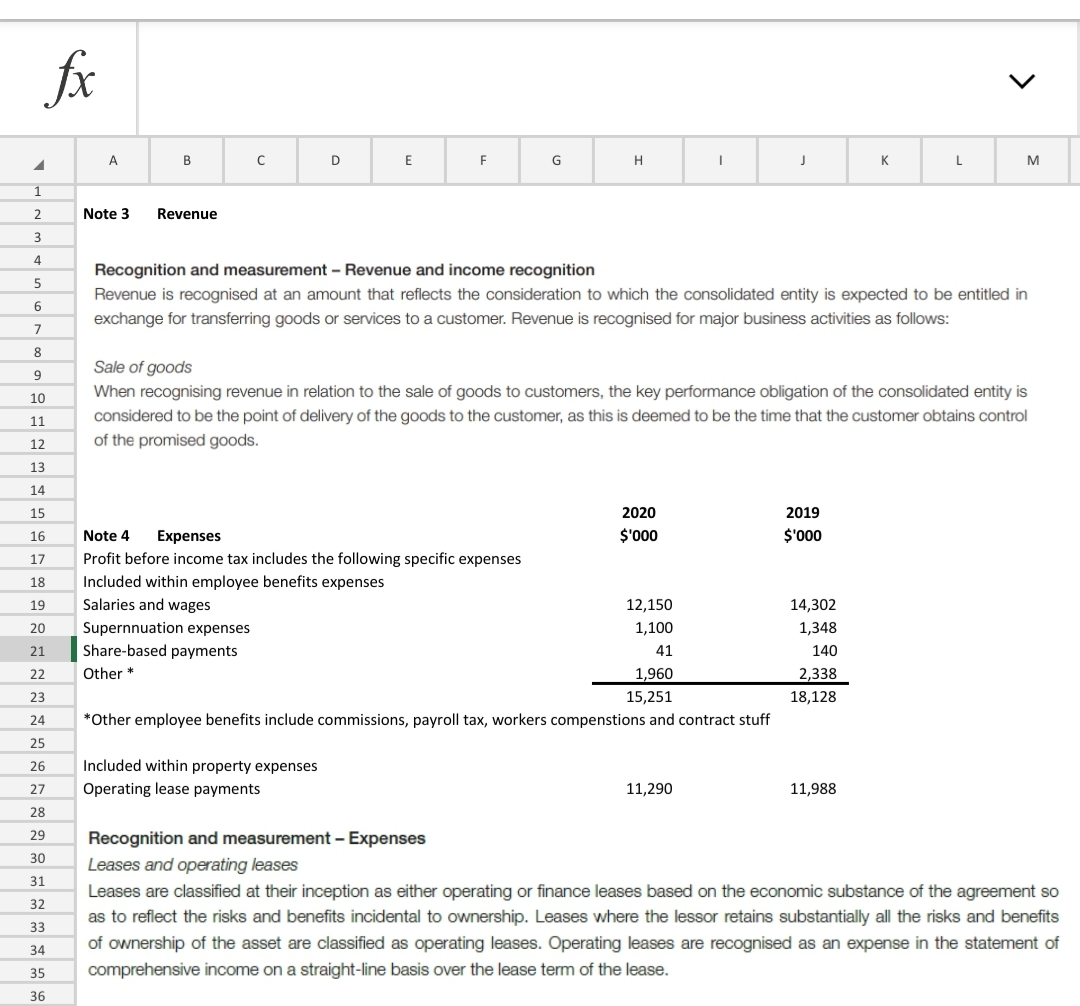

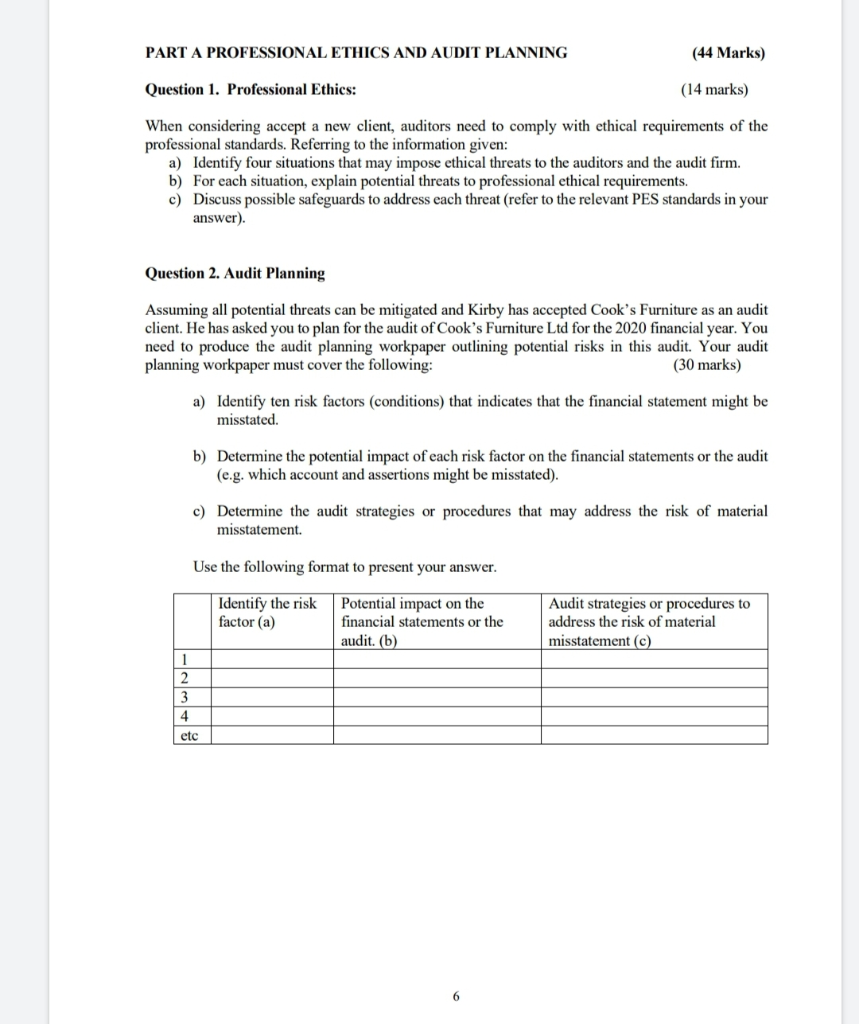

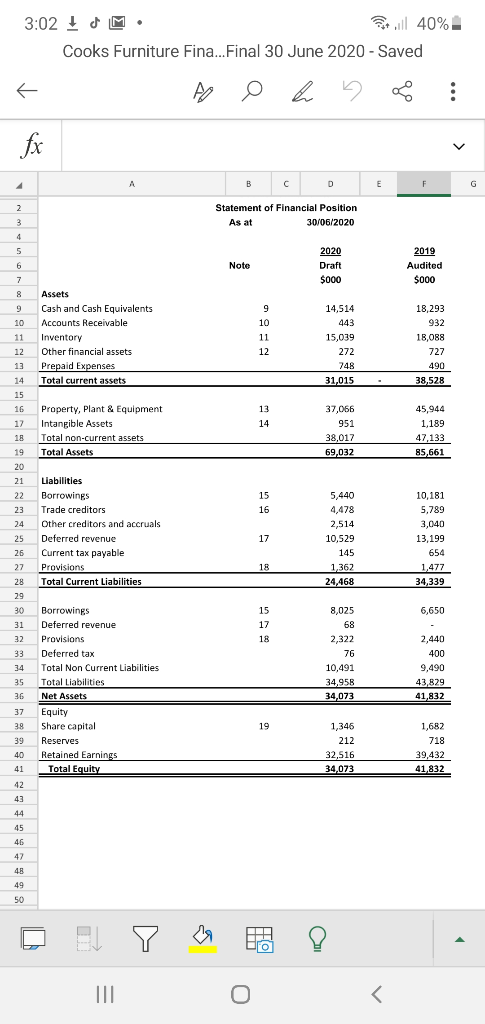

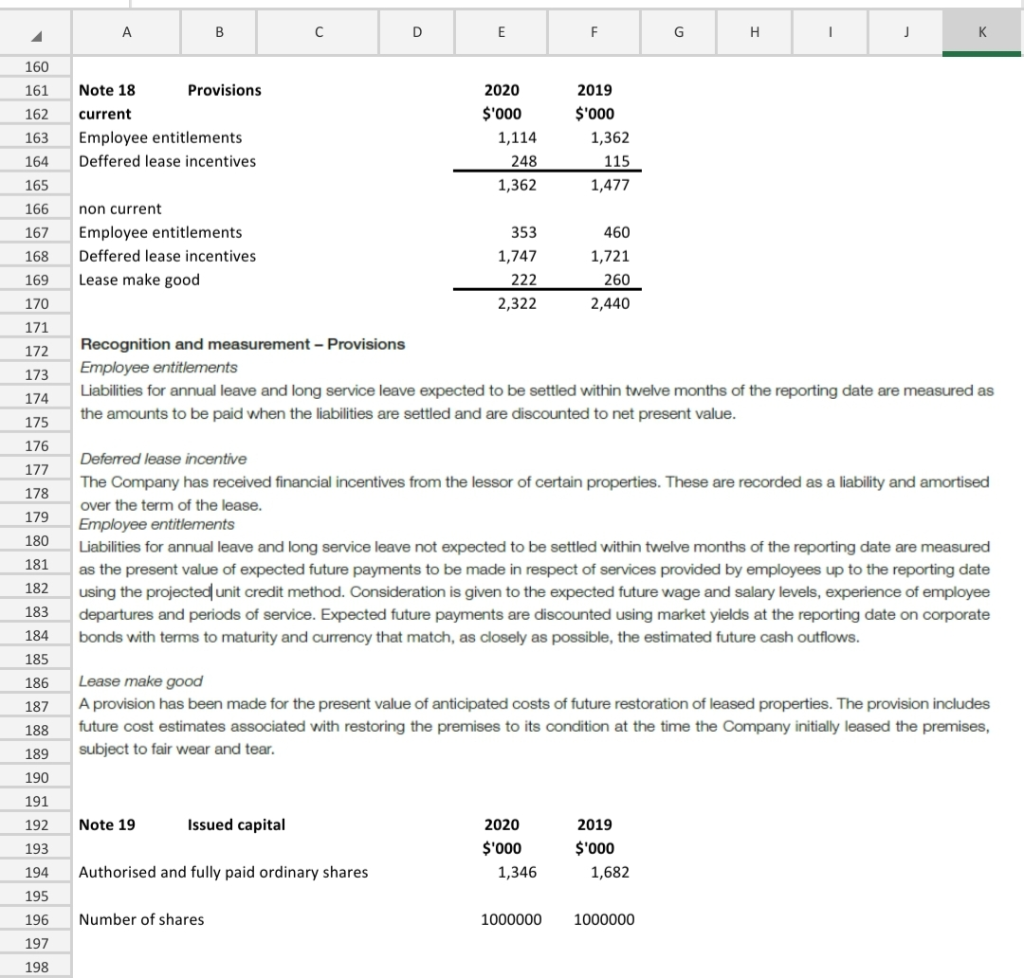

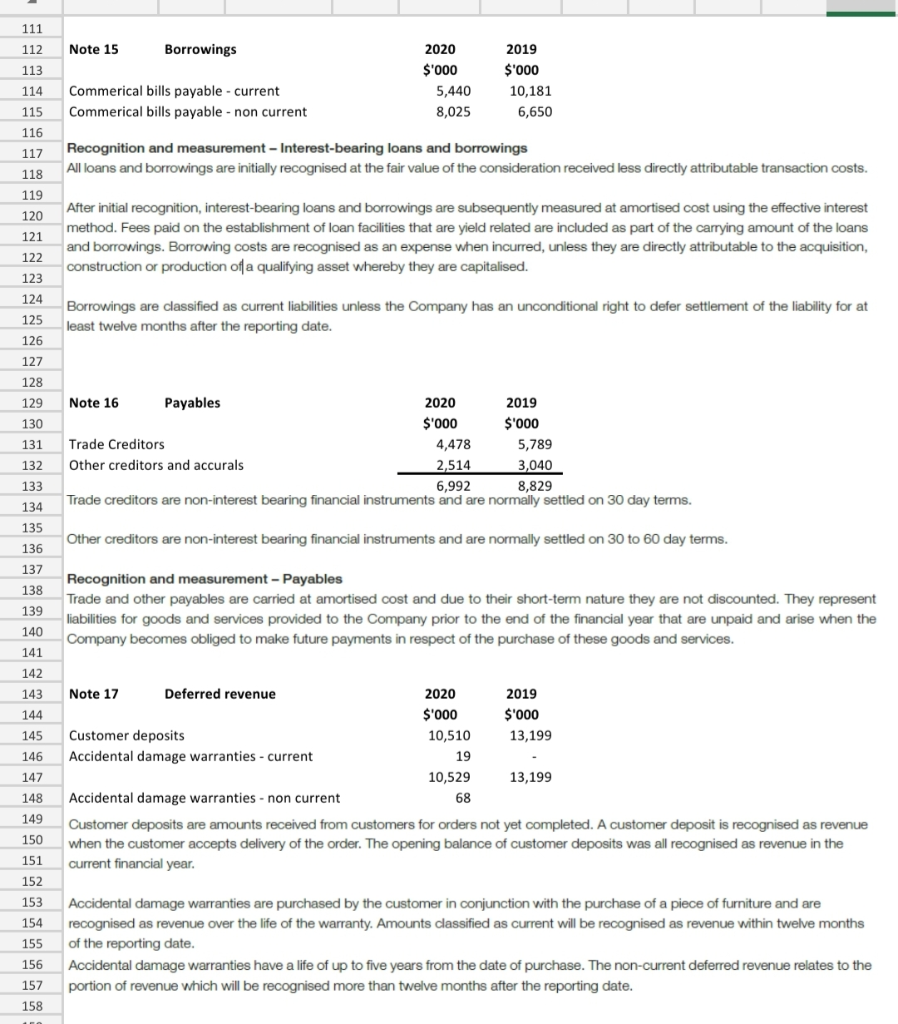

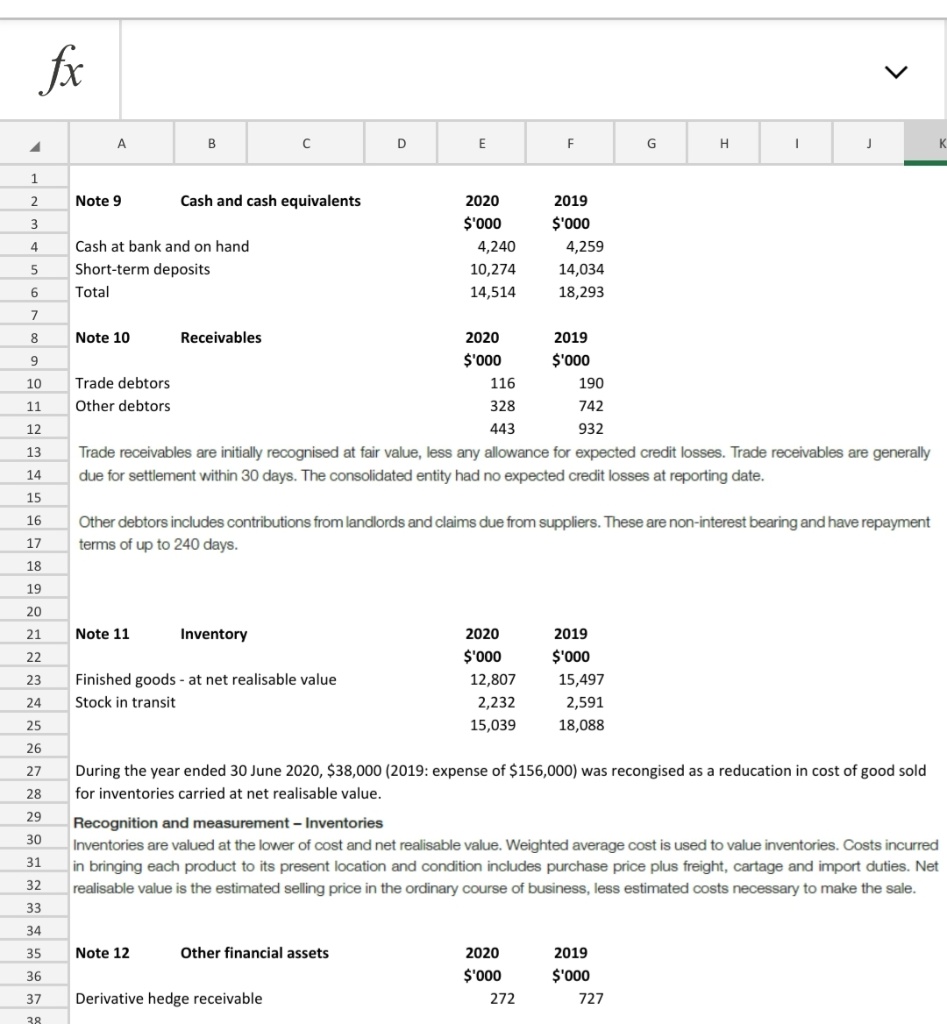

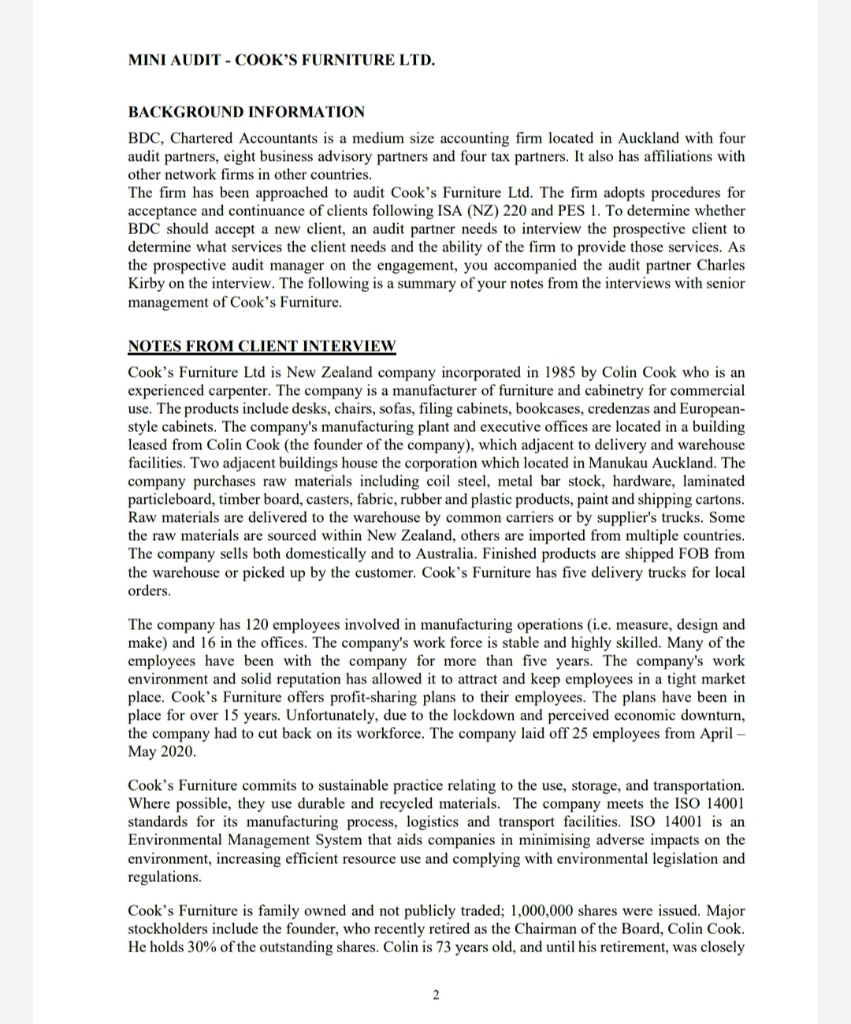

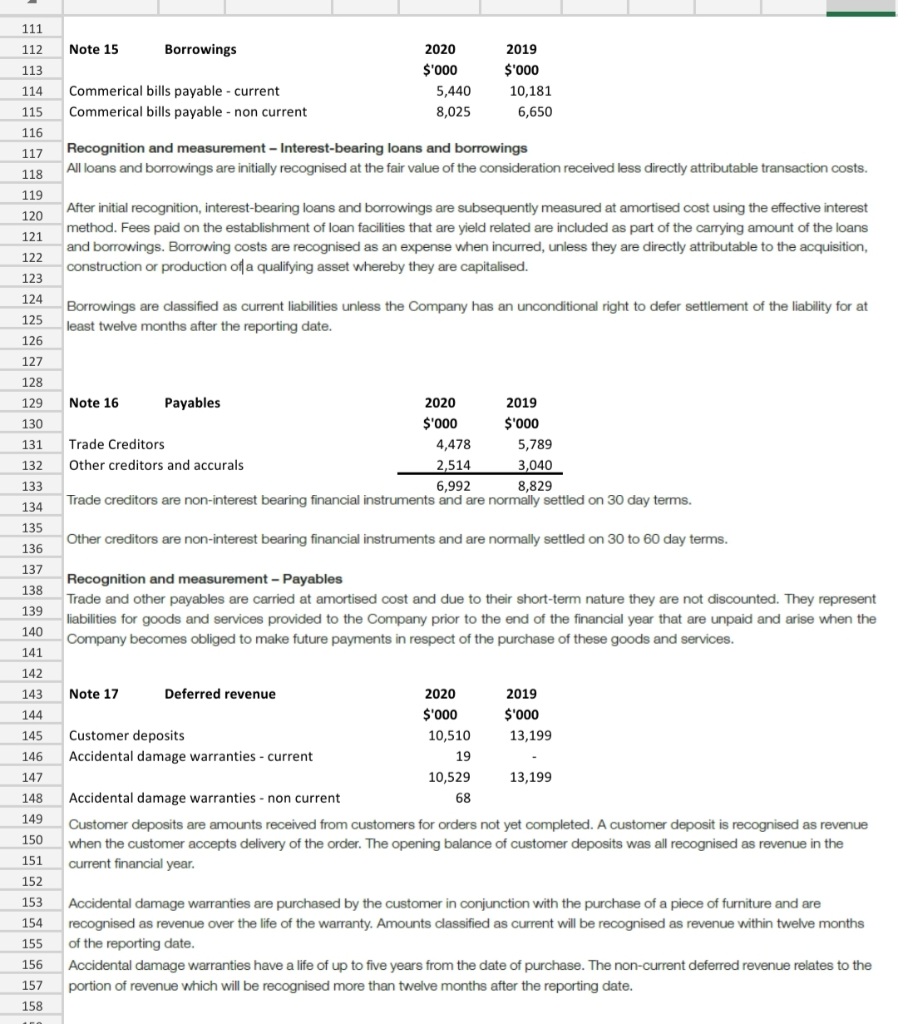

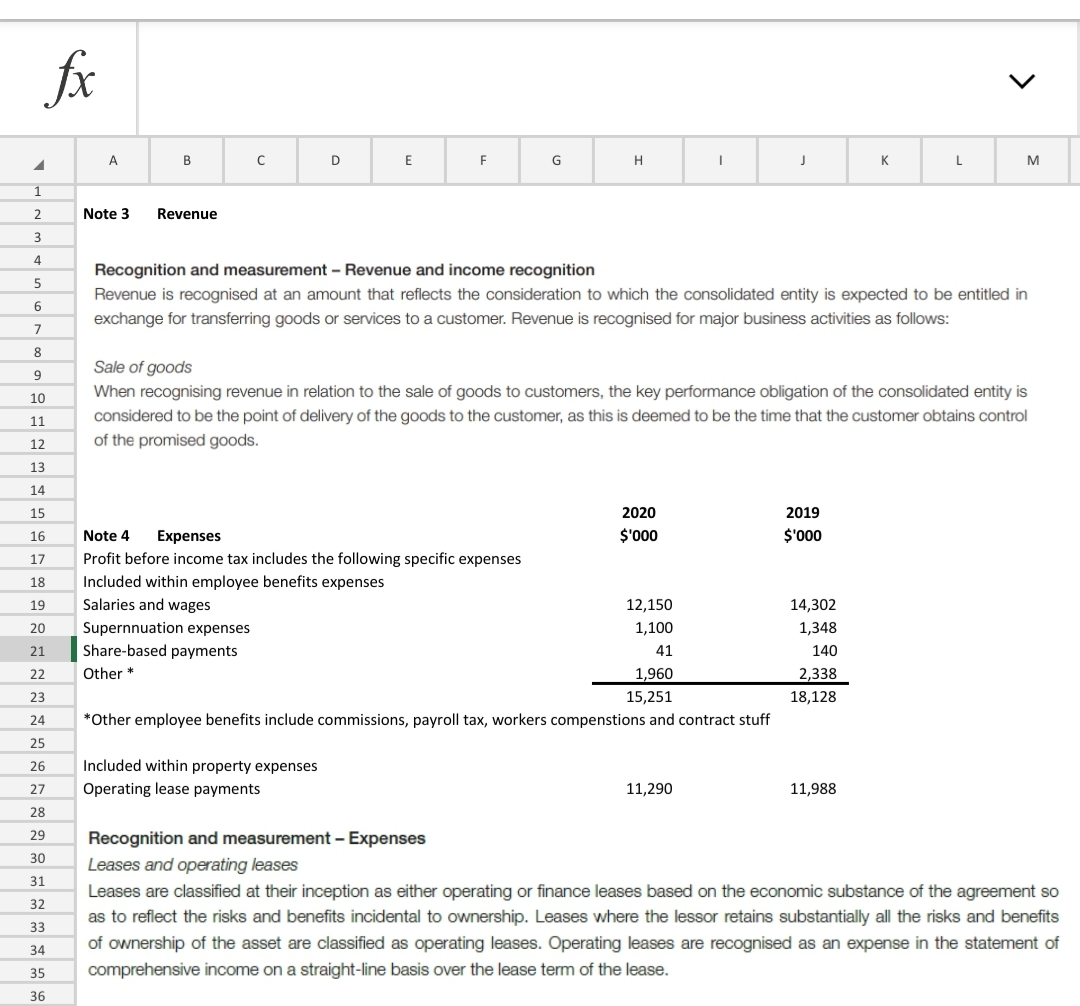

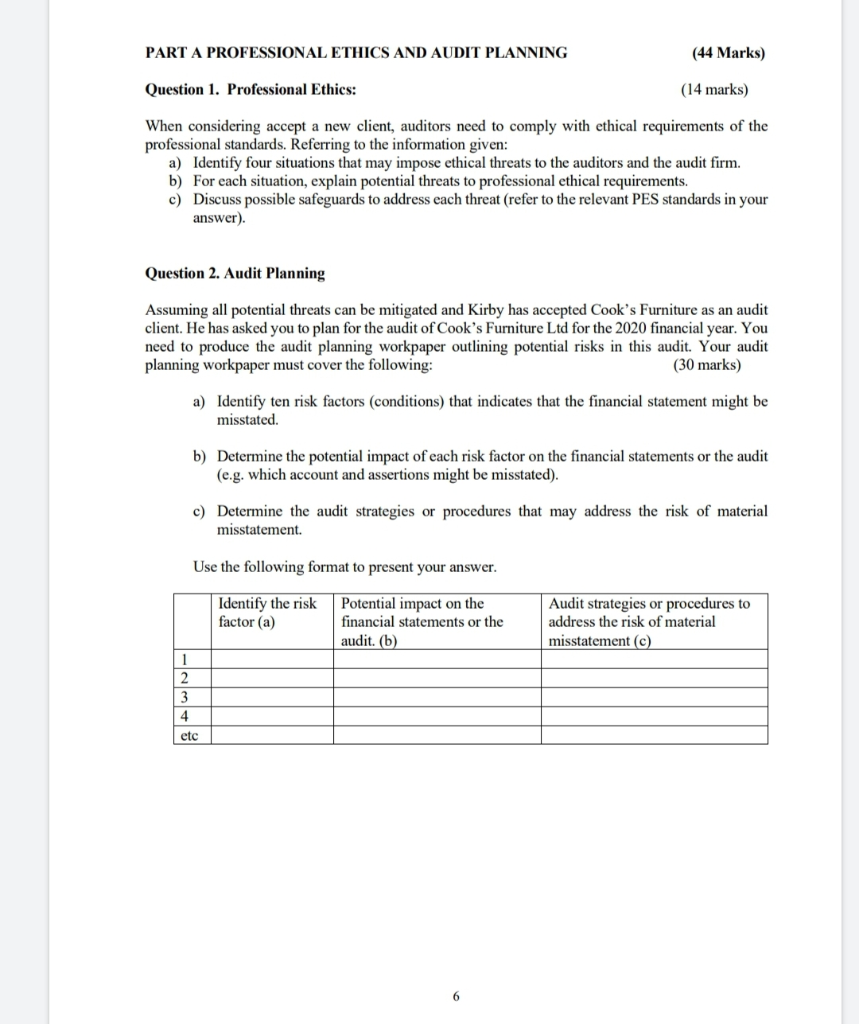

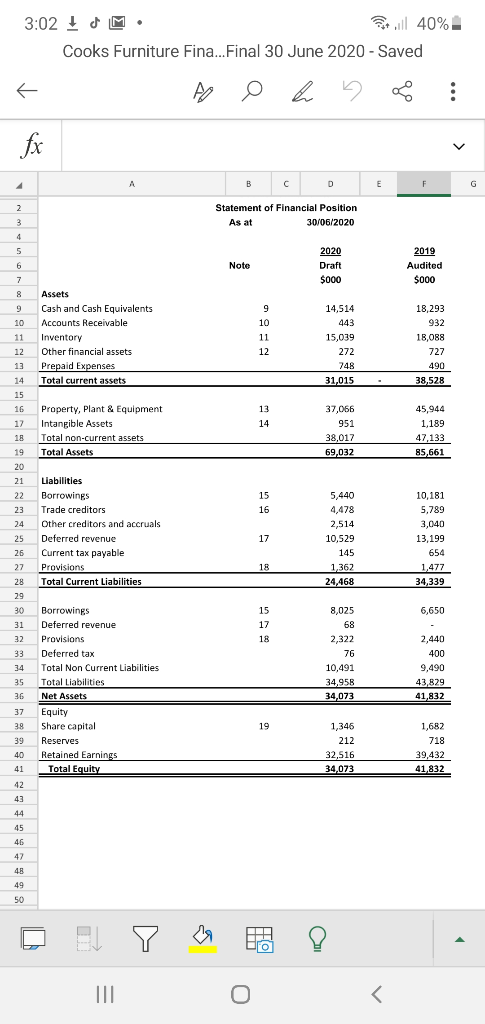

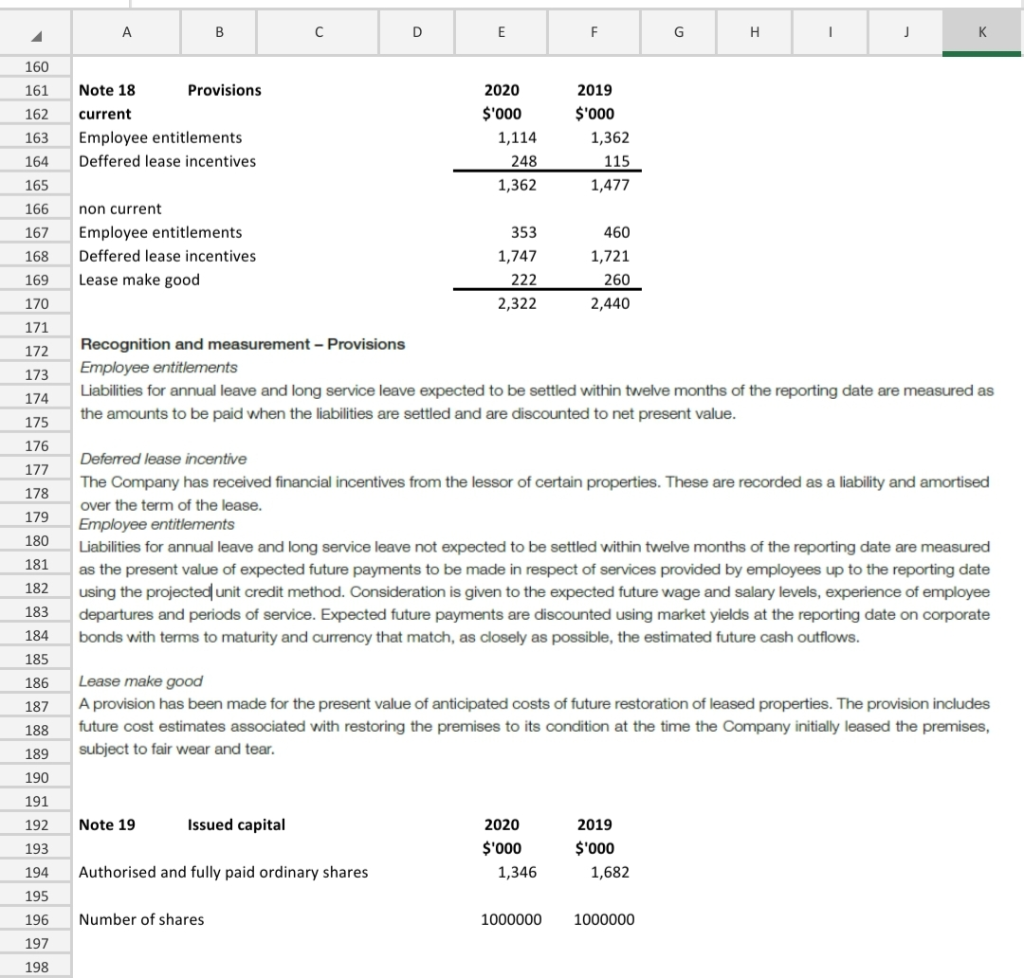

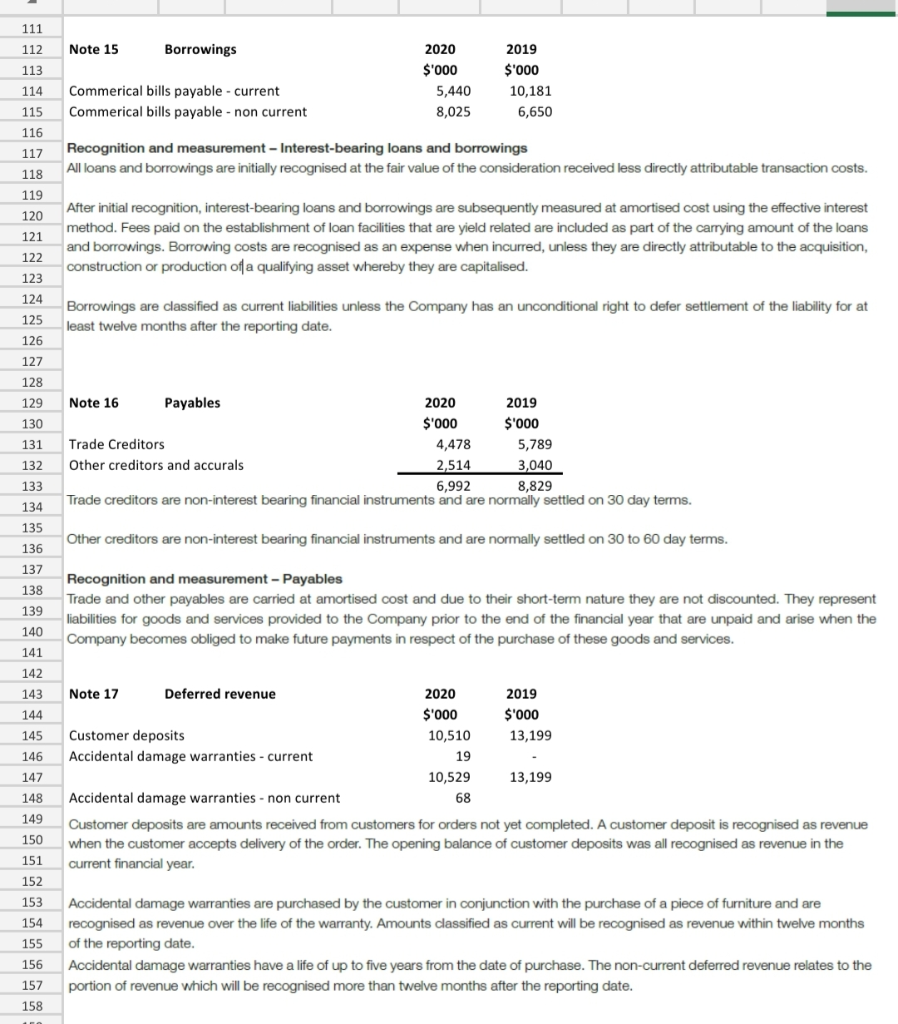

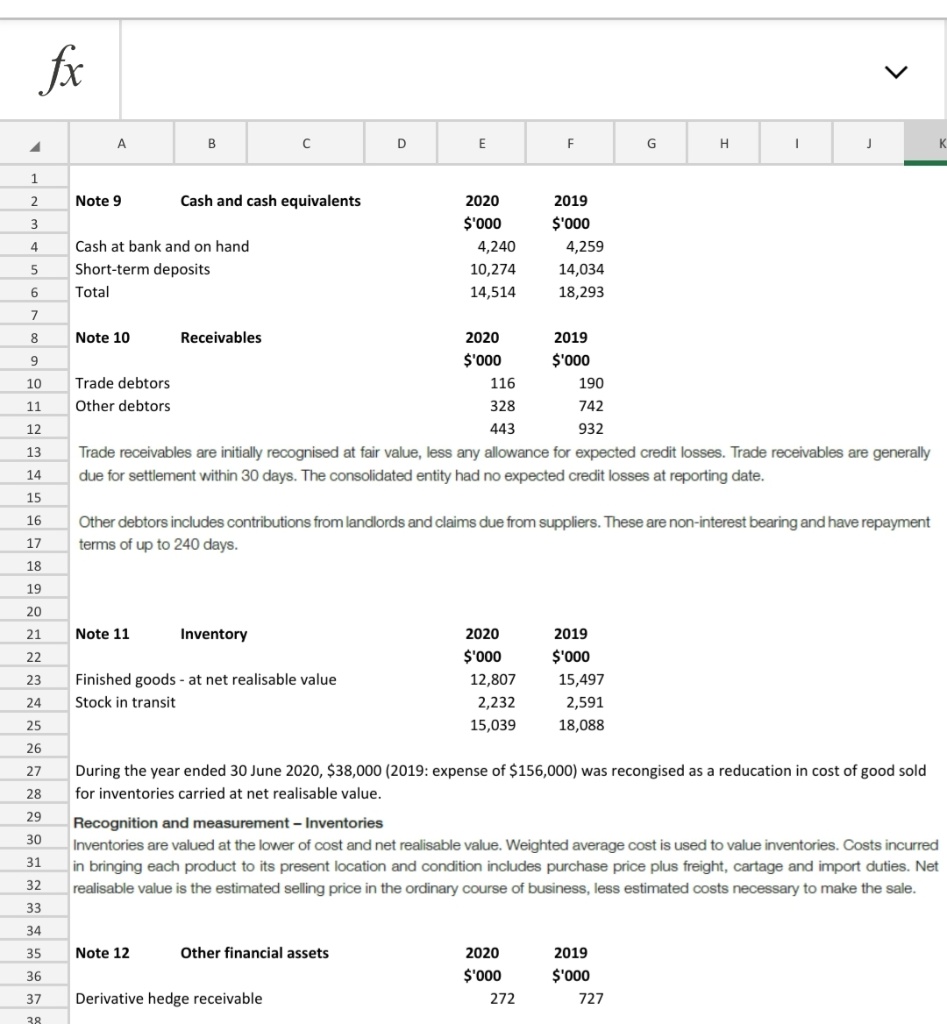

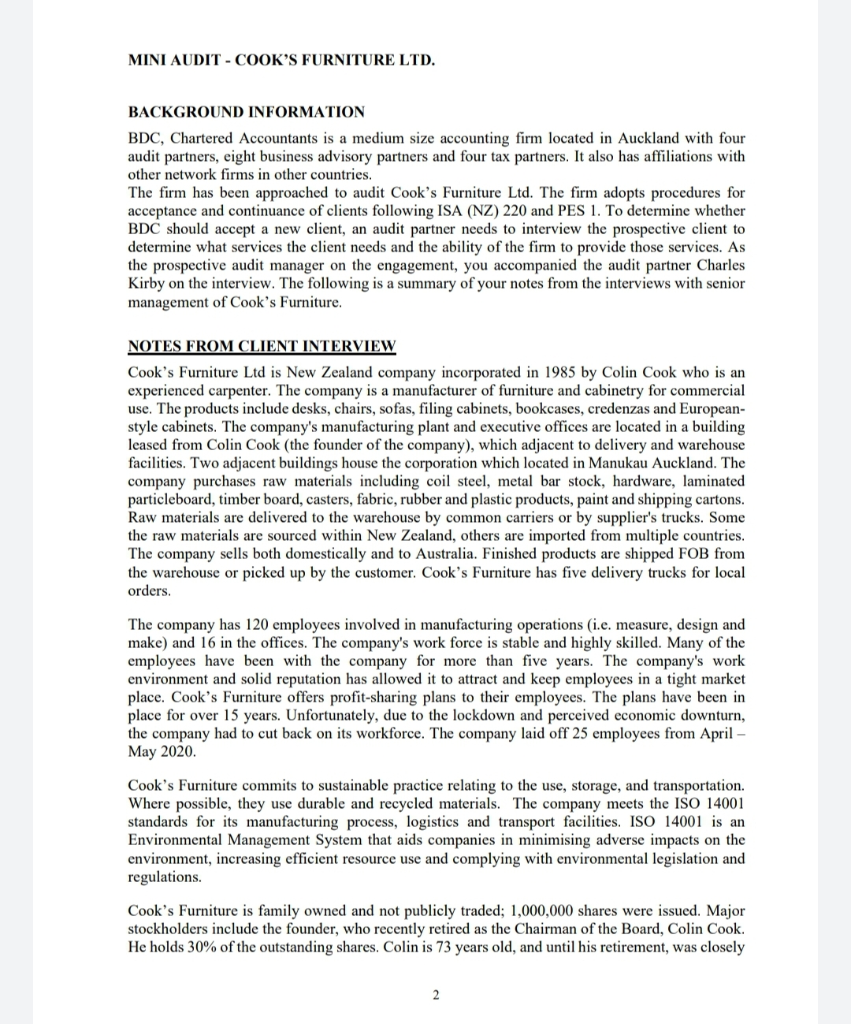

