Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gainesboro Machine is planning to implement a change in their business strategy. A change that will include a stock repurchase and a change to their

Gainesboro Machine is planning to implement a change in their business strategy. A change that will include a stock repurchase and a change to their dividend policy.

What changes have developed and what are their consequences? How has this improved or hurt the companys financial situation? What marketplace conditions prompted the changes? Have those conditions improved? Explain.

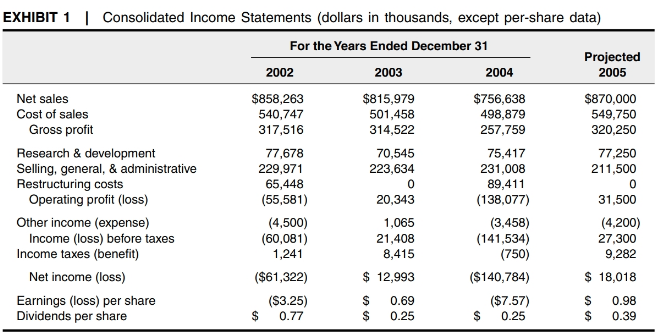

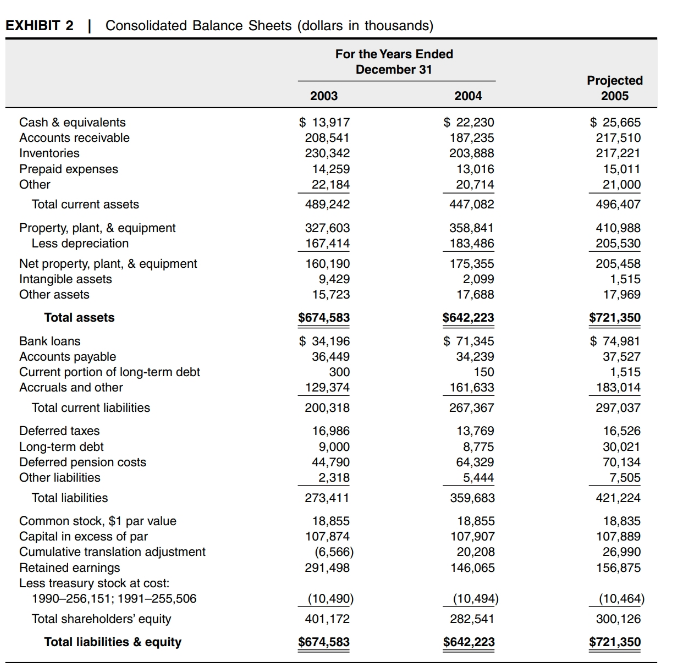

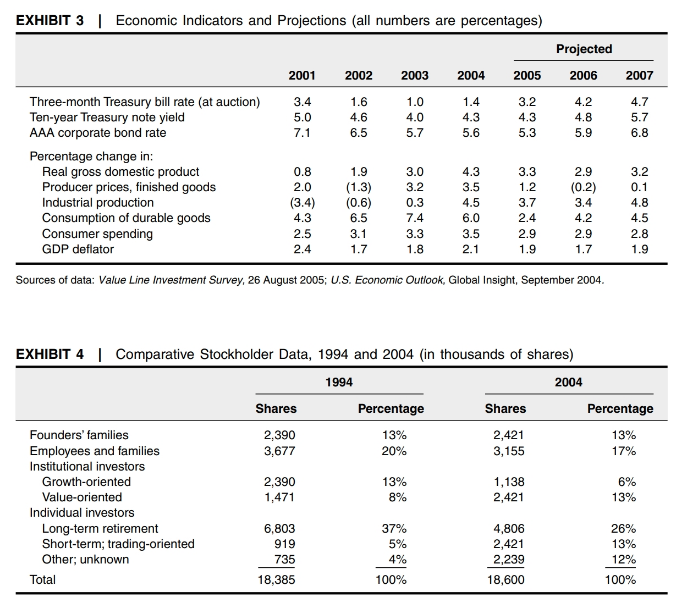

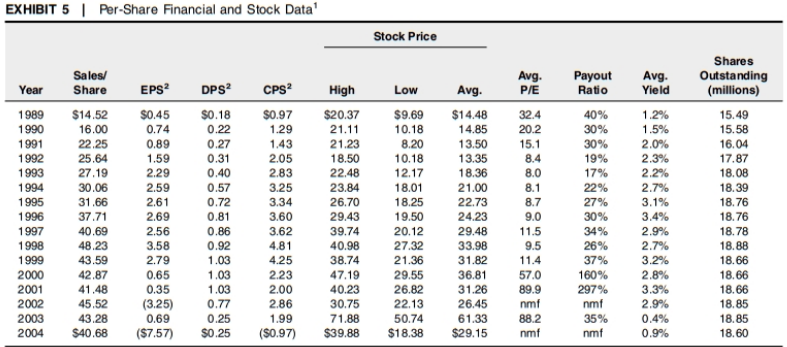

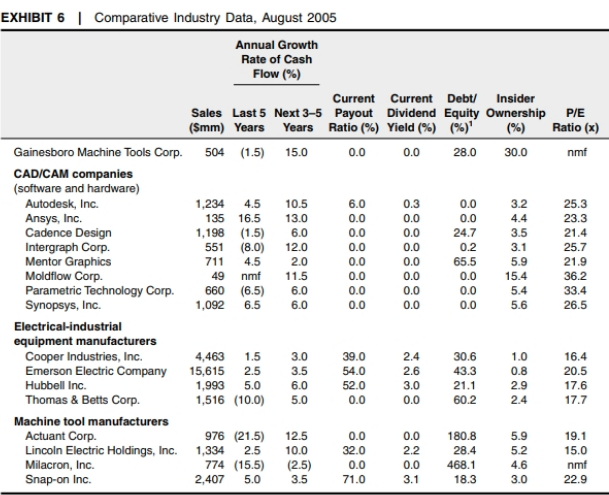

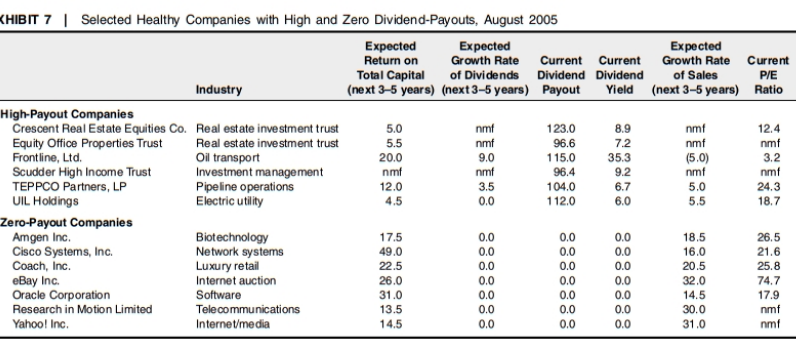

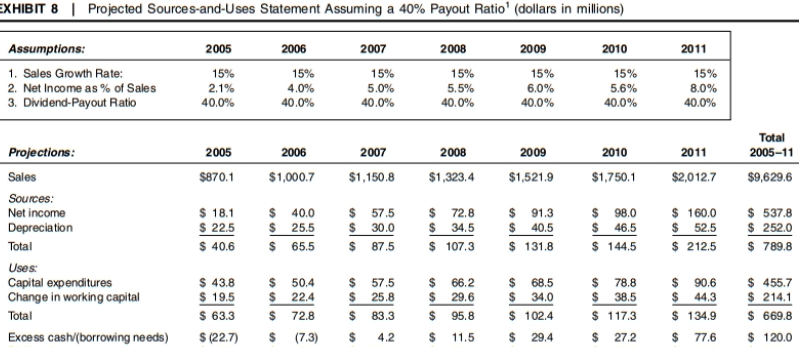

Gainesboro Machine Tools Corporation In mid-September 2005, Ashley Swenson, chief financial officer (CFO) of Gainesboro Machine Tools Corporation, paced the floor of her Minnesota office. She needed to submit a recommendation to Gainesboro's board of directors regarding the company's dividend policy, which had been the subject of an ongoing debate among the firm's senior managers. Compounding her problem was the uncertainty surrounding the recent impact of Hurricane Katrina, which had caused untold destruction across the southeastern United States. In the weeks after the storm, the stock market had spiraled downward and, along with it, Gainesboro's stock, which had fallen 18%, to $22.15. In response to the market shock, a spate of companies had announced plans to buy back stock. While some were motivated by a desire to signal confidence in their companies as well as in the U.S. financial markets, still others had opportunistic reasons. Now AShley SWenson s dvidend-decision problem Was c whether to use company funds to pay shareholder dividends or to buy back stock. ompounded by the dilemma of Background on the Dividend Question After years of traditionally strong earnings and predictable dividend growth, Gainesboro had faltered in the past five years. In response, management implemented two extensive restructuring programs, both of which were accompanied by net losses. For three years in a row since 