Fundamental Managerial Accounting Concepts Chapter 3, question ATC-1 on page 145. I need help with part C.

C. Notice that from 2009 to 2010 Apple's percentage increase in earnings was 1.8 times the percentage increase in revenue (139/79=1.8). From 2010 to 2011, however Apple's percentage increase in earnings was only 1.3 times its increase in revenue (84/66=13). Based on the concepts discussed in the chapter, what might explain why the ration of increase in earnings to increase in revenue was lower from 2010 to 2011 than from 2009 to 2010. Assume Apple's general pricing policies and cost structure did not change.

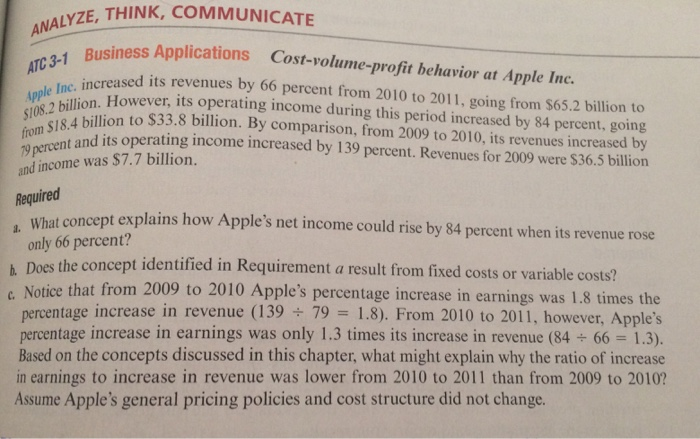

VZE, THINK, COMMUNICATE ANALYZE, THIA ATC 3-1 Business A Apple Ine, increas $108.2 billion. How from $18.4 billion 79 percent and its ope, siness Applications Cost-volume-profit behavior at Apple Inc. increased its revenues by 66 percent from 2010 to 2011, going from $65.2 billion to However, its operating income during this period increased by 84 percent, going billion to $33.8 billion. By comparison, from 2009 to 2010, its revenues increased by and its operating income increased by 139 percent. Revenues for 2009 were $36.5 billion and income was $7.7 billion. Required what concept explains how Apple's net income could rise by 84 percent when its revenue rose only 66 percent? Does the concept identified in Requirement a result from fixed costs or variable costs? Notice that from 2009 to 2010 Apple's percentage increase in earnings was 1.8 times the percentage increase in revenue (139 79 = 1.8). From 2010 to 2011. however. Apple's! percentage increase in earnings was only 1.3 times its increase in revenue (84 + 66 = 1.3). Based on the concepts discussed in this chapter, what might explain why the ratio of increase in earnings to increase in revenue was lower from 2010 to 2011 than from 2009 to 2010?! Assume Apple's general pricing policies and cost structure did not change. VZE, THINK, COMMUNICATE ANALYZE, THIA ATC 3-1 Business A Apple Ine, increas $108.2 billion. How from $18.4 billion 79 percent and its ope, siness Applications Cost-volume-profit behavior at Apple Inc. increased its revenues by 66 percent from 2010 to 2011, going from $65.2 billion to However, its operating income during this period increased by 84 percent, going billion to $33.8 billion. By comparison, from 2009 to 2010, its revenues increased by and its operating income increased by 139 percent. Revenues for 2009 were $36.5 billion and income was $7.7 billion. Required what concept explains how Apple's net income could rise by 84 percent when its revenue rose only 66 percent? Does the concept identified in Requirement a result from fixed costs or variable costs? Notice that from 2009 to 2010 Apple's percentage increase in earnings was 1.8 times the percentage increase in revenue (139 79 = 1.8). From 2010 to 2011. however. Apple's! percentage increase in earnings was only 1.3 times its increase in revenue (84 + 66 = 1.3). Based on the concepts discussed in this chapter, what might explain why the ratio of increase in earnings to increase in revenue was lower from 2010 to 2011 than from 2009 to 2010?! Assume Apple's general pricing policies and cost structure did not change