Answered step by step

Verified Expert Solution

Question

1 Approved Answer

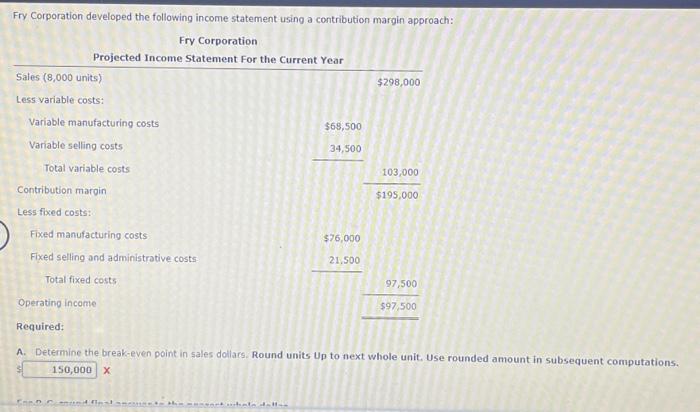

Fry Corporation developed the following income statement using a contribution margin approach: Fry Corporation Projected Income Statement For the Current Year Sales (8,000 units)

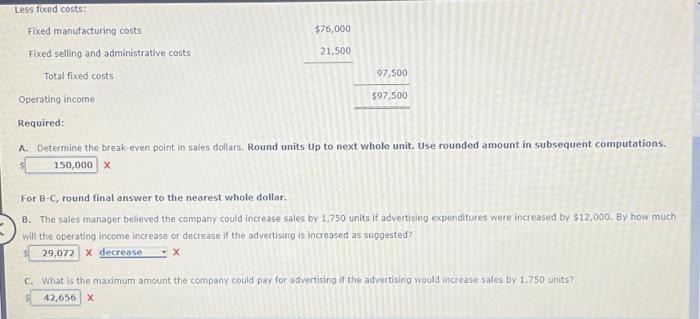

Fry Corporation developed the following income statement using a contribution margin approach: Fry Corporation Projected Income Statement For the Current Year Sales (8,000 units) Less variable costs: Variable manufacturing costs Variable selling costs Total variable costs Contribution margin Less fixed costs: Fixed manufacturing costs Fixed selling and administrative costs Total fixed costs Operating income Required: $68,500 34,500 $76,000 21,500 $298,000 103,000 $195,000 97,500 $97,500 A. Determine the break-even point in sales dollars. Round units Up to next whole unit. Use rounded amount in subsequent computations. 150,000 X Less fixed costs: Fixed manufacturing costs Fixed selling and administrative costs Total fixed costs Operating income Required: $76,000 21,500 150,000 X 97,500 $97,500 A. Determine the break-even point in sales dollars. Round units Up to next whole unit. Use rounded amount in subsequent computations. For B-C, round final answer to the nearest whole dollar. B. The sales manager believed the company could increase sales by 1,750 units if advertising expenditures were increased by $12,000. By how much will the operating income increase or decrease if the advertising is increased as suggested? 29,072 X decrease - X c. What is the maximum amount the company could pay for advertising if the advertising would increase sales by 1,750 units? 42,656 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the breakeven point in sales dollars we need to find the sales volume at which the contribution margin equals the fixed costs This can be calculated using the following formula Breakeven ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started