2000, dividends had exceeded earnings. Then, in 2003, dividends were decreased to a level below earnings. Despite extraordinary losses in 2004, the board of directors declared a small dividend. For the first two quarters of 2005, the board declared no dividend. But in a special letter to shareholders, the board committed itself to resuming payment of the dividend as soon as possible -ideally, sometime in 20025 Gainesboro Machine Tools Corporation In mid-September 2005, Ashley Swenson, chief financial officer (CFO) of Gainesboro Machine Tools Corporation, paced the floor of her Minnesota office. She needed to submit a recommendation to Gainesboro's board of directors regarding the company's dividend policy, which had been the subject of an ongoing debate among the firm's senior managers. Compounding her problem was the uncertainty surrounding the recent impact of Hurricane Katrina, which had caused untold destruction across the southeastern United States. In the weeks after the storm, the stock market had spiraled downward and, along with it, Gainesboro's stock, which had fallen 18%, to $22.15. In response to the market shock, a spate of companies had announced plans to buy back stock. While some were motivated by a desire to signal confidence in their companies as well as in the U.S. financial markets, still others had opportunistic reasons. Now AShley SWenson s dvidend-decision problem Was c whether to use company funds to pay shareholder dividends or to buy back stock. ompounded by the dilemma of Background on the Dividend Question After years of traditionally strong earnings and predictable dividend growth, Gainesboro had faltered in the past five years. In response, management implemented two extensive restructuring programs, both of which were accompanied by net losses. For three years in a row since 2000, dividends had exceeded earnings. Then, in 2003, dividends were decreased to a level below earnings. Despite extraordinary losses in 2004, the board of directors declared a small dividend. For the first two quarters of 2005, the board declared no dividend. But in a special letter to shareholders, the board committed itself to resuming payment of the dividend as soon as possible -ideally, sometime in 20025Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started