Full answers plz.

Full answers plz.

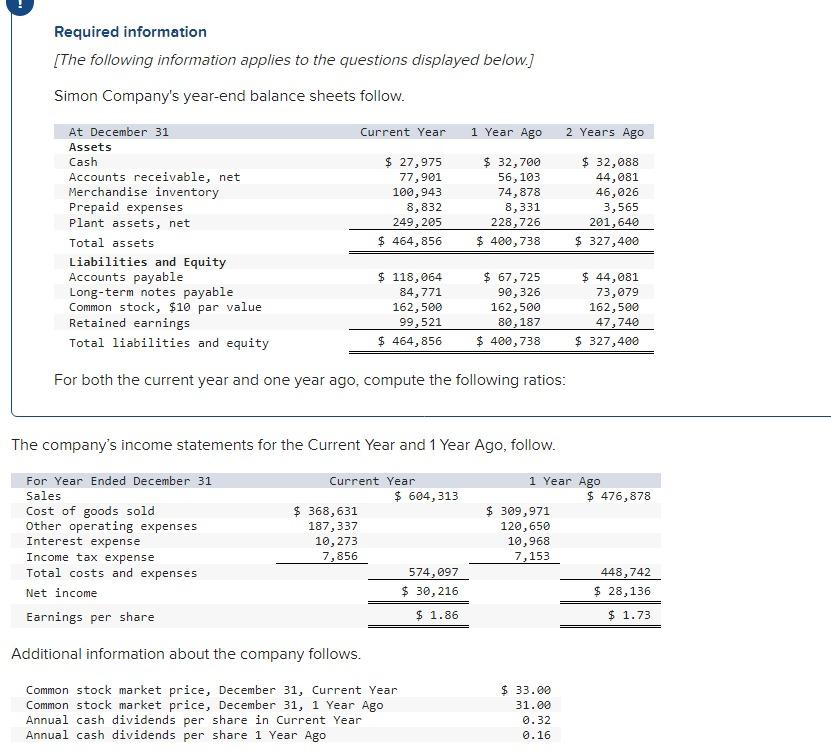

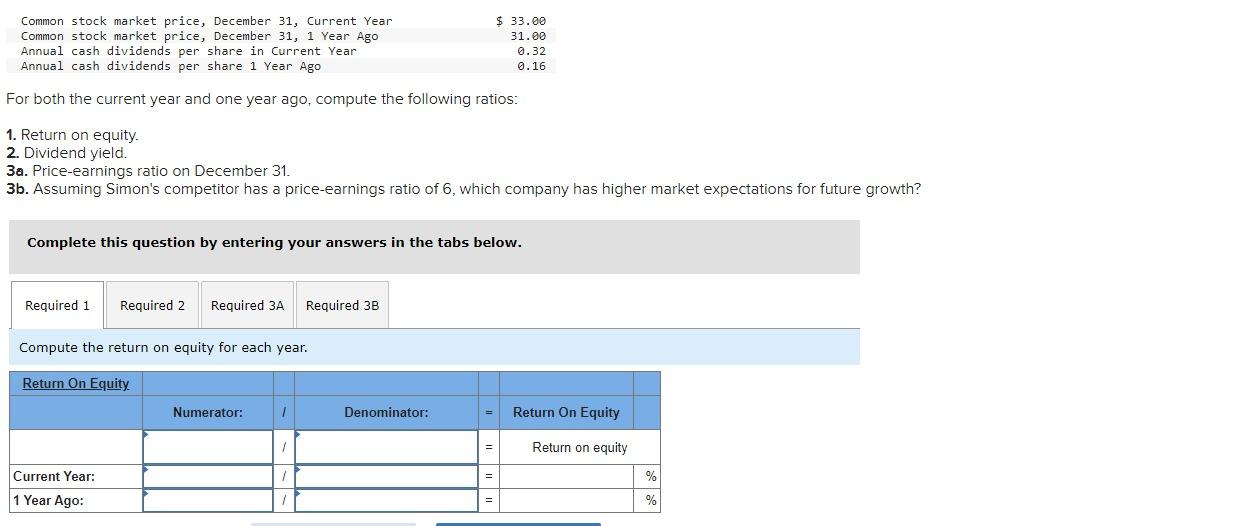

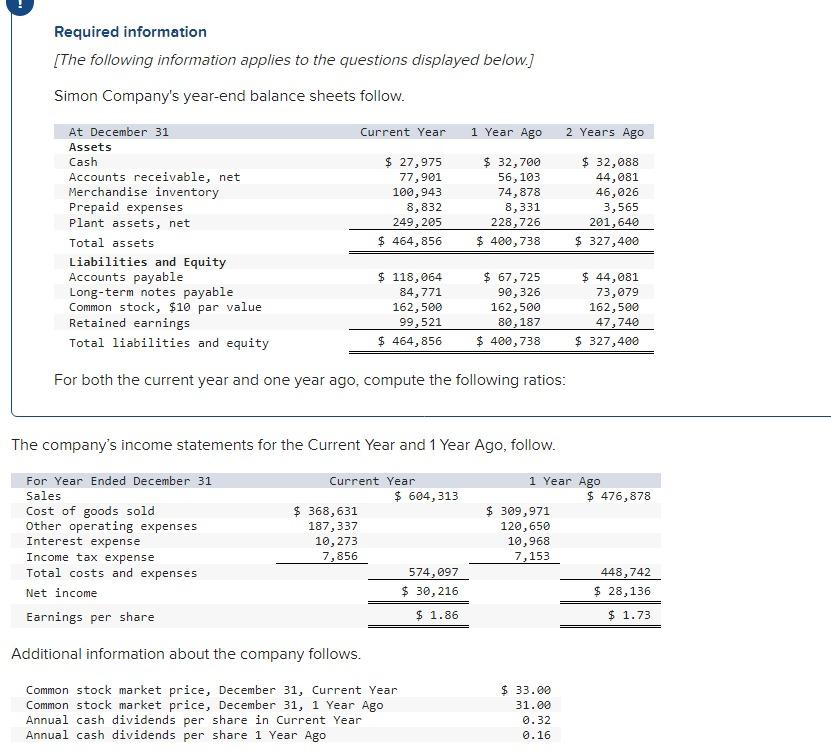

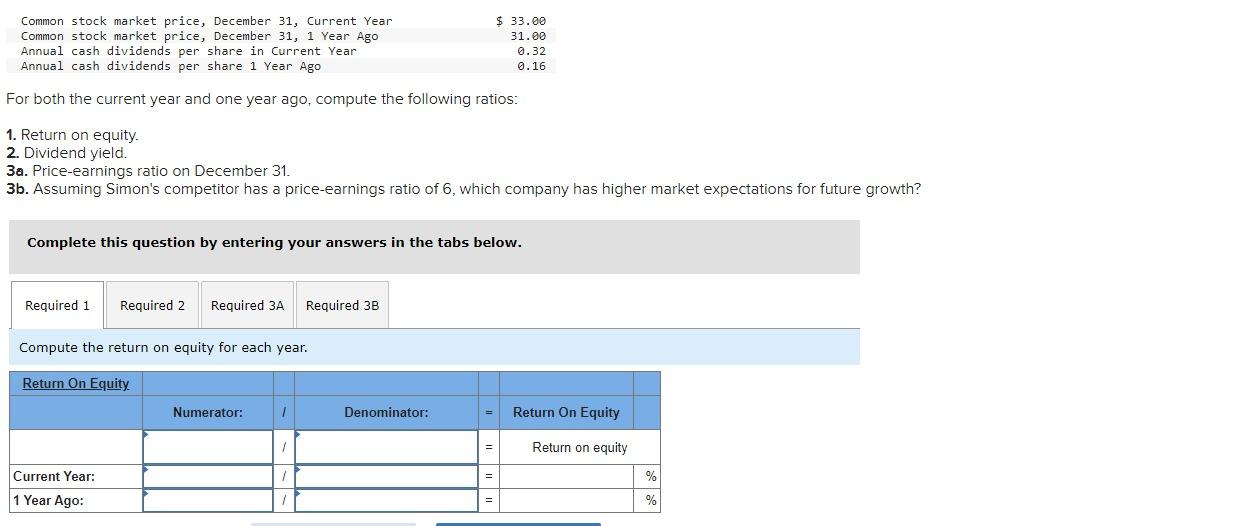

Required information [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity $ 27,975 77,901 100,943 8,832 249, 205 $ 464,856 $ 32,700 56,103 74,878 8,331 228,726 $ 400,738 $ 32,088 44,081 46,026 3,565 201,640 $ 327,400 $ 118,064 84,771 162,500 99,521 $ 464,856 $ 67,725 90, 326 162,500 80, 187 $ 400,738 $ 44,081 73,079 162,500 47,740 $ 327,400 For both the current year and one year ago, compute the following ratios: The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Year $ 604,313 $ 368,631 187,337 10,273 7,856 574,097 $ 30,216 $ 1.86 1 Year Ago $ 476,878 $ 309,971 120,650 10,968 7,153 448, 742 $ 28,136 $ 1.73 Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago $ 33.00 31.00 0.32 0.16 Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago $ 33.00 31.00 0.32 0.16 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the return on equity for each year. Return On Equity Numerator: 1 Denominator: = Return On Equity = Return on equity = % Current Year: 1 Year Ago: %

Full answers plz.

Full answers plz.