Question

Galaxy Limited was incorporated in Hong Kong in January 2020 and earned its revenue by manufacturing q-pads. Its financial year end was 31 December. The

Galaxy Limited was incorporated in Hong Kong in January 2020 and earned its revenue by manufacturing q-pads. Its financial year end was 31 December. The following issues had not been included into Galaxy Limiteds financial statements for the year ended 31 December 2021.

Issue 1: Deferred tax

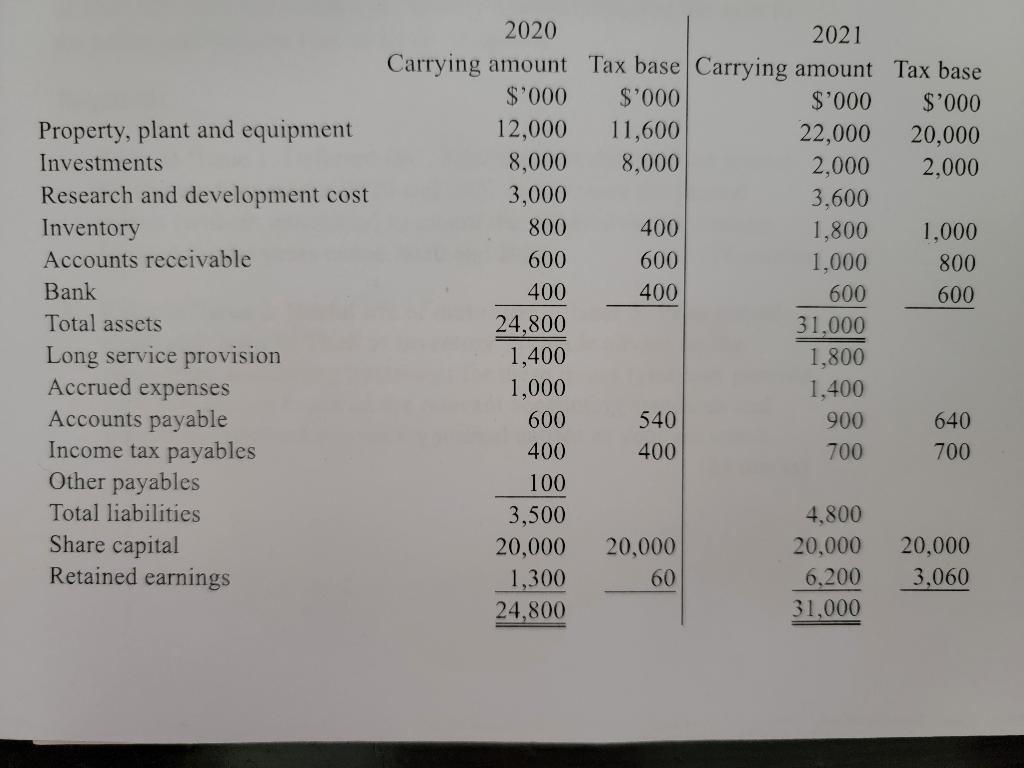

No deferred tax has been provided since its establishment. For the purpose of computing the deferred tax balance as at December 2021, the following shows the draft statements of financial position as at 31 December 2020 and 31 December 2021:

Galaxy Limited had determined that it was probable that taxable profits would be available in future against which any resulting deferred tax assets could be utilized. The Inland Revenue Department also allowed Galaxy Limited to offset current tax assets against current tax liability. The tax rates for 2020 and 2021 were 20%.

Issue 2: Useful life of motor van

A motor van was purchased in January 2020 for delivery purpose. The cost of the van was $100,000. The estimated useful life was 10 years. In January 2021, the motor van was seriously damaged in a traffic accident. The remaining useful life of the motor van was expected to be two years.

