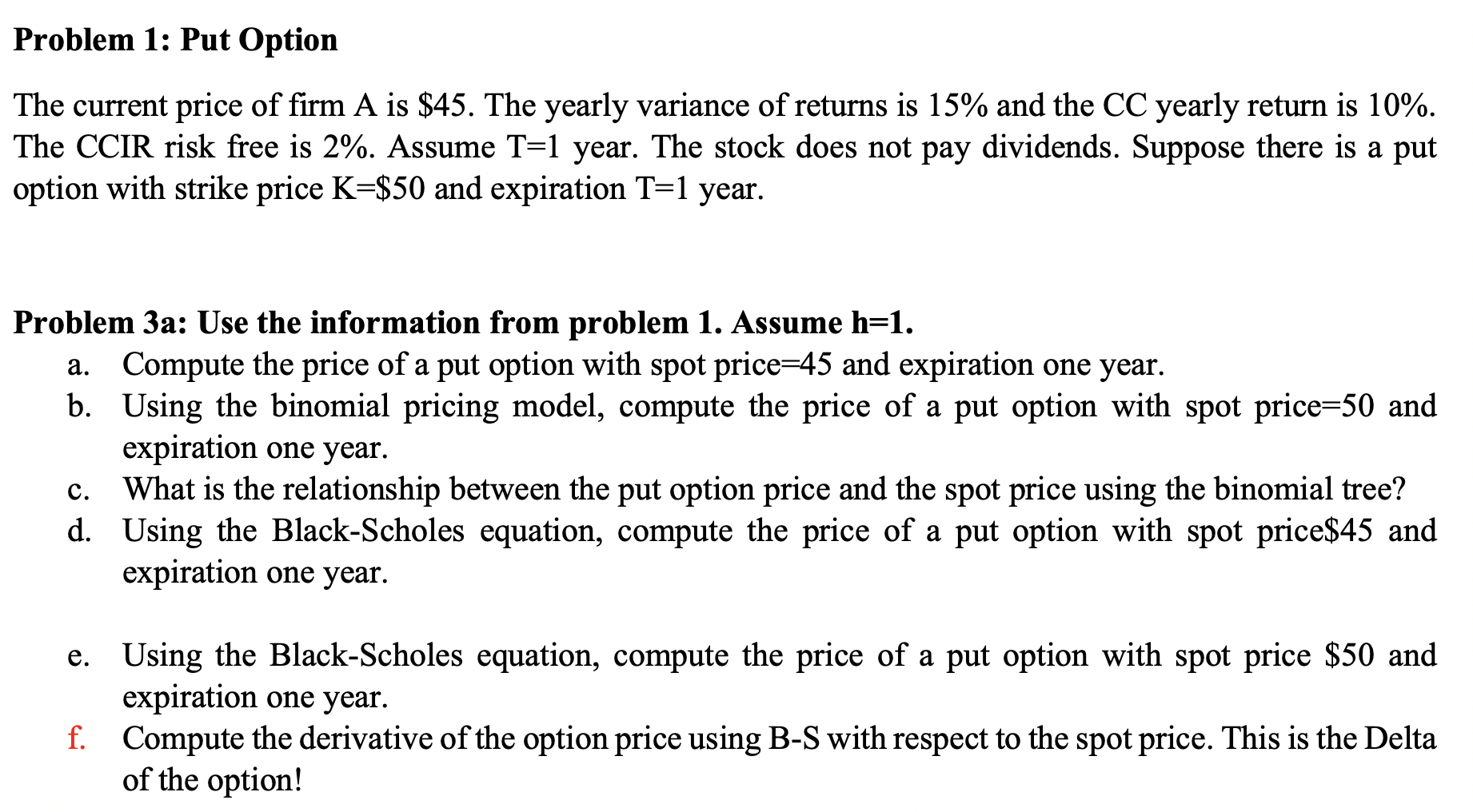

Fundamentals: The current price of firm A is $45. The yearly variance of returns is 15% and the CC yearly return is 10%. The CCIR risk free is 2%. Assume T=1 year. The stock does not pay dividends. The purpose is to model the stock price behavior over one year. If h = 1, compute u, d, q,q* If h = 1/2, compute u,d,q,q* If h = 1/4, compute u, d,q,q* What does h represent? Problem 1: Put Option The current price of firm A is $45. The yearly variance of returns is 15% and the CC yearly return is 10%. The CCIR risk free is 2%. Assume T=1 year. The stock does not pay dividends. Suppose there is a put option with strike price K=$50 and expiration T=1 year. a. Problem 3a: Use the information from problem 1. Assume h=1. Compute the price of a put option with spot price=45 and expiration one year. b. Using the binomial pricing model, compute the price of a put option with spot price=50 and expiration one year. What is the relationship between the put option price and the spot price using the binomial tree? d. Using the Black-Scholes equation, compute the price of a put option with spot price$45 and expiration one year. c. e. Using the Black-Scholes equation, compute the price of a put option with spot price $50 and expiration one year. f. Compute the derivative of the option price using B-S with respect to the spot price. This is the Delta of the option! Fundamentals: The current price of firm A is $45. The yearly variance of returns is 15% and the CC yearly return is 10%. The CCIR risk free is 2%. Assume T=1 year. The stock does not pay dividends. The purpose is to model the stock price behavior over one year. If h = 1, compute u, d, q,q* If h = 1/2, compute u,d,q,q* If h = 1/4, compute u, d,q,q* What does h represent? Problem 1: Put Option The current price of firm A is $45. The yearly variance of returns is 15% and the CC yearly return is 10%. The CCIR risk free is 2%. Assume T=1 year. The stock does not pay dividends. Suppose there is a put option with strike price K=$50 and expiration T=1 year. a. Problem 3a: Use the information from problem 1. Assume h=1. Compute the price of a put option with spot price=45 and expiration one year. b. Using the binomial pricing model, compute the price of a put option with spot price=50 and expiration one year. What is the relationship between the put option price and the spot price using the binomial tree? d. Using the Black-Scholes equation, compute the price of a put option with spot price$45 and expiration one year. c. e. Using the Black-Scholes equation, compute the price of a put option with spot price $50 and expiration one year. f. Compute the derivative of the option price using B-S with respect to the spot price. This is the Delta of the option