Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Full explanation with formulas Calculate all relevant variances and prepare a statement reconciling the profit that was originally budgeted to actual profit achieved Namibia Limited

Full explanation with formulas

Calculate all relevant variances and prepare a statement reconciling the profit that was originally budgeted to actual profit achieved

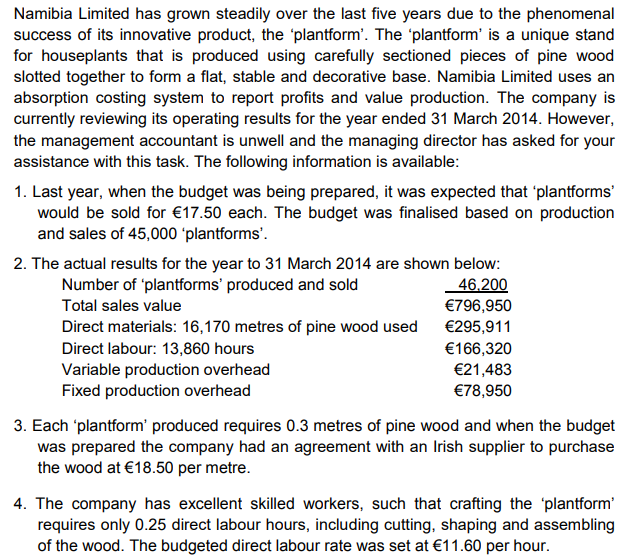

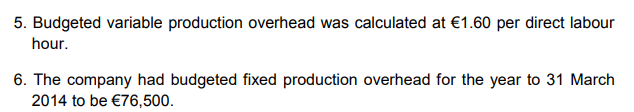

Namibia Limited has grown steadily over the last five years due to the phenomenal success of its innovative product, the plantform'. The plantform' is a unique stand for houseplants that is produced using carefully sectioned pieces of pine wood slotted together to form a flat, stable and decorative base. Namibia Limited uses an absorption costing system to report profits and value production. The company is currently reviewing its operating results for the year ended 31 March 2014. However, the management accountant is unwell and the managing director has asked for your assistance with this task. The following information is available: 1. Last year, when the budget was being prepared, it was expected that plantforms' would be sold for 17.50 each. The budget was finalised based on production and sales of 45,000 plantforms'. 2. The actual results for the year to 31 March 2014 are shown below: Number of 'plantforms' produced and sold 46.200 Total sales value 796,950 Direct materials: 16,170 metres of pine wood used 295,911 Direct labour: 13,860 hours 166,320 Variable production overhead 21,483 Fixed production overhead 78,950 3. Each plantform' produced requires 0.3 metres of pine wood and when the budget was prepared the company had an agreement with an Irish supplier to purchase the wood at 18.50 per metre. 4. The company has excellent skilled workers, such that crafting the 'plantform? requires only 0.25 direct labour hours, including cutting, shaping and assembling of the wood. The budgeted direct labour rate was set at 11.60 per hour. 5. Budgeted variable production overhead was calculated at 1.60 per direct labour hour. 6. The company had budgeted fixed production overhead for the year to 31 March 2014 to be 76,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started