Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gear Out There (GOT) Inc., located in Prince George, B.C., is a wholesale company selling supplies and materials for climbing, hiking and other outdoor

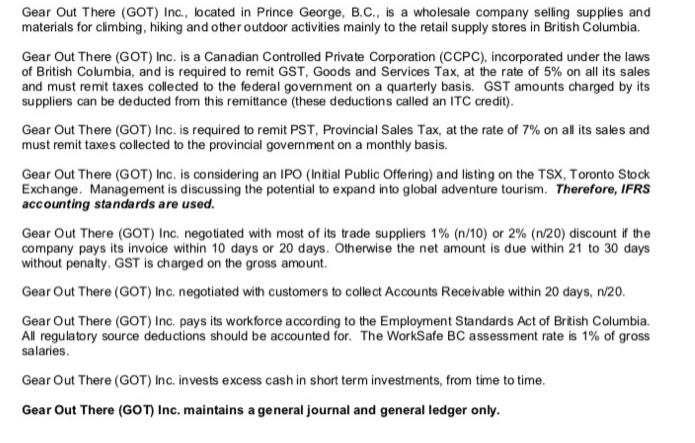

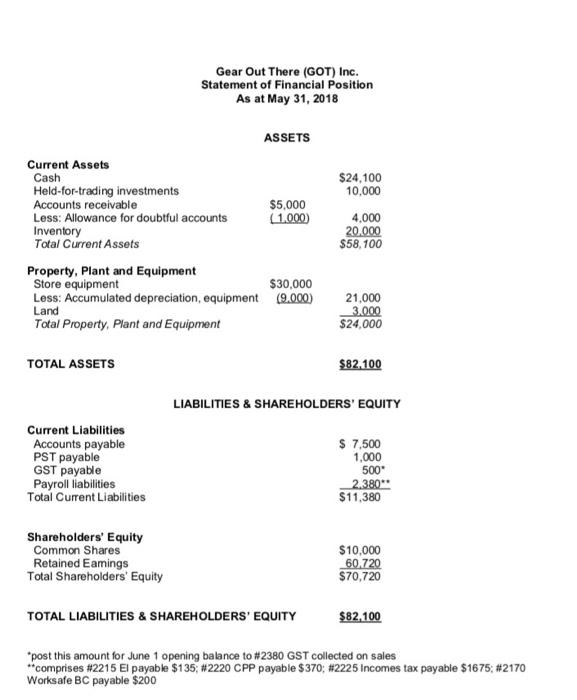

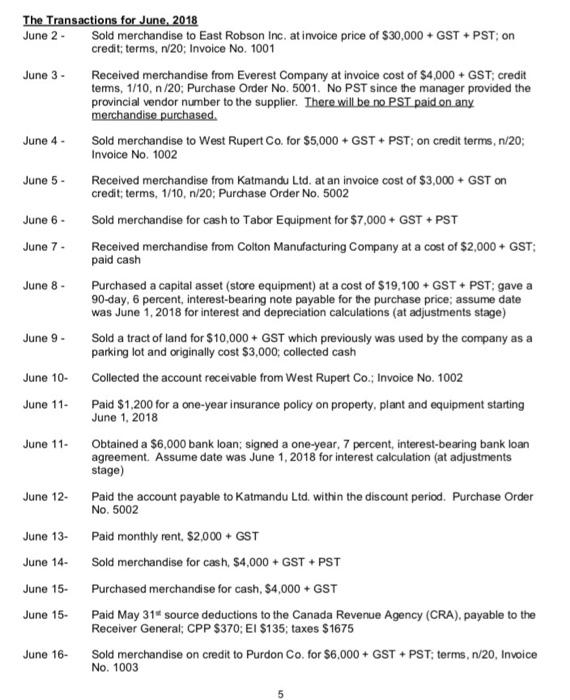

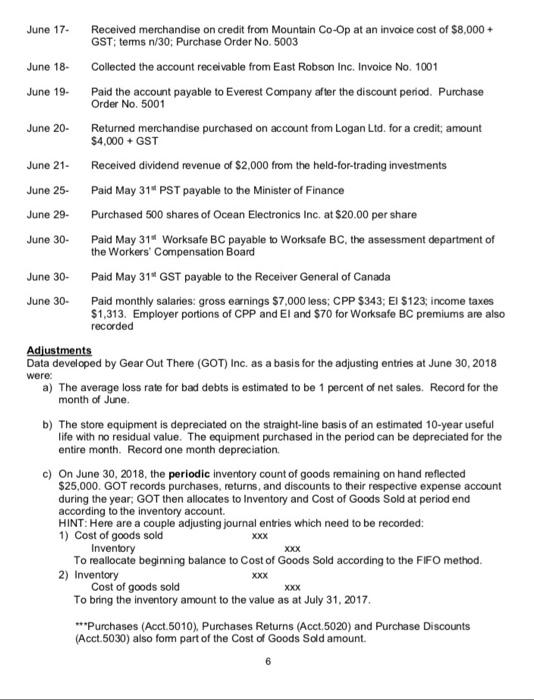

Gear Out There (GOT) Inc., located in Prince George, B.C., is a wholesale company selling supplies and materials for climbing, hiking and other outdoor activities mainly to the retail supply stores in British Columbia. Gear Out There (GOT) Inc. is a Canadian Controlled Private Corporation (CCPC), incorporated under the laws of British Columbia, and is required to remit GST, Goods and Services Tax, at the rate of 5% on all its sales and must remit taxes collected to the federal government on a quarterly basis. GST amounts charged by its suppliers can be deducted from this remittance (these deductions called an ITC credit). Gear Out There (GOT) Inc. is required to remit PST, Provincial Sales Tax, at the rate of 7% on all its sales and must remit taxes collected to the provincial government on a monthly basis. Gear Out There (GOT) Inc. is considering an IPO (Initial Public Offering) and listing on the TSX, Toronto Stock Exchange. Management is discussing the potential to expand into global adventure tourism. Therefore, IFRS accounting standards are used. Gear Out There (GOT) Inc. negotiated with most of its trade suppliers 1% (n/10) or 2% (n/20) discount if the company pays its invoice within 10 days or 20 days. Otherwise the net amount is due within 21 to 30 days without penalty. GST is charged on the gross amount. Gear Out There (GOT) Inc. negotiated with customers to collect Accounts Receivable within 20 days, n/20. Gear Out There (GOT) Inc. pays its workforce according to the Employment Standards Act of British Columbia. All regulatory source deductions should be accounted for. The WorkSafe BC assessment rate is 1% of gross salaries. Gear Out There (GOT) Inc. invests excess cash in short term investments, from time to time. Gear Out There (GOT) Inc. maintains a general journal and general ledger only. Current Assets Cash Held-for-trading investments Accounts receivable Less: Allowance for doubtful accounts Inventory Total Current Assets Property, Plant and Equipment Store equipment Less: Accumulated depreciation, equipment Land Total Property, Plant and Equipment TOTAL ASSETS Gear Out There (GOT) Inc. Statement of Financial Position As at May 31, 2018 Current Liabilities Accounts payable PST payable GST payable Payroll liabilities Total Current Liabilities Shareholders' Equity Common Shares