Fubuki co.

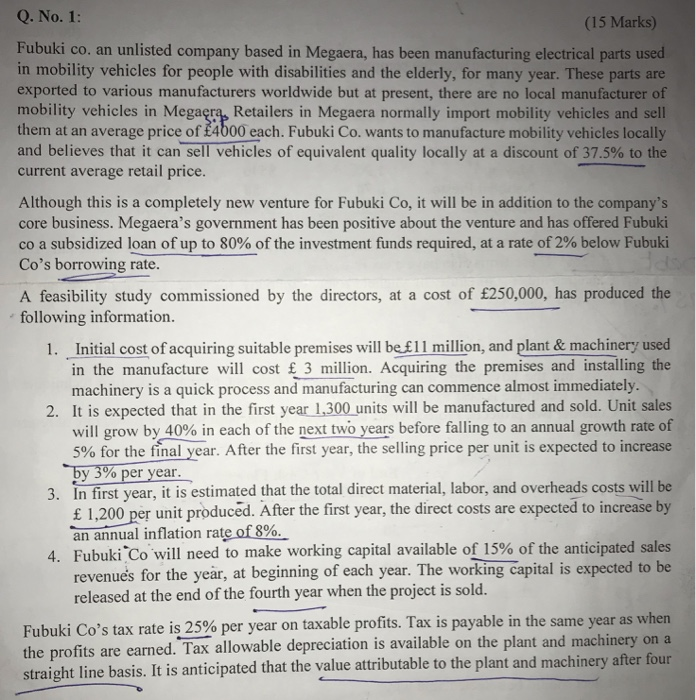

Required:

a) Calculate the initial, operating, terminal and total cash flows of the project for the next four years.

b) Evaluate the project by using capital budgeting techniques (NPV and Profitability index)

c) Should Fubuki Co. invest in proposed plan of contract enhancement?

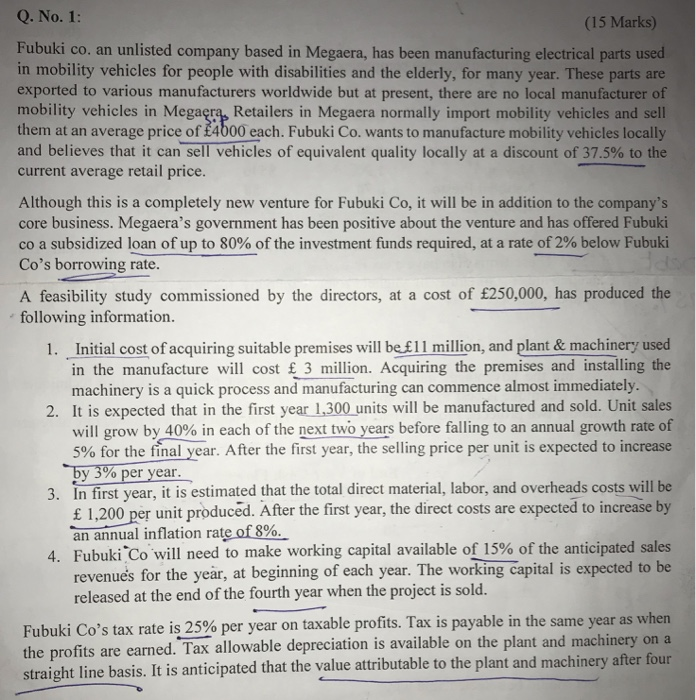

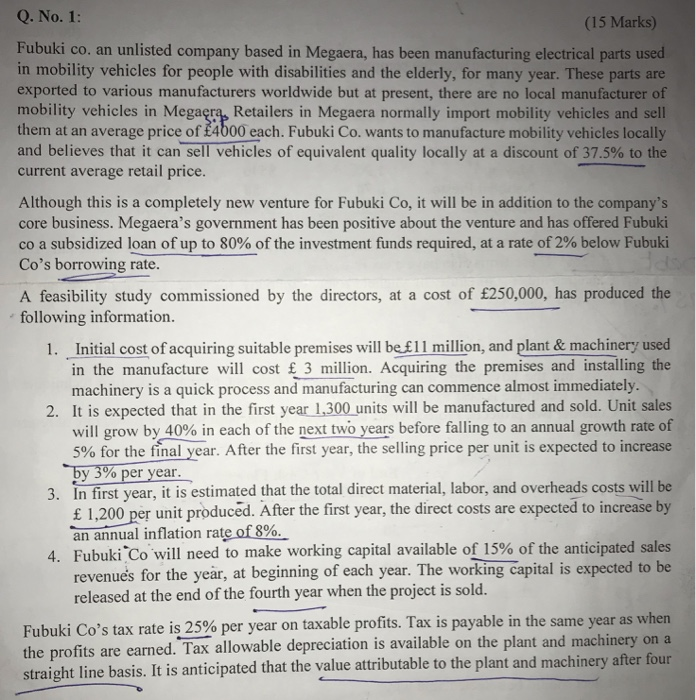

Q. No. 1: (15 Marks) Fubuki co. an unlisted company based in Megaera, has been manufacturing electrical parts used in mobility vehicles for people with disabilities and the elderly, for many year. These parts are exported to various manufacturers worldwide but at present, there are no local manufacturer of mobility vehicles in Megara, Retailers in Megaera normally import mobility vehicles and sell them at an average price of $4b00 each. Fubuki Co. wants to manufacture mobility vehicles locally and believes that it can sell vehicles of equivalent quality locally at a discount of 37.5% to the current average retail price. Although this is a completely new venture for Fubuki Co, it will be in addition to the company core business. Megaera's govenment has been positive about the venture and has offered Fub co a subsidized loan of up to 80% of the investment funds required, at a rate of 2% below Fubu Co's borrowing rate. A feasibility study commissioned by the directors, at a cost of 250,000, has produced the following information. 1. Initial cost of acquiring suitable premises will be &11 million, and plant &machinery used in the manufacture will cost 3 million. Acquiring the premises and installing the machinery is a quick process and manufacturing can commence almost immediately 2. It is expected that in the first year 1,300 units will be manufactured and sold. Unit sales will grow by 40% in each of the next two years before falling to an annual growth rate of 5% for the final year. After the first year, the selling price per unit is expected to increase by 3% per year 3. In first year, it is estimated that the total direct material, labor, and overheads costs will be 1,200 per unit produced. After the first year, the direct costs are expected to increase by an annual inflation rate of 8%, 4. Fubuki-Co will need to make working capital available of 15% of the anticipated sales ed to be revenues for the year, at beginning of each year. The working capital is expect released at the end of the fourth year when the project is sold. is 25% per year on taxable profits. Tax is payable in the same year as when Fubuki Co's tax rate the profits are earned. Tax allowable depreciation is available on the plant and machinery orn straight line basis. It is anticipated that the value attributable to the plant and machinery aft er four years is 400,000 of the price at which the project is sold. Weighted average cost of capital is 14% of this company Required: Calculate the initial, operating, terminal and total cash flows of the project for the next four years. a) b) Evaluate the project by using capital budgeting techniques (NPV and Profitability index). c) Should Fubuki Co. invest in proposed plan of contract enhancement