Issue 3: Prior period error

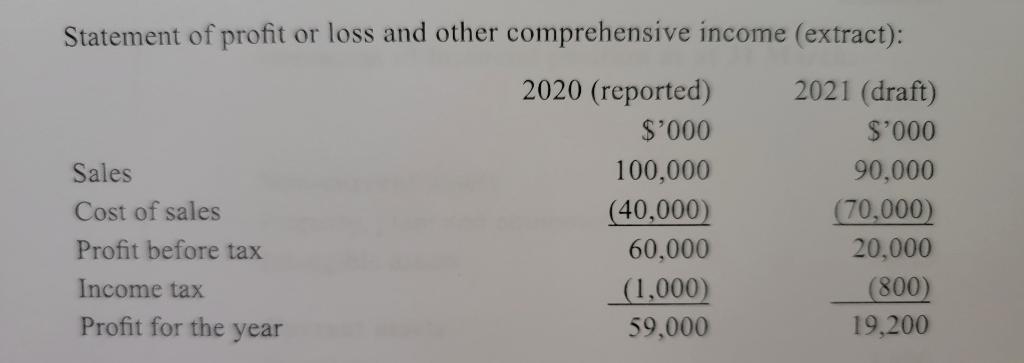

In the review of the financial records of 2020, Galaxy Limited discovered that there was an under-statement of $6,000,000 in the cost of sales in the financial statements for the year ended 2020. Be low was the extract of the statement of profit or loss and other comprehensive income for the years 2020 and 2021:

Issue 4: Theft of inventory

On 20 January 2022, it was found that the store manager stole inventory of $600,000 from the warehouse. Galaxy Limited reported the case to the police and the case was under investigation.

Required:

a) Refer to Issue 1: Deferred tax, determine the deferred tax impact for Galaxy Limited for 2020 and 2021 and prepare the journal entries (without narratives) to record the deferred tax for Galaxy Limited for the years ended 2020 and 2021.

b) Refer to Issue 2: Useful life of motor van, Issue 3: Prior period error and Issue 4: Theft of inventory, provide advice on the appropriate accounting treatments for these issues (you may provide your explanation based on the relevant accounting standards and prepare the relevant accounting journal entries as your answers).

Property, plant and equipment Investments Research and development cost Inventory Accounts receivable Bank Total assets Long service provision Accrued expenses Accounts payable Income tax payables Other payables Total liabilities Share capital Retained earnings 2020 2021 Carrying amount Tax base Carrying amount Tax base $'000 $'000 $'000 $'000 12,000 11,600 22,000 20,000 8,000 8,000 2,000 2,000 3,000 3.600 800 400 1,800 1,000 600 600 1,000 800 400 400 600 600 24,800 31,000 1,400 1,800 1,000 1,400 600 540 900 640 400 400 700 700 100 3,500 4.800 20,000 20,000 20,000 20,000 1,300 60 6,200 3,060 24,800 31,000 Statement of profit or loss and other comprehensive income (extract): 2020 (reported) 2021 (draft) $'000 $'000 Sales 100,000 90,000 Cost of sales (40,000) (70,000) Profit before tax 60,000 20,000 Income tax (1,000) (800) Profit for the year 59,000 19,200 Property, plant and equipment Investments Research and development cost Inventory Accounts receivable Bank Total assets Long service provision Accrued expenses Accounts payable Income tax payables Other payables Total liabilities Share capital Retained earnings 2020 2021 Carrying amount Tax base Carrying amount Tax base $'000 $'000 $'000 $'000 12,000 11,600 22,000 20,000 8,000 8,000 2,000 2,000 3,000 3.600 800 400 1,800 1,000 600 600 1,000 800 400 400 600 600 24,800 31,000 1,400 1,800 1,000 1,400 600 540 900 640 400 400 700 700 100 3,500 4.800 20,000 20,000 20,000 20,000 1,300 60 6,200 3,060 24,800 31,000 Statement of profit or loss and other comprehensive income (extract): 2020 (reported) 2021 (draft) $'000 $'000 Sales 100,000 90,000 Cost of sales (40,000) (70,000) Profit before tax 60,000 20,000 Income tax (1,000) (800) Profit for the year 59,000 19,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started