Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From your reading, recall that in structural model, company equity is similar to a call option on the company's assets with a strike price equal

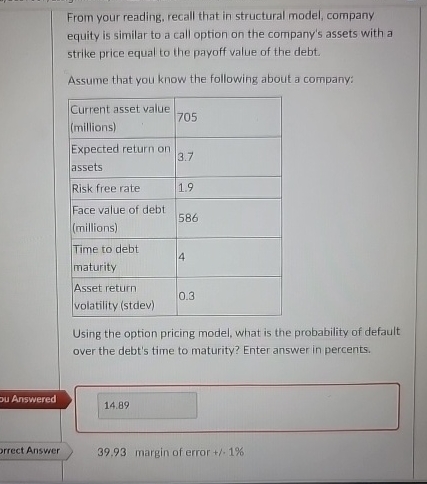

From your reading, recall that in structural model, company equity is similar to a call option on the company's assets with a strike price equal to the payoff value of the debt.

Assume that you know the following about a company:

tabletableCurrent asset valuemillionstableExpected return onassetsRisk free rate,tableFace value of debtmillionstableTime to debtmaturitytableAsset returnvolatility stdev

Using the option pricing model, what is the probability of default over the debt's time to maturity? Enter answer in percents.

Answered

orrect Answer

margin of error

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started