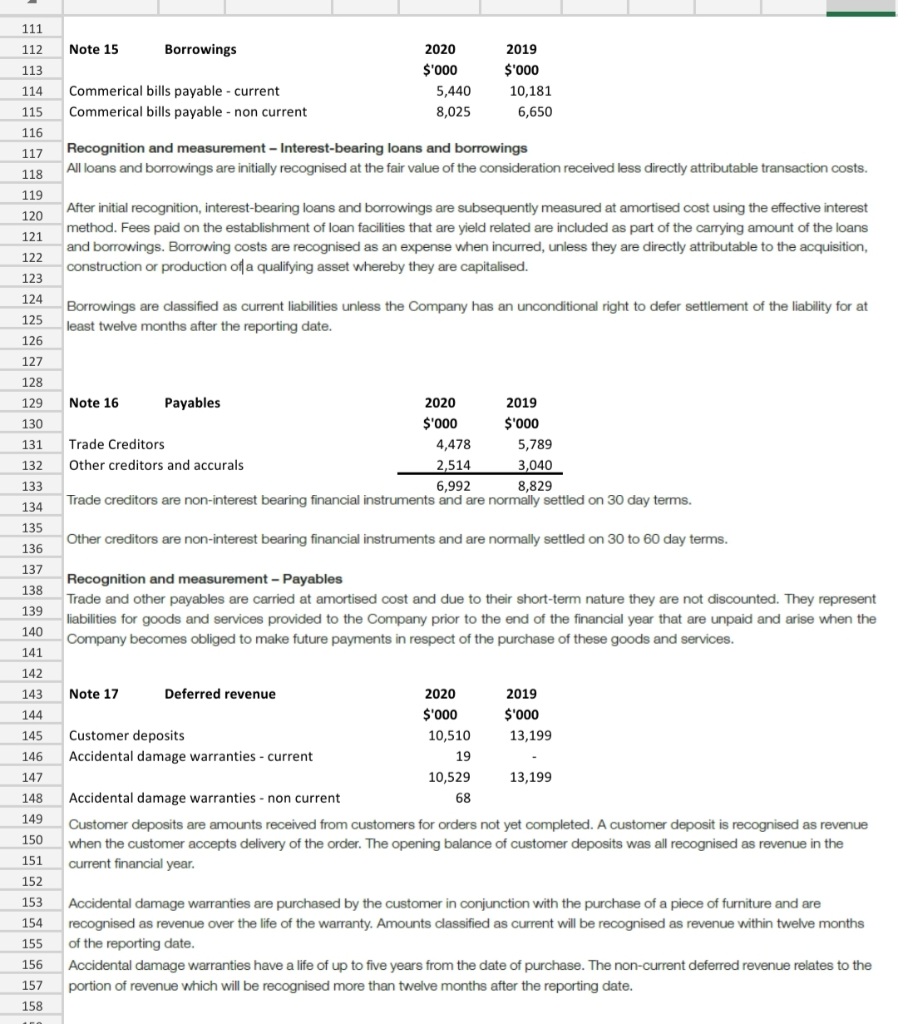

fx B D E F G H 1 L M 1 2 Note 3 Revenue 3 4 5 Recognition and measurement - Revenue and income recognition Revenue is recognised at an amount that reflects the consideration to which the consolidated entity is expected to be entitled in exchange for transferring goods or services to a customer. Revenue is recognised for major business activities as follows: 6 7 8 9 10 Sale of goods When recognising revenue in relation to the sale of goods to customers, the key performance obligation of the consolidated entity is considered to be the point of delivery of the goods to the customer, as this is deemed to be the time that the customer obtains control of the promised goods. 