Question

GAMESA is a Spanish company specialized in sustainable energy technologies, mainly wind power. GAMESA is positioned among the most important wind generator manufacturers in the

GAMESA is a Spanish company specialized in sustainable energy technologies, mainly wind power. GAMESA is positioned among the most important wind generator manufacturers in the world. On January 1 2010 GAMESA US has reached an agreement with SIEMENS to sell 10 generators for a total of €26 Million. Obviously this operation has a translation risk that GAMESA US wants to hedge assuming a short position in a Forward contract at one year maturity. Assume exchange rate on January 2010 is 1$/€.

Which is the delivery price agreed in the Forward contract?

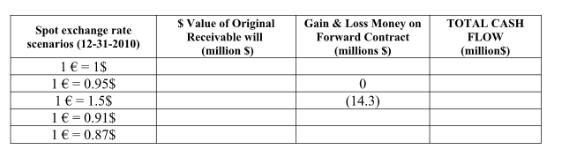

$ Value of Original Gain & Loss Money on Forward Contract (millions S) TOTAL CASH Spot exchange rate scenarios (12-31-2010) Receivable will FLOW (million S) (millions) 1 = 1$ 1= 0.95$ 1 = 1.5$ 1= 0.91$ 1= 0.87$ (14.3)

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 095 F Explanation The computation of the delivery price agreed in the Forward ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started