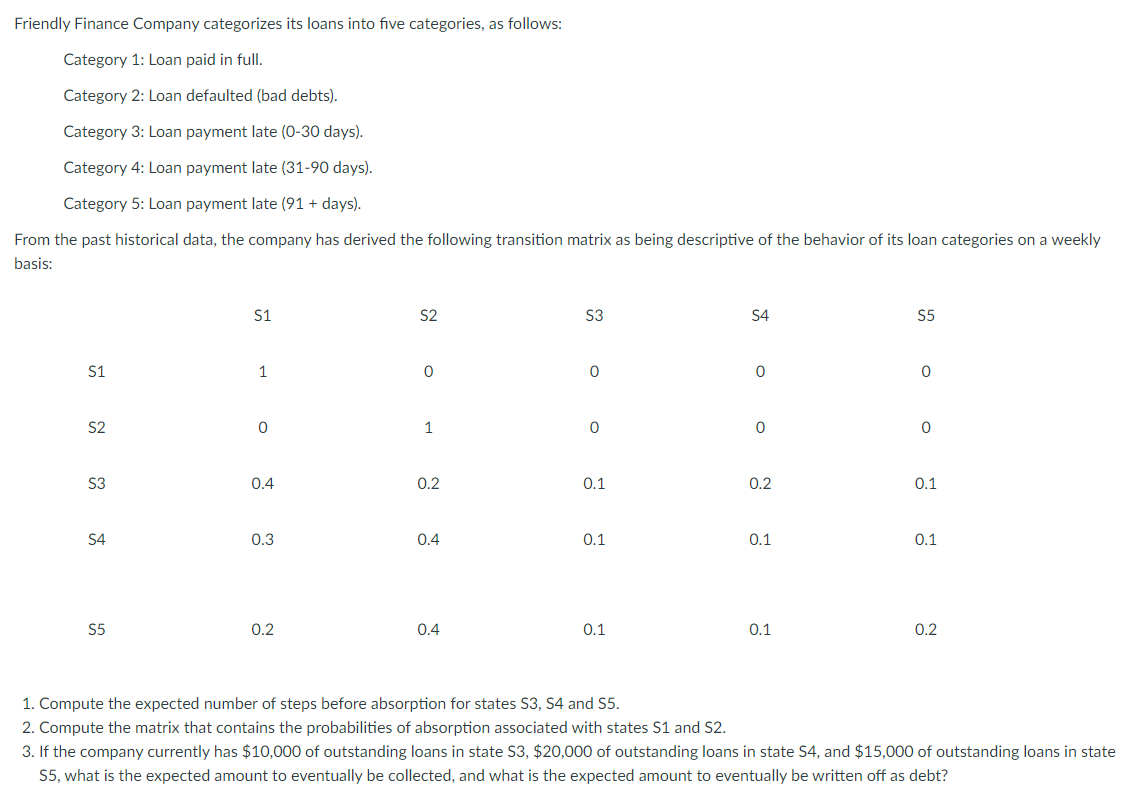

Friendly Finance Company categorizes its loans into five categories, as follows: Category 1: Loan paid in full. Category 2: Loan defaulted (bad debts). Category 3: Loan payment late (0-30 days). Category 4: Loan payment late (31-90 days). Category 5: Loan payment late (91 + days). From the past historical data, the company has derived the following transition matrix as being descriptive of the behavior of its loan categories on a weekly basis: S1 S2 S3 S4 S5 S1 1 0 0 0 0 S2 0 1 0 0 0 S3 0.4 0.2 0.1 0.2 0.1 S4 0.3 0.4 0.1 0.1 0.1 S5 0.2 0.4 0.1 -0 0.1 0.2 1. Compute the expected number of steps before absorption for states S3, S4 and S5. 2. Compute the matrix that contains the probabilities of absorption associated with states S1 and S2. 3. If the company currently has $10,000 of outstanding loans in state $3, $20,000 of outstanding loans in state S4, and $15,000 of outstanding loans in state S5, what is the expected amount to eventually be collected, and what is the expected amount to eventually be written off as debt?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started