11 12 13 14 15 2019 $'000 16 17 18 19 2020 Note 4 Expenses $'000 Profit before income tax includes the following specific expenses Included within employee benefits expenses Salaries and wages 12,150 Supernnuation expenses 1,100 Share-based payments 41 Other * 1,960 15,251 *Other employee benefits include commissions, payroll tax, workers compenstions and contract stuff 20 21 14,302 1,348 140 2,338 18,128 22 23 24 25 26 Included within property expenses Operating lease payments 11,290 11,988 27 28 29 30 31 32 Recognition and measurement - Expenses Leases and operating leases Leases are classified at their inception as either operating or finance leases based on the economic substance of the agreement so as to reflect the risks and benefits incidental to ownership. Leases where the lessor retains substantially all the risks and benefits of ownership of the asset are classified as operating leases. Operating leases are recognised as an expense in the statement of comprehensive income on a straight-line basis over the lease term of the lease. 33 34 35 36 PART A PROFESSIONAL ETHICS AND AUDIT PLANNING (44 Marks) Question 1. Professional Ethics: (14 marks) When considering accept a new client, auditors need to comply with ethical requirements of the professional standards. Referring to the information given: a) Identify four situations that may impose ethical threats to the auditors and the audit firm. b) For each situation, explain potential threats to professional ethical requirements. c) Discuss possible safeguards to address each threat (refer to the relevant PES standards in your answer) Question 2. Audit Planning Assuming all potential threats can be mitigated and Kirby has accepted Cook's Furniture as an audit client. He has asked you to plan for the audit of Cook's Furniture Ltd for the 2020 financial year. You need to produce the audit planning workpaper outlining