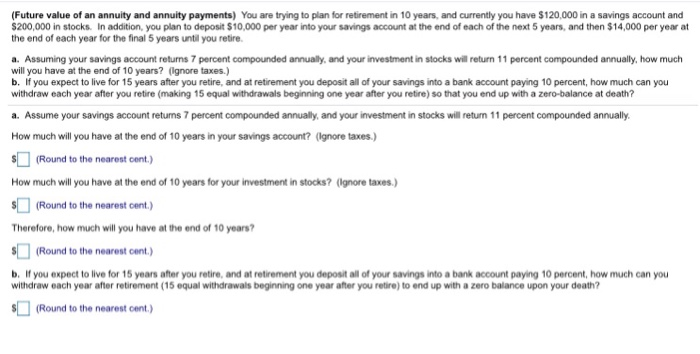

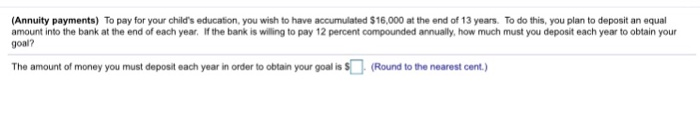

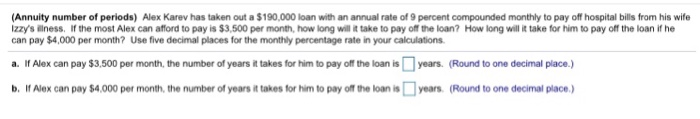

(Future value of an annuity and annuity payments) You are trying to plan for retirement in 10 years, and currently you have $120,000 in a savings account and $200,000 in stocks In addition, you plan to deposit $10,000 per year into your savings account at the end of each of the next 5 years, and then $14,000 per year at the end of each year for the final 5 years until you retire a. Assuming your savings account returns 7 percent compounded annually, and your investment in stocks will return 11 percent compounded annually, how much will you have at the end of 10 years? (gnore taxes.) b. If you expect to live for 15 years after you retire, and at retirement you deposit all of your savings into a bank account paying 10 percent, how much can you withdraw each year after you retire (making 15 equal withdrawals beginning one year after you retire) so that you end up with a zero-balance at death? a. Assume your savings account retuns 7 percent compounded annually, and your investment in stocks will returm 11 percent compounded annually How much will you have at the end of 10 years in your savings account? (Ignore taxes) (Round to the nearest cent.) How much will you have at the end of 10 years for your investment in stocks? (Ignore taxes.) (Round to the nearest cent) Therefore, how much will you have at the end of 10 years Round to the nearest cent) b. If you expect to live for 15 years after you retire, and at retirement you deposit all of your savings into a bank account paying 10 percent, how much can you withdraw each year after retirement (15 equal withdrawals beginning one year after you retire) to end up with a zero balance upon your death? S(Round to the nearest cent) (Annuity payments) To pay for your childs educaion, you wish to have accumulated $16,000 at the end of 13 years. To do this, you plan to deposit an equal amount into the bank at the end of each year, If the bank is willing to pay 12 percent compounded annualy, how much must you deposit each year to obtain your goal? The amount of money you must deposit each year in order to oblain your goal is s(Round to the nearest cent) (Annuity number of periods) Alex Karev has taken out a $190,000 loan with an annual rate of 9 percent compounded monthly to pay off hospital bills from his wife Izzy's lness. If the most Alex can afford to pay is $3,500 per month, how long will it take to pay off the loan? How long will it take for him to pay off the loan if he can pay $4,000 per month? Use five decimal places for the monthly percentage rate in your calculations a. If Alex can pay $3,500 per month, the number of years it takes for him to pay off the loan isyears. (Round to one decimal place) b. If Alex can pay $4,000 per month, the number of years it takes for him to pay off the loan is years (Round to one decimal place.)