Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gail Equestrian Corp. (GEC), the buyer-lessor, purchased equipment for $1,000,000 cash on January 1, 2025, and entered into an agreement that grants another company ILF

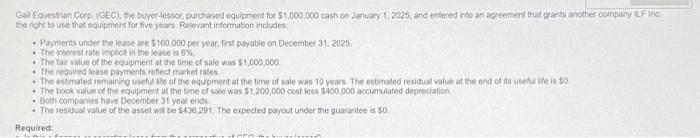

Gail Equestrian Corp. (GEC), the buyer-lessor, purchased equipment for $1,000,000 cash on January 1, 2025, and entered into an agreement that grants another company ILF Inc. the right to use that equipment for five years. Relevant information includes: Payments under the lease are $160,000 per year, first payable on December 31, 2025. . The interest rate implicit in the lease is 6%, The fair value of the equipment at the time of sale was $1,000,000. The required lease payments reflect market rates. The estimated remaining useful life of the equipment at the time of sale was 10 years. The estimated residual value at the end of its useful life is $0. . The book value of the equipment at the time of sale was $1,200,000 cost less $400,000 accumulated depreciation. . Both companies have December 31 year ends. The residual value of the asset will be $436,291. The expected payout under the guarantee is $0. Required:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started