Answered step by step

Verified Expert Solution

Question

1 Approved Answer

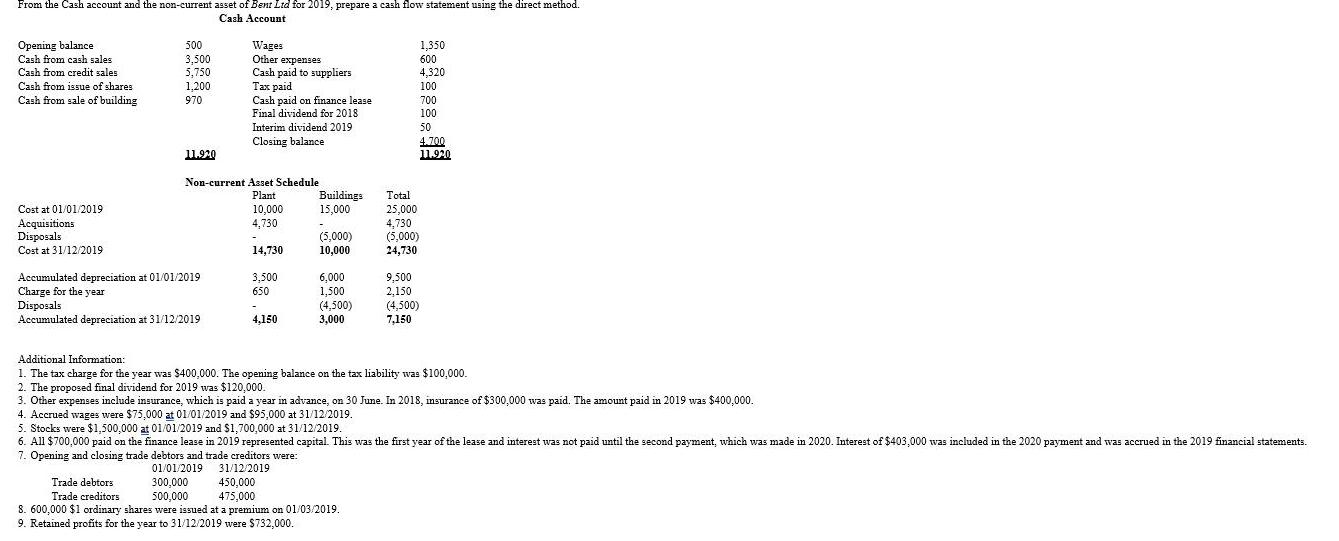

From the Cash account and the non-current asset of Bent Ltd for 2019, prepare a cash flow statement using the direct method. Cash Account

From the Cash account and the non-current asset of Bent Ltd for 2019, prepare a cash flow statement using the direct method. Cash Account Opening balance Cash from cash sales Cash from credit sales Cash from issue of shares Cash from sale of building Cost at 01/01/2019 Acquisitions Disposals Cost at 31/12/2019 500 3,500 5,750 1,200 970 11.920 Accumulated depreciation at 01/01/2019 Charge for the year Disposals Accumulated depreciation at 31/12/2019 Trade debtors Trade creditors Wages Other expenses Cash paid to suppliers Tax paid Cash paid on finance lease Final dividend for 2018 Interim dividend 2019 Closing balance Non-current Asset Schedule Plant 10,000 4,730 14,730 3,500 650 4,150 Buildings 15,000 (5,000) 10,000 6,000 1,500 (4,500) 3,000 1,350 600 4.320 100 Total 25,000 4,730 (5,000) 24,730 9,500 2,150 700 100 50 4.700 11.920 (4,500) 7,150 Additional Information: 1. The tax charge for the year was $400,000. The opening balance on the tax liability was $100,000. 2. The proposed final dividend for 2019 was $120,000. 3. Other expenses include insurance, which is paid a year in advance, on 30 June. In 2018, insurance of $300,000 was paid. The amount paid in 2019 was $400,000. 4. Accrued wages were $75,000 at 01/01/2019 and $95,000 at 31/12/2019. 5. Stocks were $1,500,000 at 01/01/2019 and $1,700,000 at 31/12/2019. 6. All $700,000 paid on the finance lease in 2019 represented capital. This was the first year of the lease and interest was not paid until the second payment, which was made in 2020. Interest of $403,000 was included in the 2020 payment and was accrued in the 2019 financial statements. 7. Opening and closing trade debtors and trade creditors were: 31/12/2019 01/01/2019 300,000 450,000 500,000 475,000 8. 600,000 $1 ordinary shares were issued at a premium on 01/03/2019. 9. Retained profits for the year to 31/12/2019 were $732,000.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Calculations Operating Activities Cash Receipts from Customers Credit Sales Cash from credit sales 5750 Change in trade debtors 450000 300000 150000 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started