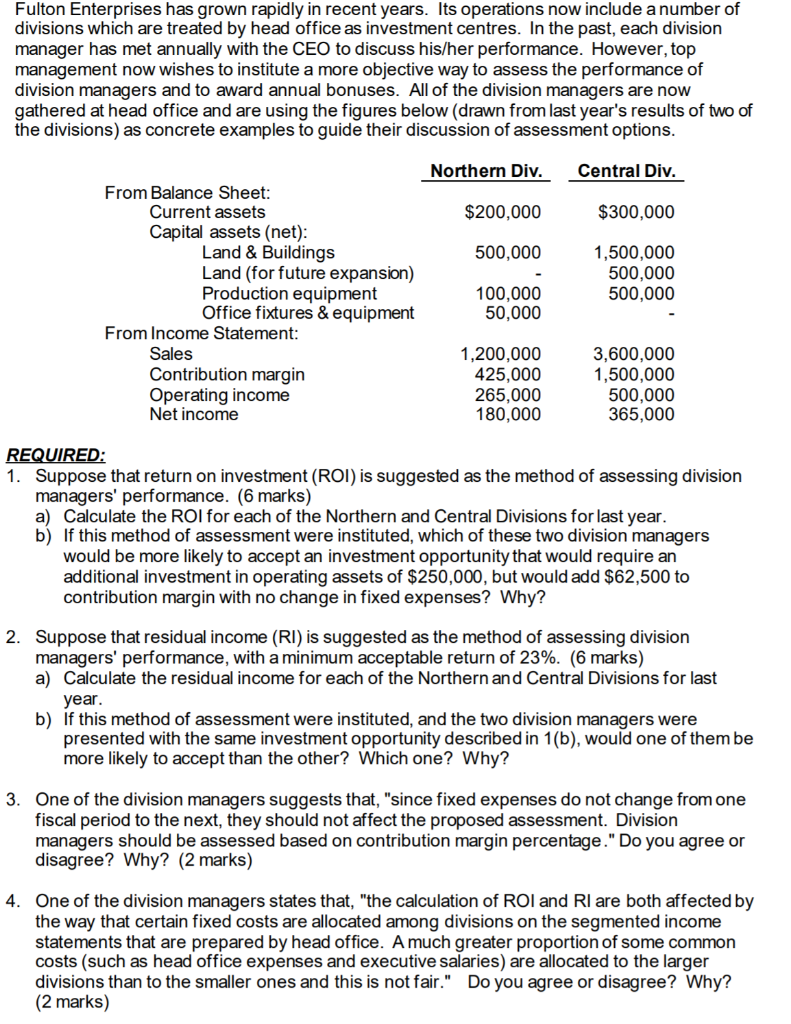

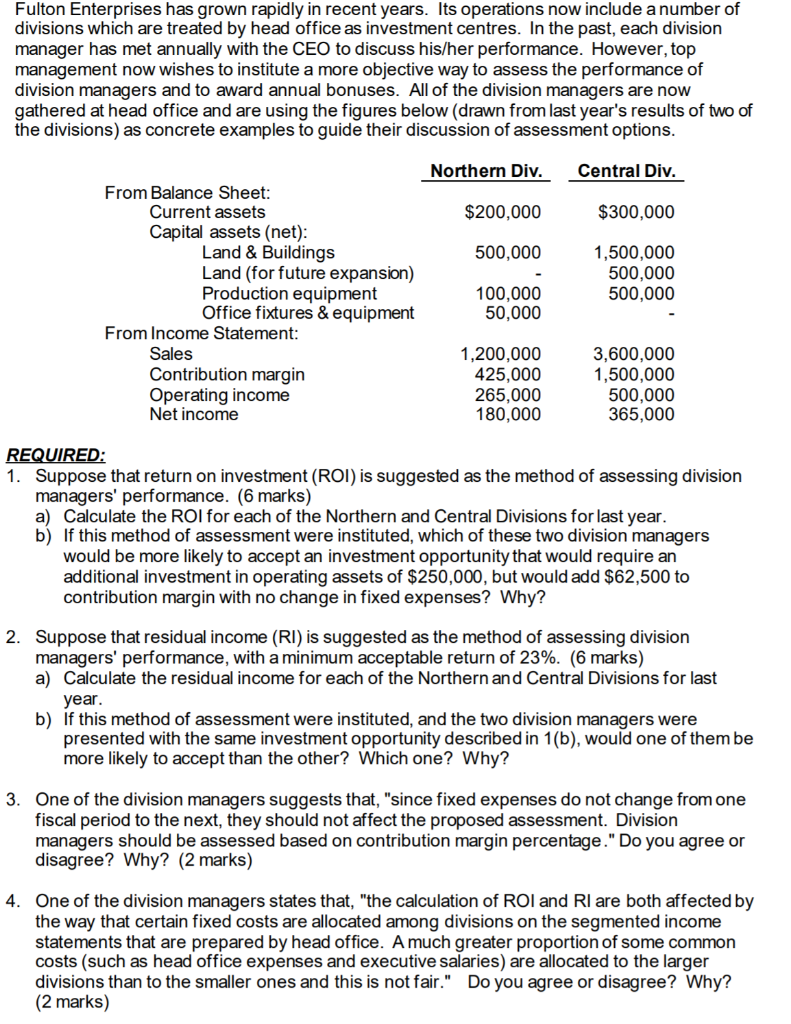

Fulton Enterprises has grown rapidly in recent years. Its operations now include a number of divisions which are treated by head office as investment centres. In the past, each division manager has met annually with the CEO to discuss his/her performance. However, top management now wishes to institute a more objective way to assess the performance of division managers and to award annual bonuses. All of the division managers are now gathered at head office and are using the figures below (drawn from last year's results of two of the divisions) as concrete examples to guide their discussion of assessment options. Northern Div. Central Div. $200,000 $300,000 500,000 From Balance Sheet: Current assets Capital assets (net): Land & Buildings Land (for future expansion) Production equipment Office fixtures & equipment From Income Statement: Sales Contribution margin Operating income Net income 1,500,000 500,000 500,000 100,000 50,000 1,200,000 425,000 265.000 180,000 3,600,000 1,500,000 500,000 365,000 REQUIRED: 1. Suppose that return on investment (ROI) is suggested as the method of assessing division managers' performance. (6 marks) a) Calculate the ROI for each of the Northern and Central Divisions for last year. b) If this method of assessment were instituted, which of these two division managers would be more likely to accept an investment opportunity that would require an additional investment in operating assets of $250,000, but would add $62,500 to contribution margin with no change in fixed expenses? Why? 2. Suppose that residual income (RI) is suggested as the method of assessing division managers' performance, with a minimum acceptable return of 23%. (6 marks) a) Calculate the residual income for each of the Northern and Central Divisions for last year. b) If this method of assessment were instituted, and the two division managers were presented with the same investment opportunity described in 1(b), would one of them be more likely to accept than the other? Which one? Why? 3. One of the division managers suggests that, "since fixed expenses do not change from one fiscal period to the next, they should not affect the proposed assessment. Division managers should be assessed based on contribution margin percentage." Do you agree or disagree? Why? (2 marks) 4. One of the division managers states that, "the calculation of ROI and RI are both affected by the way that certain fixed costs are allocated among divisions on the segmented income statements that are prepared by head office. A much greater proportion of some common costs (such as head office expenses and executive salaries) are allocated to the larger divisions than to the smaller ones and this is not fair." Do