Retained Eamings Total Shareholders' Equity ASSETS $5,000 (1,000) $30,000 (9.000) $24,100 10,000 TOTAL LIABILITIES & SHAREHOLDERS' EQUITY 4,000 20,000 $58,100 21,000 3.000 $24,000 $82,100 LIABILITIES & SHAREHOLDERS' EQUITY $ 7,500 1,000 500* 2.380** $11,380 $10,000 60,720 $70,720 $82,100 *post this amount for June 1 opening balance to #2380 GST collected on sales **comprises #2215 El payable $135; #2220 CPP payable $370 ; # 2225 Incomes tax payable $1675; #2170 Worksafe BC payable $200 The Transactions for June, 2018 June 2- June 3- June 4- June 5 - June 6 - June 7 - June 8 - June 9- June 10- June 11- June 11- June 12- June 13- June 14- June 15- June 15- June 16- Sold merchandise to East Robson Inc. at invoice price of $30,000+ GST + PST; on credit; terms, n/20: Invoice No. 1001 Received merchandise from Everest Company at invoice cost of $4,000+ GST; credit terms, 1/10, n/20; Purchase Order No. 5001. No PST since the manager provided the provincial vendor number to the supplier. There will be no PST paid on any merchandise purchased. Sold merchandise to West Rupert Co. for $5,000 + GST + PST; on credit terms, n/20; Invoice No. 1002 Received merchandise from Katmandu Ltd. at an invoice cost of $3,000 + GST on credit; terms, 1/10, n/20; Purchase Order No. 5002 Sold merchandise for cash to Tabor Equipment for $7,000+ GST + PST Received merchandise from Colton Manufacturing Company at a cost of $2,000+ GST; paid cash Purchased a capital asset (store equipment) at a cost of $19,100+ GST + PST: gave a 90-day, 6 percent, interest-bearing note payable for the purchase price; assume date was June 1, 2018 for interest and depreciation calculations (at adjustments stage) Sold a tract of land for $10,000+ GST which previously was used by the company as a parking lot and originally cost $3,000; collected cash Collected the account receivable from West Rupert Co.; Invoice No. 1002 Paid $1,200 for a one-year insurance policy on property, plant and equipment starting June 1, 2018 Obtained a $6,000 bank loan; signed a one-year, 7 percent, interest-bearing bank loan agreement. Assume date was June 1, 2018 for interest calculation (at adjustments stage) Paid the account payable to Katmandu Ltd. within the discount period. Purchase Order No. 5002 Paid monthly rent. $2,000 + GST Sold merchandise for cash, $4,000 + GST + PST Purchased merchandise for cash, $4,000 + GST Paid May 31 source deductions to the Canada Revenue Agency (CRA), payable to the Receiver General; CPP $370; El $135; taxes $1675 Sold merchandise on credit to Purdon Co. for $6,000+ GST + PST: terms, n/20, Invoice No. 1003 5 June 17- June 18- June 19- June 20- June 21- June 25- June 29- June 30- June 30- June 