Answered step by step

Verified Expert Solution

Question

1 Approved Answer

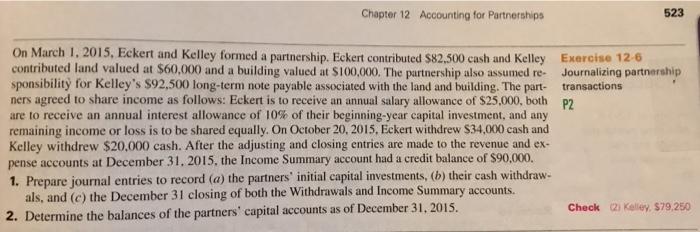

Fundamental Accounting Principles 22nd Edition Exercise 12-6 Chapter 12 Accounting for Partnerships 523 On March 1, 2015, Eckert and Kelley formed a partnership. Eckert contributed

Fundamental Accounting Principles 22nd Edition Exercise 12-6

Chapter 12 Accounting for Partnerships 523 On March 1, 2015, Eckert and Kelley formed a partnership. Eckert contributed $82,500 cash and Kelley Exercise 12-6 contributed land valued at $60,000 and a building valued at $100,000. The partnership also assumed re- sponsibility for Kelley's $92,500 long-term note payable associated with the land and building. The part- transactions Journalizing partnership ners agreed to share income as follows: Eckert is to receive an annual salary allowance of $25.000, both P2 are to receive an annual interest allowance of 10% of their beginning-year capital investment, and any remaining income or loss is to be shared equally. On October 20, 2015, Eckert withdrew S34,000 cash and Kelley withdrew $20,000 cash. After the adjusting and closing entries are made to the revenue and ex- pense accounts at December 31, 2015. the Income Summary account had a credit balance of $90,000. 1. Prepare journal entries to record (a) the partners' initial capital investments, (b) their cash withdraw- als, and (c) the December 31 closing of both the Withdrawals and Income Summary accounts. Check 2 Kelley, $79,250 2. Determine the balances of the partners' capital accounts as of December 31, 2015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started