you agree or disagree? Why? (2 marks) Fulton Enterprises has grown rapidly in recent years. Its operations now include a number of divisions which are treated by head office as investment centres. In the past, each division manager has met annually with the CEO to discuss his/her performance. However, top management now wishes to institute a more objective way to assess the performance of division managers and to award annual bonuses. All of the division managers are now gathered at head office and are using the figures below (drawn from last year's results of two of the divisions) as concrete examples to guide their discussion of assessment options. Northern Div. Central Div. $200,000 $300,000 500,000 From Balance Sheet: Current assets Capital assets (net): Land & Buildings Land (for future expansion) Production equipment Office fixtures & equipment From Income Statement: Sales Contribution margin Operating income Net income 1,500,000 500,000 500,000 100,000 50,000 1,200,000 425,000 265.000 180,000 3,600,000 1,500,000 500,000 365,000 REQUIRED: 1. Suppose that return on investment (ROI) is suggested as the method of assessing division managers' performance. (6 marks) a) Calculate the ROI for each of the Northern and Central Divisions for last year. b) If this method of assessment were instituted, which of these two division managers would be more likely to accept an investment opportunity that would require an additional investment in operating assets of $250,000, but would add $62,500 to contribution margin with no change in fixed expenses? Why? 2. Suppose that residual income (RI) is suggested as the method of assessing division managers' performance, with a minimum acceptable return of 23%. (6 marks) a) Calculate the residual income for each of the Northern and Central Divisions for last year. b) If this method of assessment were instituted, and the two division managers were presented with the same investment opportunity described in 1(b), would one of them be more likely to accept than the other? Which one? Why? 3. One of the division managers suggests that, "since fixed expenses do not change from one fiscal period to the next, they should not affect the proposed assessment. Division managers should be assessed based on contribution margin percentage." Do you agree or disagree? Why? (2 marks) 4. One of the division managers states that, "the calculation of ROI and RI are both affected by the way that certain fixed costs are allocated among divisions on the segmented income statements that are prepared by head office. A much greater proportion of some common costs (such as head office expenses and executive salaries) are allocated to the larger divisions than to the smaller ones and this is not fair." Do you agree or disagree? Why? (2 marks)