Answered step by step

Verified Expert Solution

Question

1 Approved Answer

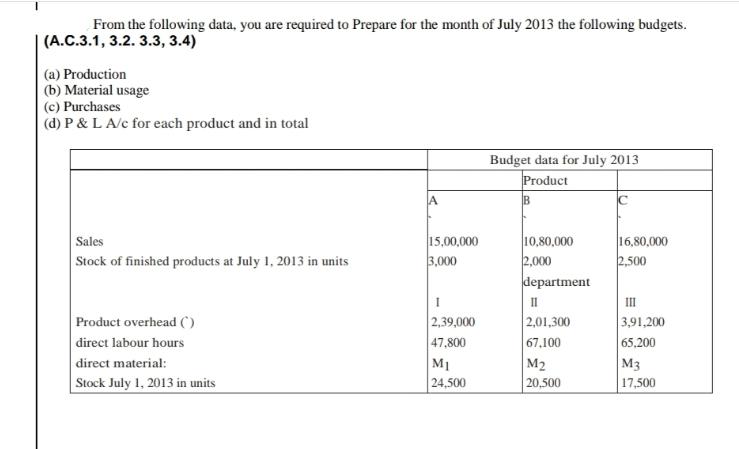

From the following data, you are required to Prepare for the month of July 2013 the following budgets. (A.C.3.1, 3.2. 3.3, 3.4) (a) Production

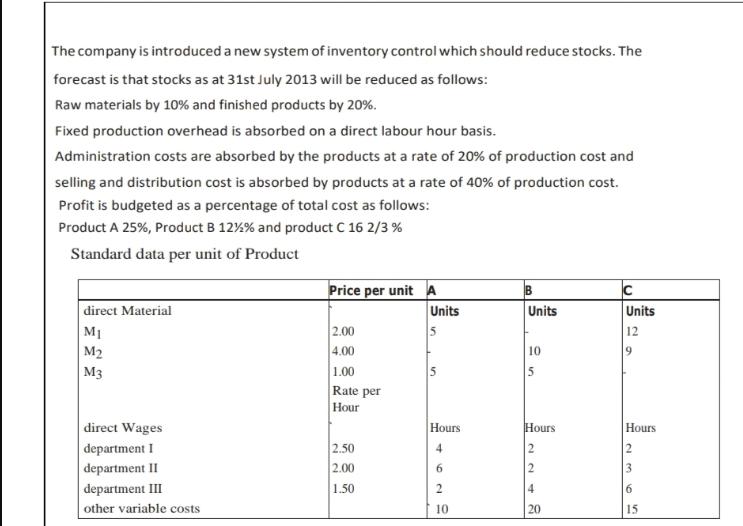

From the following data, you are required to Prepare for the month of July 2013 the following budgets. (A.C.3.1, 3.2. 3.3, 3.4) (a) Production (b) Material usage (c) Purchases (d) P & L A/c for each product and in total Sales Stock of finished products at July 1, 2013 in units Product overhead () direct labour hours direct material: Stock July 1, 2013 in units 15,00,000 3,000 I 2,39,000 47,800 M 24,500 Budget data for July 2013 Product B 10,80,000 2,000 department II 2,01,300 67,100 M 20,500 16,80,000 2,500 III 3,91,200 65,200 M3 17,500 The company is introduced a new system of inventory control which should reduce stocks. The forecast is that stocks as at 31st July 2013 will be reduced as follows: Raw materials by 10% and finished products by 20%. Fixed production overhead is absorbed on a direct labour hour basis. Administration costs are absorbed by the products at a rate of 20% of production cost and selling and distribution cost is absorbed by products at a rate of 40% of production cost. Profit is budgeted as a percentage of total cost as follows: Product A 25%, Product B 12% % and product C 16 2/3 % Standard data per unit of Product direct Material M M2 M3 direct Wages department I department II department III other variable costs Price per unit A 2.00 4.00 1.00 Rate per Hour 2.50 2.00 1.50 Units 5 Hours 6 2 10 Units 10 5 Hours 2 4 20 Units 12 9 Hours 2 3 6 15

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Budgets for July 2013 a Production Budget Product Sales Opening Stock Closing Stock Production A 150...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started