Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxpayer Penalties and Disclosure - 10 points Your client, Betty wants to claim a tax deduction for the original artwork to by hung in

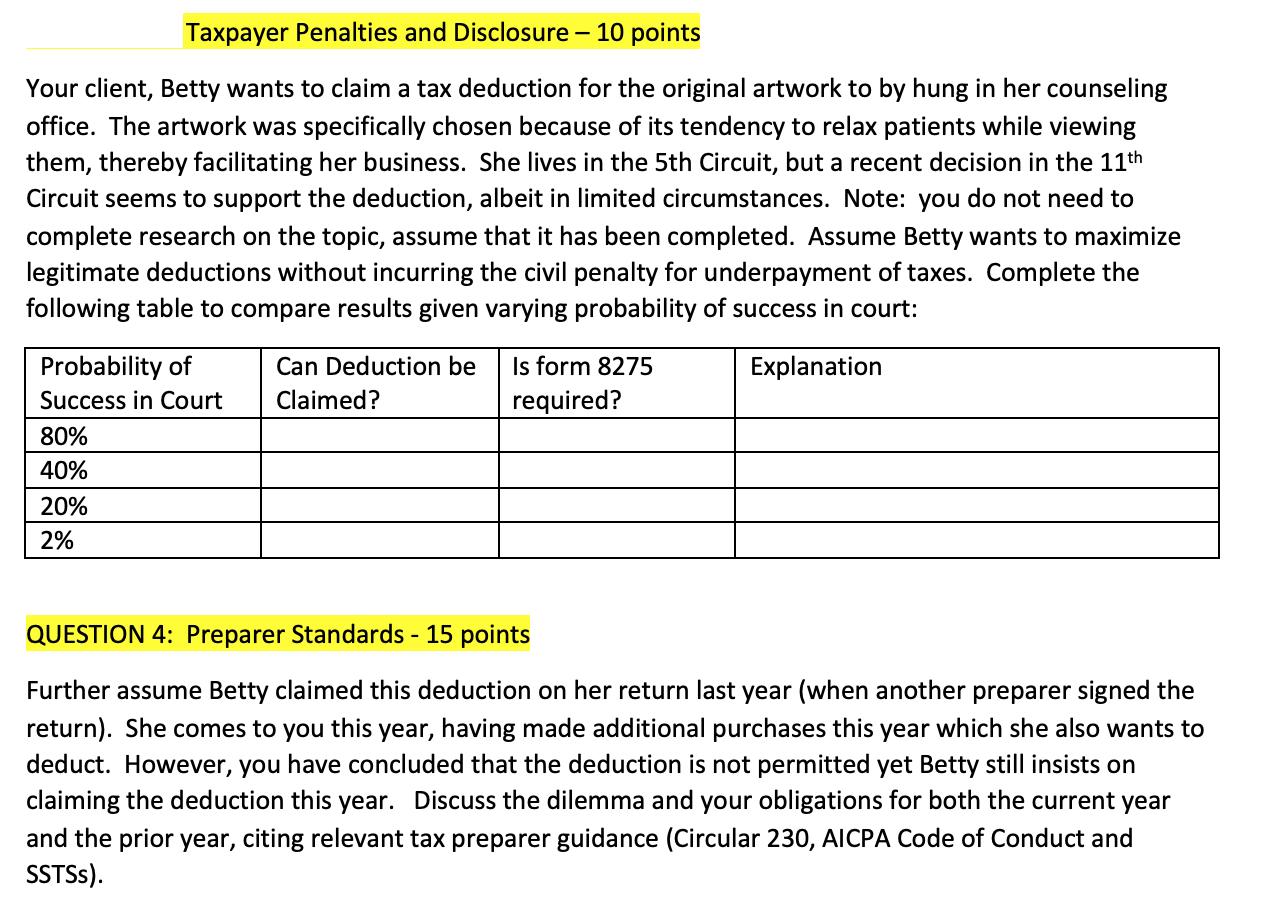

Taxpayer Penalties and Disclosure - 10 points Your client, Betty wants to claim a tax deduction for the original artwork to by hung in her counseling office. The artwork was specifically chosen because of its tendency to relax patients while viewing them, thereby facilitating her business. She lives in the 5th Circuit, but a recent decision in the 11th Circuit seems to support the deduction, albeit in limited circumstances. Note: you do not need to complete research on the topic, assume that it has been completed. Assume Betty wants to maximize legitimate deductions without incurring the civil penalty for underpayment of taxes. Complete the following table to compare results given varying probability of success in court: Explanation Probability of Success in Court 80% 40% 20% 2% Can Deduction be Is form 8275 Claimed? required? QUESTION 4: Preparer Standards - 15 points Further assume Betty claimed this deduction on her return last year (when another preparer signed the return). She comes to you this year, having made additional purchases this year which she also wants to deduct. However, you have concluded that the deduction is not permitted yet Betty still insists on claiming the deduction this year. Discuss the dilemma and your obligations for both the current year and the prior year, citing relevant tax preparer guidance (Circular 230, AICPA Code of Conduct and SSTSS).

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The dilemma for the current year is that Betty insists on claiming a deduction for the artwork that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started