Answered step by step

Verified Expert Solution

Question

1 Approved Answer

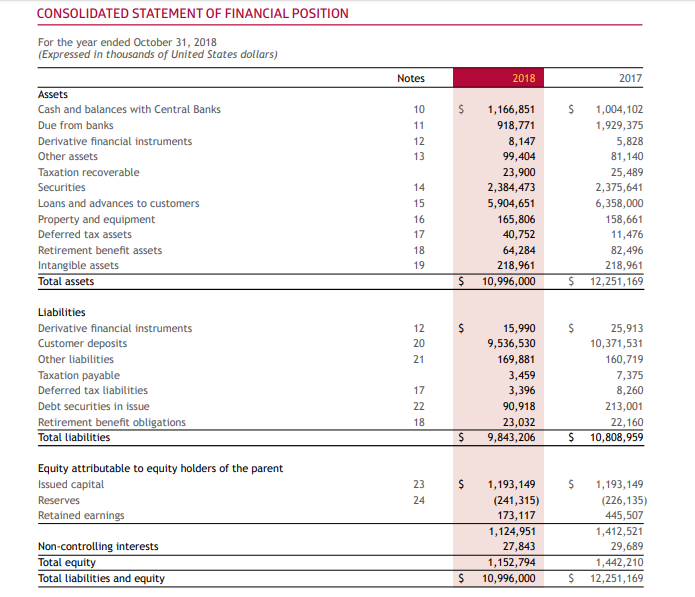

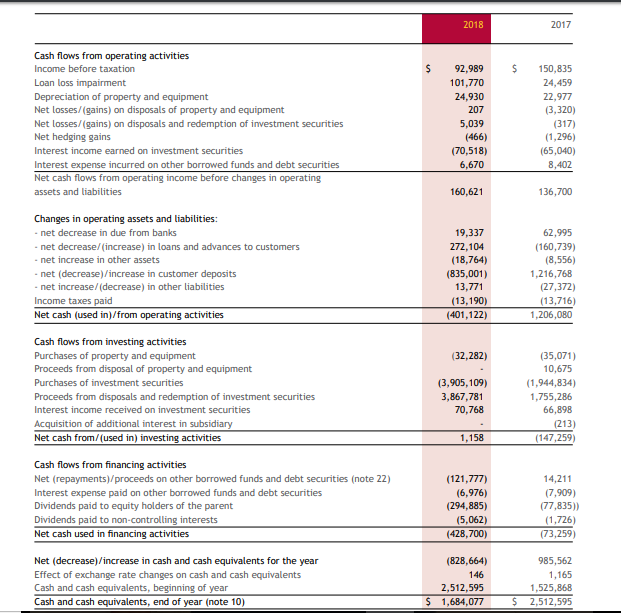

From both of the financial statements presented, comment on 2 items in the financial statements (cash flow statement and balance sheet) that are of concern

From both of the financial statements presented, comment on 2 items in the financial statements (cash flow statement and balance sheet) that are of concern to creditors and why. (3 points); items of concern to investors and why? (3 points).

Then state what each of those items reveal about the company.

NB. This company is actually a bank in my respective company. I find it very hard to read financial statements. Kindly help.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION For the year ended October 31, 2018 (Expressed in thousands of United States dollars) Notes 2018 2017 10 1,166,851 918,771 8,147 99,404 23,900 2,384,473 5,904,651 165,806 40,752 64,284 218,961 S 10,996,000 1,004,102 1,929,375 5,828 81,140 25,489 2,375,641 6,358,000 158,661 11,476 82,496 218,961 S 12,251,169 Cash and balances with Central Banks Due from banks Derivative financial instruments Other assets Taxation recoverable 13 Loans and advances to customers Property and equipment Deferred tax assets Retirement benefit assets Intangible assets Total assets 16 17 19 Liabilities Derivative financial instruments Customer deposits Other liabilities Taxation payable Deferred tax liabilities Debt securities in issue Retirement benefit obligations Total liabilities 12 S 15,990 9,536,530 169,881 3,459 3,396 90,918 23,032 S 9,843,206 S 25,913 10,371,531 160,719 7,375 8,260 213,001 22,160 S 10,808,959 17 18 Equity attributable to equity holders of the parent Issued capital Reserves Retained earnings 23 1,193,149 S 1,193,149 (226,135) 445,507 1,412,521 29,689 1,442,210 S 10,996,000 12,251,169 (241,315) 173,117 1,124,951 27,843 1,152,794 Non-controlling interests Total equity Total liabilities and equity 2018 2017 Cash flows from operating activities Income before taxation Loan loss impairment Depreciation of property and equipment Net losses/(gains) on disposals of property and equipment Net losses/(gains) on disposals and redemption of investment securities Net hedging gains Interest income earned on investment securities Interest expense incurred on other borrowed funds and debt securities Net cash flows from operating income before changes in operating assets and liabilities $92,989 101,770 24,930 207 5,039 (466) $ 150,835 24,459 22,977 (3,320) (317) (1,296) (65,040) 8,402 6,670 160,621 136,700 Changes in operating assets and liabilities: net decrease in due from banks 19,337 272,104 (18,764) (835,001) 13,771 (13,190) (401,122) 62,995 (160,739) (8,556) 1,216,768 (27,372) (13,716) 1,206,080 net decrease/(increase) in loans and advances to customers net increase in other assets net (decrease)/increase in customer deposits net increase/(decrease) in other liabilities Income taxes paid Net cash (used in)/from operating activities Cash flows from investing activities Purchases of property and equipment Proceeds from disposal of property and equipment Purchases of investment securities Proceeds from disposals and redemption of investment securities Interest income received on investment securities Acquisition of additional interest in subsidiary Net cash from/(used in) investing activities (32,282) (3,905,109) 70,768 (35,071) 10,675 (1,944,834) 1,755,286 66,898 (213) 147,259) 3,867,781 Cash flows from financing activities Net (repayments)/proceeds on other borrowed funds and debt securities (note 22) Interest expense paid on other borrowed funds and debt securities Dividends paid to equity holders of the parent Dividends paid to non-controlling interests (121,777) (6,976) (294,885) (5,062) (428,700) 14,211 (77,835) (1,726) (73,259) used in financing activities Net (decrease)/increase in cash and cash equivalents for the year Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year (note 10) (828,664) 146 2,512,595 S 1,684,077 985,562 1,165 1,525,868 2,512,595Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started