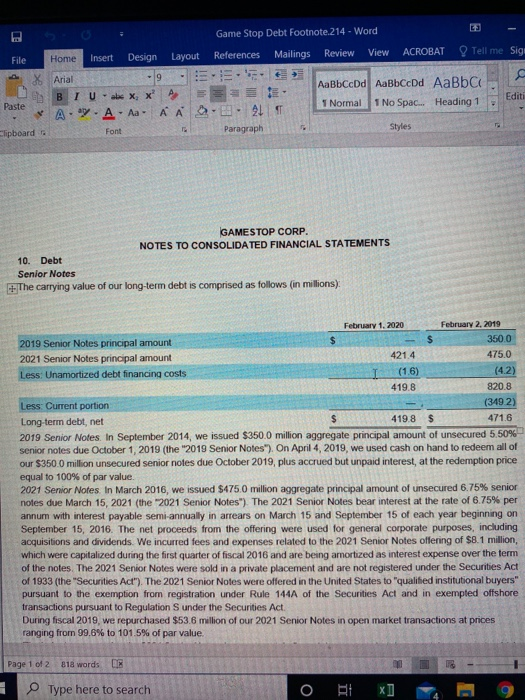

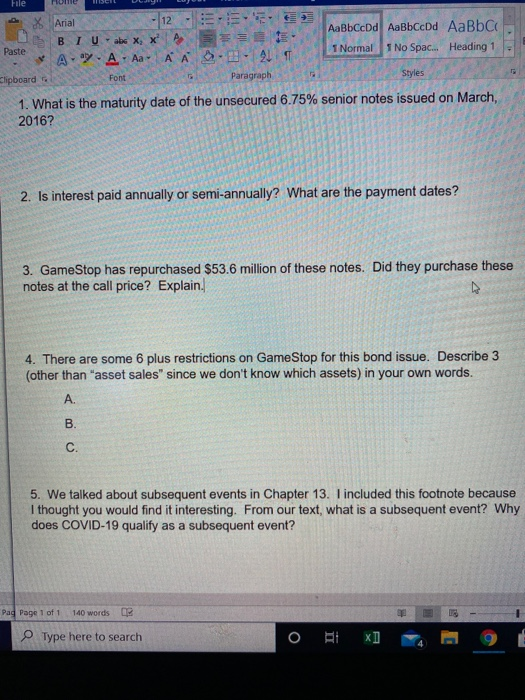

Game Stop Debt Footnote.214 - Word References Mailings Review View ACROBAT Tell me Siga File Home Insert Design Layout 111 AaBbCcDd AaBbCcDd AaBbc 1 Normal 1 No Spac... Heading 1 Editi Arial 9 BI U XXA A ..A. A O. 21 Font Paragraph Paste Styles Clipboard GAMES TOP CORP. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 10. Debt Senior Notes The carrying value of our long-term debt is comprised as follows (in millions) February 1, 2020 February 2, 2019 2019 Senior Notes principal amount $ $ 350.0 2021 Senior Notes principal amount 421.4 475.0 Less: Unamortized debt financing costs (1.6) (4.2) 419.8 820.8 Less: Current portion (3492) Long-term debt, net $ 419.8 $ 471.6 2019 Senior Notes In September 2014, we issued $350.0 million aggregate principal amount of unsecured 5.50% senior notes due October 1, 2019 (the "2019 Senior Notes"). On April 4, 2019, we used cash on hand to redeem all of our $350.0 million unsecured senior notes due October 2019, plus accrued but unpaid interest, at the redemption price equal to 100% of par value. 2021 Senior Notes. In March 2016, we issued $475.0 million aggregate principal amount of unsecured 6.75% senior notes due March 15, 2021 (the "2021 Senior Notes") The 2021 Senior Notes bear interest at the rate of 6.75% per annum with interest payable semi-annually in arrears on March 15 and September 15 of each year beginning on September 15, 2016. The net proceeds from the offering were used for general corporate purposes, including acquisitions and dividends. We incurred fees and expenses related to the 2021 Senior Notes offering of $8.1 million, which were capitalized during the first quarter of fiscal 2016 and are being amortized as interest expense over the term of the notes. The 2021 Senior Notes were sold in a private placement and are not registered under the Securities Act of 1933 (the "Securities Act"). The 2021 Senior Notes were offered in the United States to "qualified institutional buyers" pursuant to the exemption from registration under Rule 144A of the Securities Act and in exempted offshore transactions pursuant to Regulation under the Securities Act. During fiscal 2019, we repurchased $53.6 million of our 2021 Senior Notes in open market transactions at prices ranging from 99.6% to 101.5% of par value. Page 1 of 2 818 words Type here to search o File SCE Arial - 12 E. AaBbCcDd AaBbCcDd AaBb C BI U abc X, XA Paste 1 Normal 1 No Spac... Heading 1 * Aay. A Aa A AS211 Clipboard Font Paragraph Styles 1. What is the maturity date of the unsecured 6.75% senior notes issued on March, 2016? 2. Is interest paid annually or semi-annually? What are the payment dates? 3. GameStop has repurchased $53.6 million of these notes. Did they purchase these notes at the call price? Explain. 4. There are some 6 plus restrictions on GameStop for this bond issue. Describe 3 (other than "asset sales" since we don't know which assets) in your own words. A. B. C. 5. We talked about subsequent events in Chapter 13. I included this footnote because I thought you would find it interesting. From our text, what is a subsequent event? Why does COVID-19 qualify as a subsequent event? Pag Page 1 of 1 140 words Type here to search O Game Stop Debt Footnote.214 - Word References Mailings Review View ACROBAT Tell me Siga File Home Insert Design Layout 111 AaBbCcDd AaBbCcDd AaBbc 1 Normal 1 No Spac... Heading 1 Editi Arial 9 BI U XXA A ..A. A O. 21 Font Paragraph Paste Styles Clipboard GAMES TOP CORP. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 10. Debt Senior Notes The carrying value of our long-term debt is comprised as follows (in millions) February 1, 2020 February 2, 2019 2019 Senior Notes principal amount $ $ 350.0 2021 Senior Notes principal amount 421.4 475.0 Less: Unamortized debt financing costs (1.6) (4.2) 419.8 820.8 Less: Current portion (3492) Long-term debt, net $ 419.8 $ 471.6 2019 Senior Notes In September 2014, we issued $350.0 million aggregate principal amount of unsecured 5.50% senior notes due October 1, 2019 (the "2019 Senior Notes"). On April 4, 2019, we used cash on hand to redeem all of our $350.0 million unsecured senior notes due October 2019, plus accrued but unpaid interest, at the redemption price equal to 100% of par value. 2021 Senior Notes. In March 2016, we issued $475.0 million aggregate principal amount of unsecured 6.75% senior notes due March 15, 2021 (the "2021 Senior Notes") The 2021 Senior Notes bear interest at the rate of 6.75% per annum with interest payable semi-annually in arrears on March 15 and September 15 of each year beginning on September 15, 2016. The net proceeds from the offering were used for general corporate purposes, including acquisitions and dividends. We incurred fees and expenses related to the 2021 Senior Notes offering of $8.1 million, which were capitalized during the first quarter of fiscal 2016 and are being amortized as interest expense over the term of the notes. The 2021 Senior Notes were sold in a private placement and are not registered under the Securities Act of 1933 (the "Securities Act"). The 2021 Senior Notes were offered in the United States to "qualified institutional buyers" pursuant to the exemption from registration under Rule 144A of the Securities Act and in exempted offshore transactions pursuant to Regulation under the Securities Act. During fiscal 2019, we repurchased $53.6 million of our 2021 Senior Notes in open market transactions at prices ranging from 99.6% to 101.5% of par value. Page 1 of 2 818 words Type here to search o File SCE Arial - 12 E. AaBbCcDd AaBbCcDd AaBb C BI U abc X, XA Paste 1 Normal 1 No Spac... Heading 1 * Aay. A Aa A AS211 Clipboard Font Paragraph Styles 1. What is the maturity date of the unsecured 6.75% senior notes issued on March, 2016? 2. Is interest paid annually or semi-annually? What are the payment dates? 3. GameStop has repurchased $53.6 million of these notes. Did they purchase these notes at the call price? Explain. 4. There are some 6 plus restrictions on GameStop for this bond issue. Describe 3 (other than "asset sales" since we don't know which assets) in your own words. A. B. C. 5. We talked about subsequent events in Chapter 13. I included this footnote because I thought you would find it interesting. From our text, what is a subsequent event? Why does COVID-19 qualify as a subsequent event? Pag Page 1 of 1 140 words Type here to search O