Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the chief investment officer for a money management firm specializing in taxable individual investors, you are trying to establish a strategic asset allocation

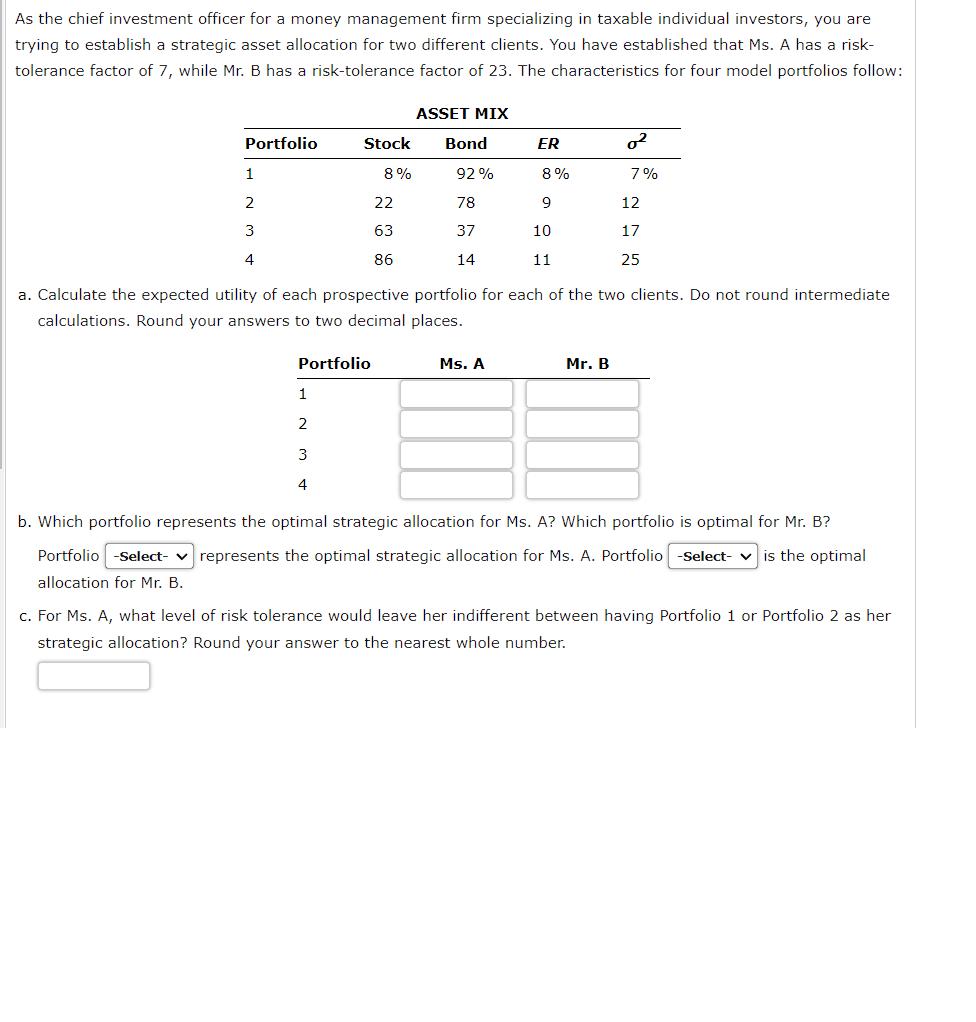

As the chief investment officer for a money management firm specializing in taxable individual investors, you are trying to establish a strategic asset allocation for two different clients. You have established that Ms. A has a risk- tolerance factor of 7, while Mr. B has a risk-tolerance factor of 23. The characteristics for four model portfolios follow: ASSET MIX Bond Portfolio 1 2 3 4 Stock 8% Portfolio 1 2 3 4 22 63 86 92% 78 37 14 ER a. Calculate the expected utility of each prospective portfolio for each of the two clients. Do not round intermediate calculations. Round your answers to two decimal places. Ms. A 8% 9 10 11 7% Mr. B 12 17 25 b. Which portfolio represents the optimal strategic allocation for Ms. A? Which portfolio is optimal for Mr. B? represents the optimal strategic allocation for Ms. A. Portfolio -Select- is the optimal Portfolio -Select- allocation for Mr. B. c. For Ms. A, what level of risk tolerance would leave her indifferent between having Portfolio 1 or Portfolio 2 as her strategic allocation? Round your answer to the nearest whole number.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started