Question

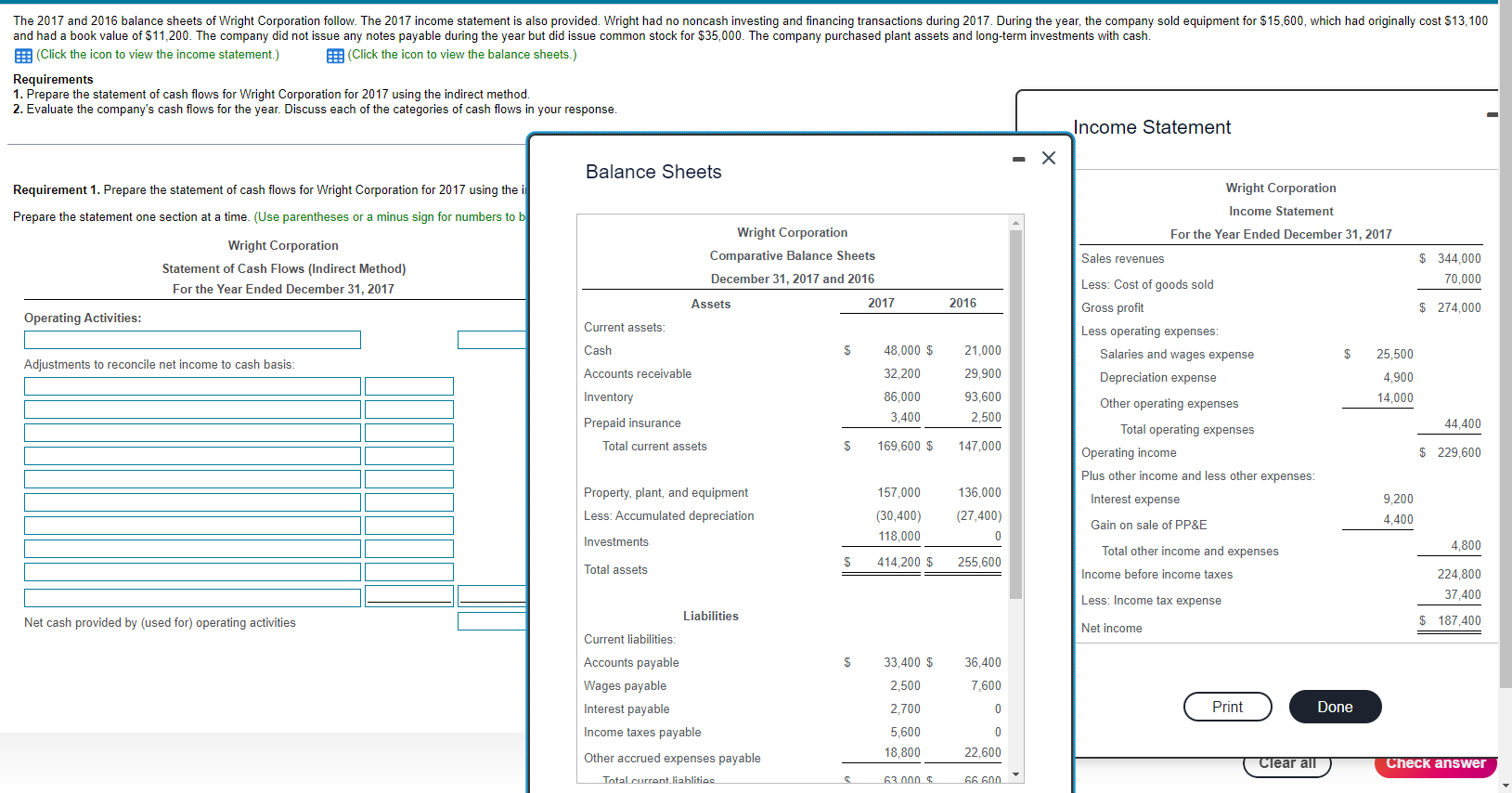

full balance sheet Wright Corporation Comparative Balance Sheets December 31, 2017 and 2016 Assets 2017 2016 Current assets: Cash $48,000 $21,000 Accounts receivable 32,200 29,900

full balance sheet

Wright Corporation

Comparative Balance Sheets

December 31, 2017 and 2016

Assets

2017

2016

Current assets:

Cash

$48,000

$21,000

Accounts receivable

32,200

29,900

Inventory

86,000

93,600

Prepaid insurance

3,400

2,500

Total current assets

$169,600

$147,000

Property, plant, and equipment

157,000

136,000

Less: Accumulated depreciation

(30,400)

(27,400)

Investments

118,000

0

Total assets

$414,200

$255,600

Liabilities

Current liabilities:

Accounts payable

$33,400

$36,400

Wages payable

2,500

7,600

Interest payable

2,700

0

Income taxes payable

5,600

0

Other accrued expenses payable

18,800

22,600

Total current liablities

$63,000

$66,600

Long-term liabilities

70,000

114,000

Total liabilities

$133,000

$180,600

Stockholders' equity

Common stock

$107,000

$72,000

Retained earnings

174,200

3,000

Total stockholders' equity

$281,200

$75,000

Total liabilities and equity

$414,200

$255,600

(Click the icon to view the income statement.) (Click the icon to view the balance sheets.) Requirements 1. Prepare the statement of cash flows for Wright Corporation for 2017 using the indirect method. 1. Prepare the statement of cash flows for Wright Corporation for 2017 using the indirect method. 2. Evaluate the company's cash flows for the year. Discuss each of the categories of cash flows in your response. Requirement 1. Prepare the statement of cash flows for Wright Corporation for 2017 using theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started