Answered step by step

Verified Expert Solution

Question

1 Approved Answer

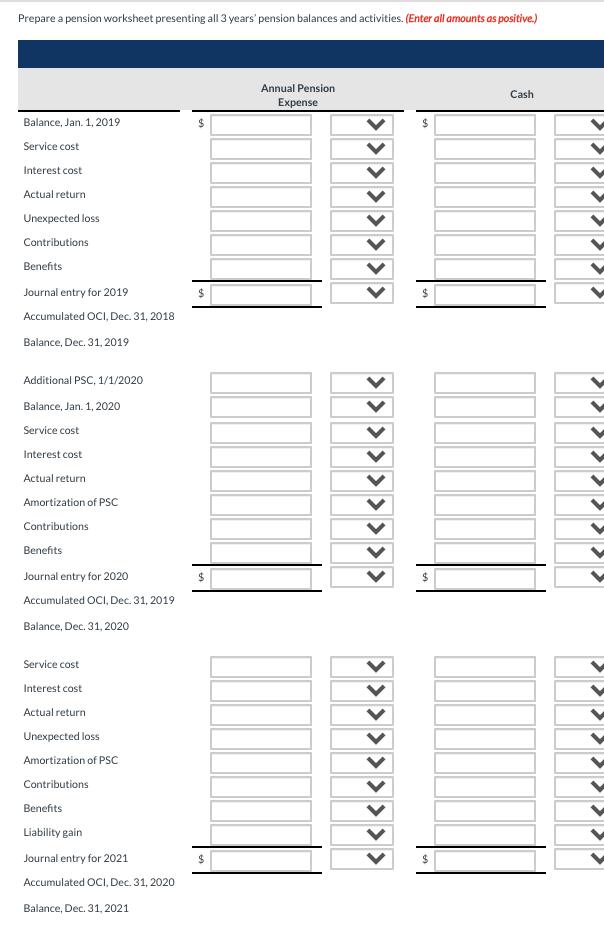

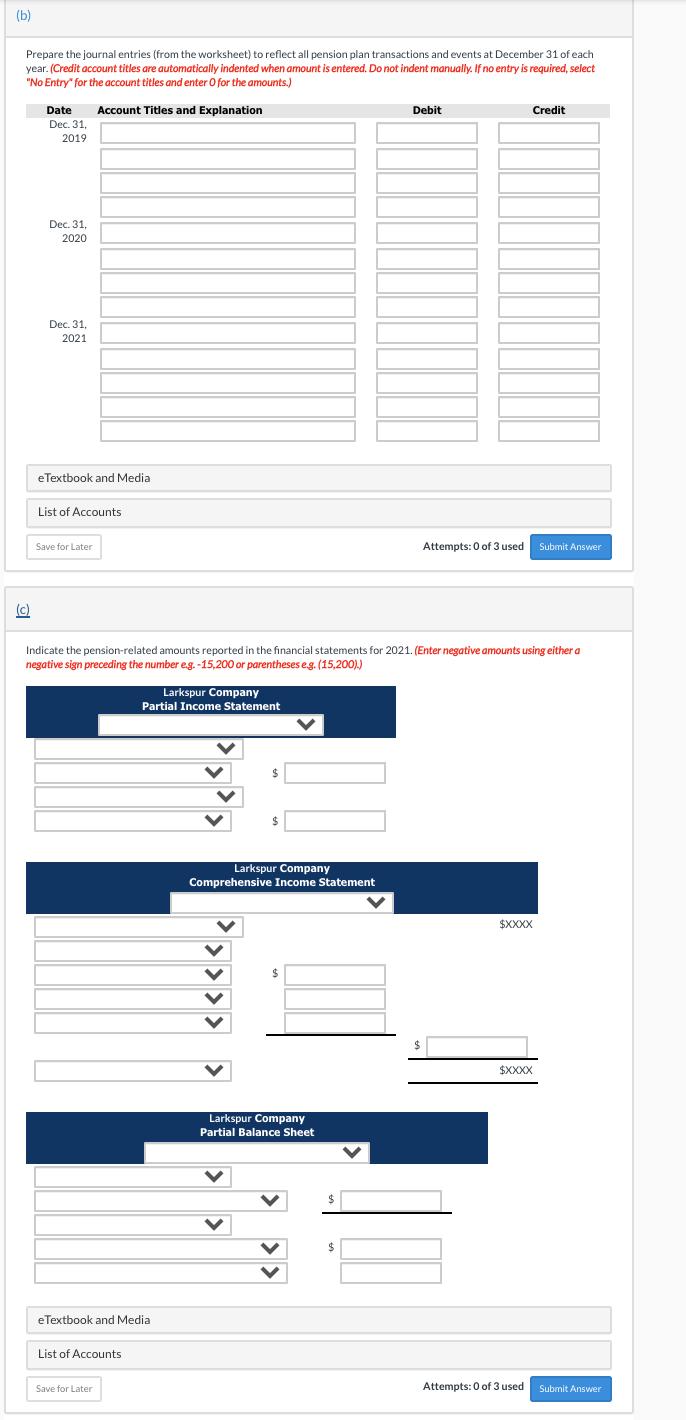

Full Pension. worksheet with: General Journal Entries Memo Record Annual Pension Expense Cash OCIPrior Service Cost OCIGain/ Loss Pension Asset/ Liability Projected Benefit Obligation Plan

Full Pension. worksheet with:

General Journal Entries | Memo Record | |||||||||||||||||||||

Annual Pension | Cash | OCI—Prior | OCI—Gain/ | Pension Asset/ | Projected Benefit | Plan | ||||||||||||||||

after

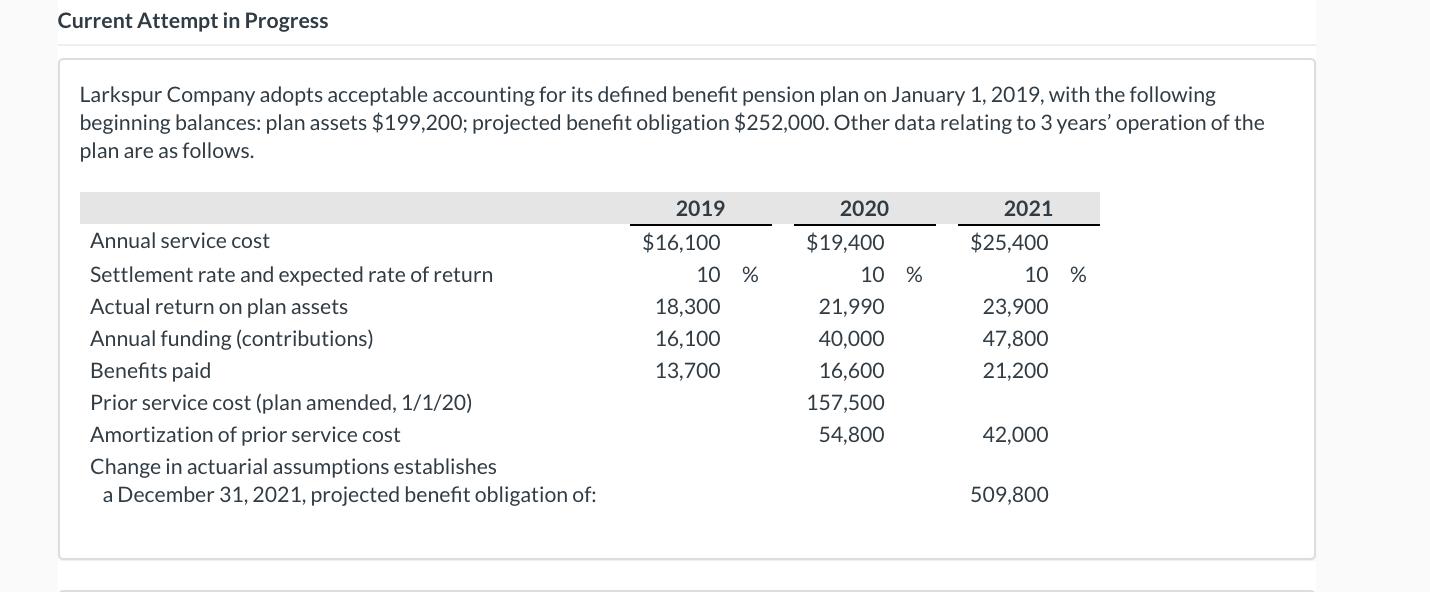

Current Attempt in Progress Larkspur Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $199,200; projected benefit obligation $252,000. Other data relating to 3 years' operation of the plan are as follows. 2019 2020 $19,400 2021 $25,400 Annual service cost $16,100 Settlement rate and expected rate of return Actual return on plan assets 18,300 21,990 23,900 Annual funding (contributions) 16,100 40,000 47,800 Benefits paid 13,700 16,600 21,200 Prior service cost (plan amended, 1/1/20) 157,500 Amortization of prior service cost 54,800 42,000 Change in actuarial assumptions establishes a December 31, 2021, projected benefit obligation of: 509,800 10 % 10 % 10 %

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution Items Balance Jan1 2019 Service Cost Interest Cost Actual Return Unexpected Loss Contributi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started