potential risks in this audit. Your audit planning workpaper must cover the following: (30 marks) a) Identify ten risk factors (conditions that indicates that the financial statement might be misstated. b) Determine the potential impact of each risk factor on the financial statements or the audit (e.g. which account and assertions might be misstated). c) Determine the audit strategies or procedures that may address the risk of material misstatement. Use the following format to present your answer. Identify the risk factor (a) Potential impact on the financial statements or the audit. (b) Audit strategies or procedures to address the risk of material misstatement (C) 1 2 3 4 etc 6 3:02 AM til 40% Cooks Furniture Fina... Final 30 June 2020 - Saved { a b 8 : fx 4 A B D E G 2 3 Statement of Financial Position As at 30/06/2020 4 5 Note 6 7 2020 Draft $000 2019 Audited $000 8 9 9 10 Assets Cash and Cash Equivalents Accounts Receivable Inventory Other financial assets Prepaid Expenses Total current assets 10 11 12 11 12 13 14 14,514 443 15,039 272 748 31,015 18,293 932 18,088 727 490 38,528 15 13 16 17 14 Property, Plant & Equipment Intangible Assets Total non-current assets Total Assets 37,066 951 38,017 69,032 45,944 1,189 47,133 85,661 18 19 20 21 22 15 16 23 24 25 Liabilities Borrowings Trade creditors Other creditors and accruals Deferred revenue Current tax payable Provisions Total Current Liabilities 17 5,440 4,478 2,514 10,529 145 1,362 24,468 10,181 5,789 3,040 13,199 654 1,477 34,339 26 27 18 28 19 = ERSAHAHAHAHAHAR 2 = = HAR S="5242888 29 30 6,650 31 15 17 18 32 33 Borrowings Deferred revenue Provisions Deferred tax Total Non Current Liabilities Total Liabilities Net Assets Equity Share capital Reserves Retained Earnings Total Equity 8,025 68 2,322 76 10,491 34,958 34,073 34 35 2,440 400 9,490 43,829 41,832 36 37 38 19 39 40 41 1,346 212 32,516 34,073 1,682 718 39,432 41,832 42 43 44 45 46 47 48 49 50 LB 5 . o