Answered step by step

Verified Expert Solution

Question

1 Approved Answer

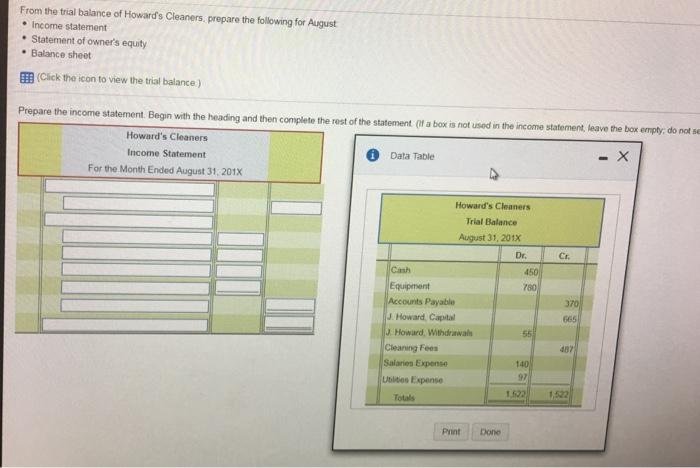

From the trial balance of Howard's Cleaners, prepare the following for August Income statement Statement of owner's equity Balance sheet (Click the icon to

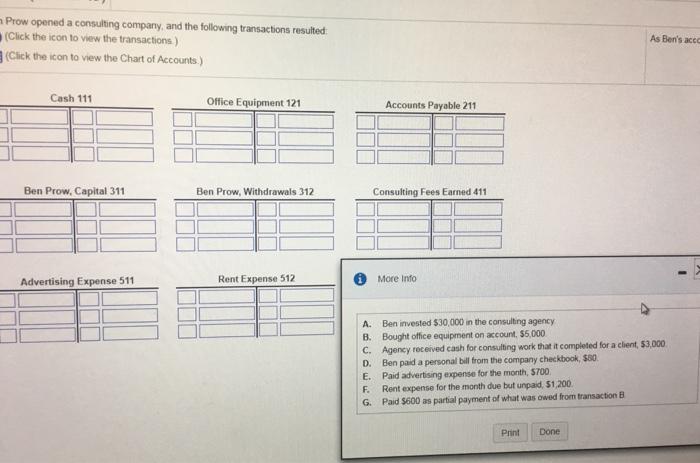

From the trial balance of Howard's Cleaners, prepare the following for August Income statement Statement of owner's equity Balance sheet (Click the icon to view the trial balance) Prepare the income statement. Begin with the heading and then complete the rest of the statement (If a box is not used in the income statement, leave the box empty; do not se Howard's Cleaners Income Statement - X For the Month Ended August 31, 201X Data Table Howard's Cleaners. Trial Balance August 31, 201X Dr. Cash Equipment Accounts Payable J. Howard, Capital J. Howard, Withdrawals Cleaning Fees Salaries Expense Utilities Expense Totals Print Done 450 780 55 140 97 1,522 Cr. 370 665 4871 1,522 Prow opened a consulting company, and the following transactions resulted (Click the icon to view the transactions) (Click the icon to view the Chart of Accounts.) Cash 111 Ben Prow, Capital 311 Advertising Expense 511 Office Equipment 121 Ben Prow, Withdrawals 312 Rent Expense 512 B. C. D. E. F. Accounts Payable 211 A. Ben invested $30,000 in the consulting agency Bought office equipment on account, $5,000 G. Consulting Fees Earned 411 More Info Agency received cash for consulting work that it completed for a client, $3,000 Ben paid a personal bill from the company checkbook, $80. Paid advertising expense for the month, $700. Rent expense for the month due but unpaid, $1,200 Paid $600 as partial payment of what was owed from transaction B Print As Ben's acco Done

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Income statement Revenues Cleaning fees 487 Expenses Salaries expense 140 Utilit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started