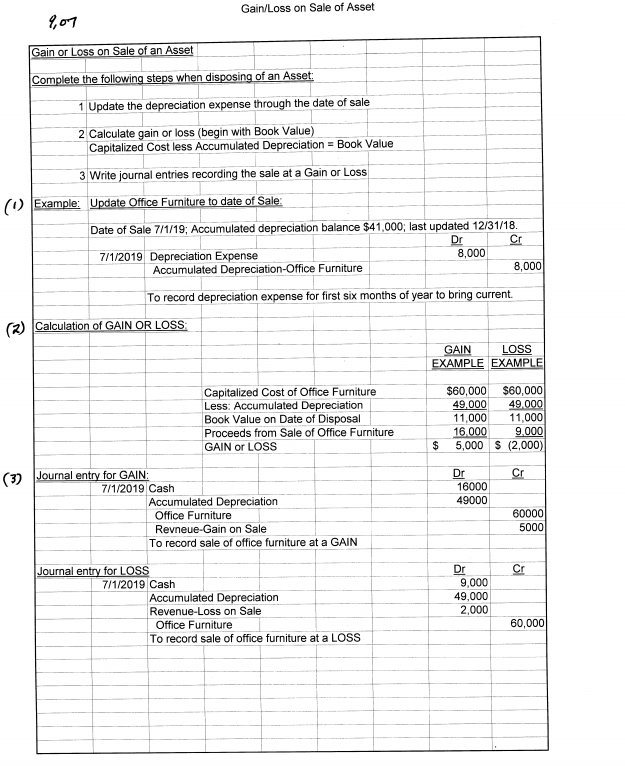

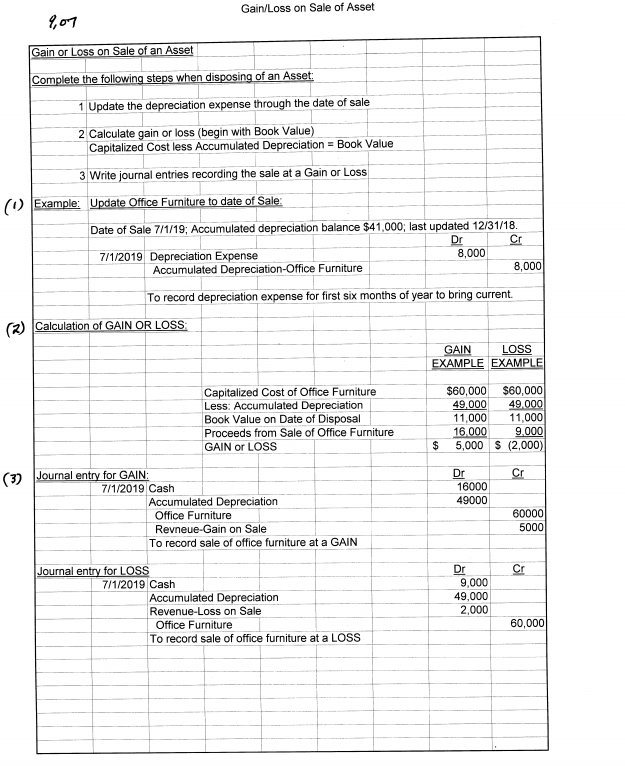

Gain/Loss on Sale of Asset 9,07 Gain or Loss on Sale of an Asset Complete the following steps when disposing of an Asset: 1 Update the depreciation expense through the date of sale 2 Calculate gain or loss (begin with Book Value) Capitalized Cost less Accumulated Depreciation = Book Value 3 Write journal entries recording the sale at a Gain or Loss (Example: Update Office Furniture to date of Sale: Date of Sale 7/1/19; Accumulated depreciation balance $41,000; last updated 12/31/18. Dr Cr 7/1/2019 Depreciation Expense 8,000 Accumulated Depreciation Office Furniture 8,000 To record depreciation expense for first six months of year to bring current (2) Calculation of GAIN OR LOSS GAIN LOSS EXAMPLE EXAMPLE Capitalized Cost of Office Furniture Less: Accumulated Depreciation Book Value on Date of Disposal Proceeds from Sale of Office Furniture GAIN or LOSS $60,000 $60,000 49.000 49.000 11,000 11,000 16.000 9.000 5,000 $ (2,000) $ Cr Dr 16000 49000 (3) Journal entry for GAIN 7/1/2019 Cash Accumulated Depreciation Office Furniture Revneue-Gain on Sale To record sale of office furniture at a GAIN 60000 5000 Cr Journal entry for LOSS 7/1/2019 Cash Accumulated Depreciation Revenue-Loss on Sale Office Furniture To record sale of office furniture at a LOSS Dr 9,000 49,000 2,000 60,000 Gain/Loss on Sale of Asset 9,07 Gain or Loss on Sale of an Asset Complete the following steps when disposing of an Asset: 1 Update the depreciation expense through the date of sale 2 Calculate gain or loss (begin with Book Value) Capitalized Cost less Accumulated Depreciation = Book Value 3 Write journal entries recording the sale at a Gain or Loss (Example: Update Office Furniture to date of Sale: Date of Sale 7/1/19; Accumulated depreciation balance $41,000; last updated 12/31/18. Dr Cr 7/1/2019 Depreciation Expense 8,000 Accumulated Depreciation Office Furniture 8,000 To record depreciation expense for first six months of year to bring current (2) Calculation of GAIN OR LOSS GAIN LOSS EXAMPLE EXAMPLE Capitalized Cost of Office Furniture Less: Accumulated Depreciation Book Value on Date of Disposal Proceeds from Sale of Office Furniture GAIN or LOSS $60,000 $60,000 49.000 49.000 11,000 11,000 16.000 9.000 5,000 $ (2,000) $ Cr Dr 16000 49000 (3) Journal entry for GAIN 7/1/2019 Cash Accumulated Depreciation Office Furniture Revneue-Gain on Sale To record sale of office furniture at a GAIN 60000 5000 Cr Journal entry for LOSS 7/1/2019 Cash Accumulated Depreciation Revenue-Loss on Sale Office Furniture To record sale of office furniture at a LOSS Dr 9,000 49,000 2,000 60,000