Answered step by step

Verified Expert Solution

Question

1 Approved Answer

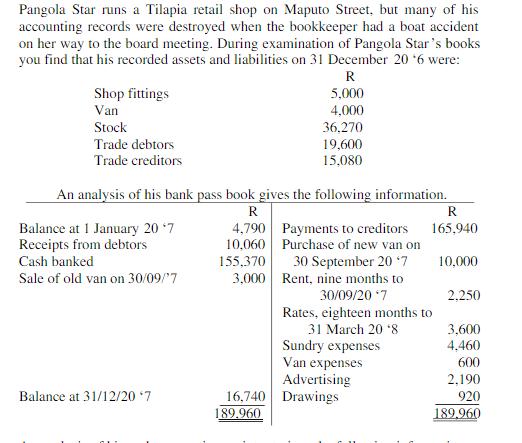

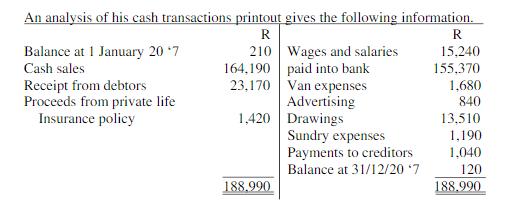

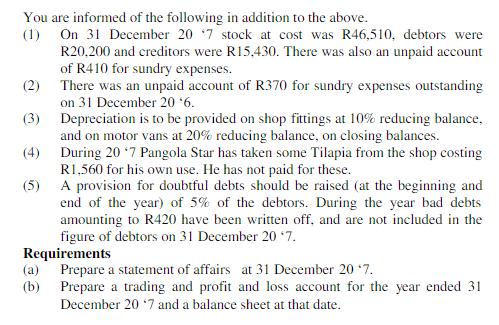

Pangola Star runs a Tilapia retail shop on Maputo Street, but many of his accounting records were destroyed when the bookkeeper had a boat

Pangola Star runs a Tilapia retail shop on Maputo Street, but many of his accounting records were destroyed when the bookkeeper had a boat accident on her way to the board meeting. During examination of Pangola Star's books you find that his recorded assets and liabilities on 31 December 20*6 were: R 5,000 4,000 36,270 19,600 15.080 Shop fittings Van Stock Trade debtors Trade creditors An analysis of his bank pass book gives the following information. R 4,790 10.060 155,370 3,000 Balance at 1 January 20*7 Receipts from debtors Cash banked Sale of old van on 30/09/7 Balance at 31/12/20 *7 16,740 189.960 Payments to creditors Purchase of new van on 30 September 2017 Rent, nine months to R 165,940 30/09/20*7 Rates, eighteen months to 31 March 20*8 Sundry expenses Van expenses Advertising Drawings 10,000 2.250 3,600 4.460 600 2,190 920 189.960 An analysis of his cash transactions printout gives the following information. R 210 Balance at 1 January 20*7 Cash sales Receipt from debtors Proceeds from private life Insurance policy 164,190 23,170 1,420 188.990 Wages and salaries paid into bank Van expenses Advertising Drawings Sundry expenses Payments to creditors Balance at 31/12/20'7 R 15,240 155.370 1,680 840 13,510 1,190 1,040 120 188.990 You are informed of the following in addition to the above. (1) On 31 December 20 7 stock at cost was R46.510, debtors were R20,200 and creditors were R15.430. There was also an unpaid account of R410 for sundry expenses. There was an unpaid account of R370 for sundry expenses outstanding on 31 December 20 *6. (2) (3) Depreciation is to be provided on shop fittings at 10% reducing balance. and on motor vans at 20% reducing balance, on closing balances. During 20 *7 Pangola Star has taken some Tilapia from the shop costing R1,560 for his own use. He has not paid for these. (4) (5) A provision for doubtful debts should be raised (at the beginning and end of the year) of 5% of the debtors. During the year bad debts amounting to R420 have been written off, and are not included in the figure of debtors on 31 December 20 *7. Requirements (a) (b) Prepare a statement of affairs at 31 December 2017. Prepare a trading and profit and loss account for the year ended 31 December 2017 and a balance sheet at that date.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of affairs at 31 December 20 7 Assets Shop fittings 5000 Van 4000 Stock 36270 Trade debt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started