Answered step by step

Verified Expert Solution

Question

1 Approved Answer

what is hkme depots P/E ratio based kn trailing twelve month net income excluding extra items? From CNBC.com, we found HomeDepot's stock is trading at

what is hkme depots P/E ratio based kn trailing twelve month net income excluding extra items?

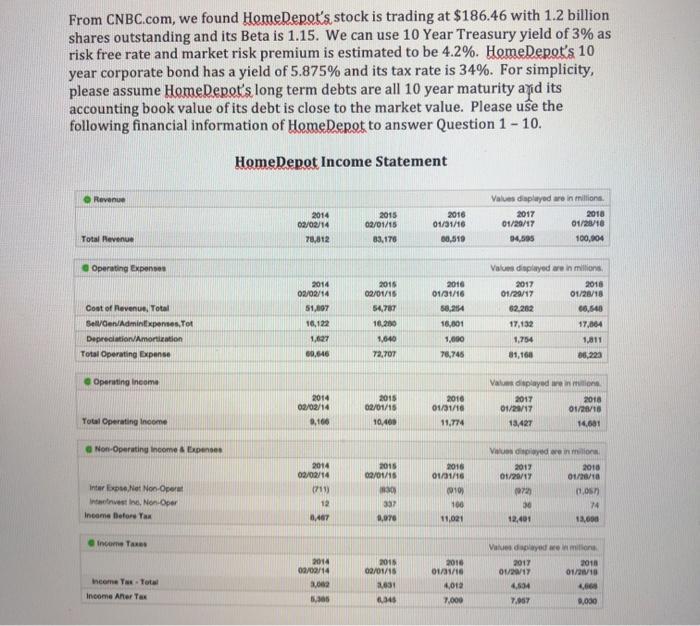

From CNBC.com, we found HomeDepot's stock is trading at $186.46 with 1.2 billion shares outstanding and its Beta is 1.15. We can use 10 Year Treasury yield of 3% as risk free rate and market risk premium is estimated to be 4.2%. Home Depot's 10 year corporate bond has a yield of 5.875% and its tax rate is 34%. For simplicity, please assume Home Depot's long term debts are all 10 year maturity and its accounting book value of its debt is close to the market value. Please use the. following financial information of Home Depot to answer Question 1 - 10. HomeDepot Income Statement Revenue Values diaplayed are in millions. 2016 2018 2015 02/01/15 2017 01/29/17 01/31/16 2014 02/02/14 78,812 01/28/18 100,904 Total Revenue 83,176 00,519 94,595 Values displayed are in millions. 2014 2015 2016 2017 2016 01/28/18 02/02/14 02/01/15 01/31/16 01/29/17 51,097 54,787 50,254 62,202 06,540 10,122 10,200 16,001 17,132 17,064 1,627 1,640 1,000 1,754 1,811 60,646 72,707 76,745 81,168 06,223 Values displayed are in milions 2014 2015 2016 2017 2018 02/01/15 01/31/16 02/02/14 9,166 01/29/17 13,427 01/26/18 14,601 10,400 11,774 Values displayed are in miliona 2014 2015 02/02/14 2016 01/31/16 02/01/15 2017 01/29/17 (972) 2018 01/26/18 (1,067) 18:30) (711) 12 0,467 (10) 100 337 30 74 9,076 11,021 12,401 13,000 Values displayed are in miliona 2014 2015 2017 2018 2016 01/31/16 02/02/14 02/01/15 01/20/17 01/26/18 3,062 3,631 4,012 4,534 4,068 5,305 6,345 7,000 7.957 9,000 Operating Expenses Cost of Revenue, Total Sell/Gen/AdminExpenses. Tot Depreciation/Amortization Total Operating Expense Operating Income Total Operating Income Non-Operating Income & Expenses Inter Expse,Net Non-Operat Intentinvest Inc, Non-Oper Income Before Tax Income Taxes Income Tax Total Income After Tax

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Finder File Edit View Go Window Help SU Page Layout Formulas V 12 V Home Insert X Paste D17 A 1 Q ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started