Question

Credit Losses Based on Accounts Receivable Hunter, Inc. analyzed its accounts receivable balances at Dec. 31, and arrived at the aged balances listed below, along

Credit Losses Based on Accounts Receivable Hunter, Inc. analyzed its accounts receivable balances at Dec. 31, and arrived at the aged balances listed below, along with the percentage that is estimated to be uncollectable:

| Age Group | Balance | Probability of Noncollection |

| 0-30 days past due | $90,000 | 1 |

| 31-60 days past due | 20,000 | 2 |

| 61-120 days past due | 11,000 | 6 |

| 121-180 days past due | 6,000 | 10 |

| Over 180 days past due | 5,000 | 25 |

| $132,000 |

The company handles credit losses using the allowance method. The credit balance of the Allowance for Doubtful Accounts is $820 on December 31, before any adjustments.

a. Prepare the adjusting entry for estimated credit losses on December 31.

b. Prepare the journal entry to write off the Rose Company's account on April 10 of the following year in the amount of $625.

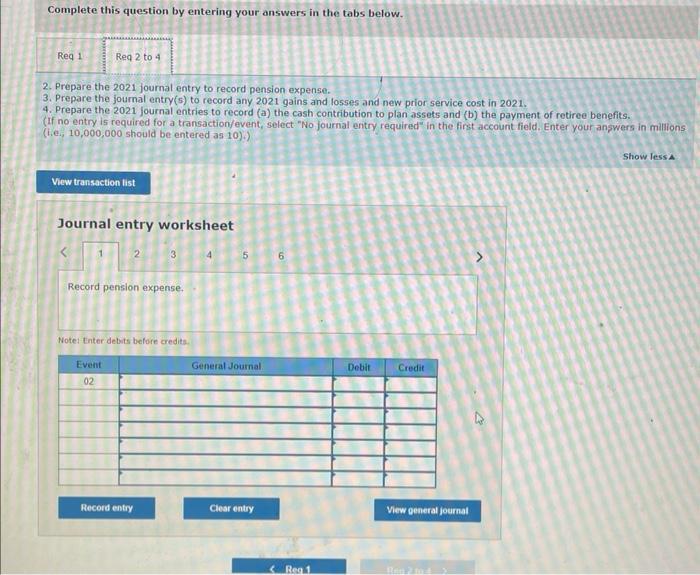

Complete this question by entering your answers in the tabs below. Req 1- Reg 2 to 4 2. Prepare the 2021 journal entry to record pension expense. 3. Prepare the journal entry(s) to record any 2021 gains and losses and new prior service cost in 2021. 4. Prepare the 2021 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (.e., 10,000,000 should be entered as 10).) View transaction list Journal entry worksheet 2 Event 02 Record pension expense. 3 Note: Enter debits before credits. Record entry 5 General Journal Clear entry 6 Reg 1 Debit Credit View general journal Ban 2 to 4 Show less A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Date Description Debit Credit Dec 31 Bad Debts Expense 29...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started