30- Received merchandise on credit from Mountain Co-Op at an invoice cost of $8,000 + GST: terms n/30; Purchase Order No. 5003 Collected the account receivable from East Robson Inc. Invoice No. 1001 Paid the account payable to Everest Company after the discount period. Purchase Order No. 5001 Returned merchandise purchased on account from Logan Ltd. for a credit; amount $4,000 + GST Received dividend revenue of $2,000 from the held-for-trading investments Paid May 31 PST payable to the Minister of Finance Purchased 500 shares of Ocean Electronics Inc. at $20.00 per share Paid May 31" Worksafe BC payable to Worksafe BC, the assessment department of the Workers' Compensation Board Paid May 31" GST payable to the Receiver General of Canada Paid monthly salaries: gross earnings $7,000 less; CPP $343; El $123; income taxes $1,313. Employer portions of CPP and El and $70 for Worksafe BC premiums are also recorded Adjustments Data developed by Gear Out There (GOT) Inc. as a basis for the adjusting entries at June 30, 2018 were: a) The average loss rate for bad debts is estimated to be 1 percent of net sales. Record for the month of June. b) The store equipment is depreciated on the straight-line basis of an estimated 10-year useful life with no residual value. The equipment purchased in the period can be depreciated for the entire month. Record one month depreciation. c) On June 30, 2018, the periodic inventory count of goods remaining on hand reflected $25,000. GOT records purchases, returns, and discounts to their respective expense account during the year, GOT then allocates to Inventory and Cost of Goods Sold at period end according to the inventory account. HINT: Here are a couple adjusting journal entries which need to be recorded: 1) Cost of goods sold XXX Inventory XXX To reallocate beginning balance to Cost of Goods Sold according to the FIFO method. 2) Inventory xxx Cost of goods sold XXX To bring the inventory amount to the value as at July 31, 2017. ***Purchases (Acct.5010), Purchases Returns (Acct.5020) and Purchase Discounts (Acct.5030) also form part of the Cost of Goods Sold amount. d) Account for the Interest expense on the Note Payable and the Bank Loan; round to the nearest dollar. Record one month interest expense. e) Uncollectible amounts in accounts receivable total $560, including GST and PST. f) Account for the Insurance expense, if applicable. g) Unrecorded corporate income tax expense is $2,500. h) Fair market value of the held-for-trading investment portfolio is $25,000. Requirements: Take the Gear Out There (GOT) Inc. Balance Sheet, as at May 31, 2018, and continue recording transactions for the fiscal year end of June 30, 2018 as follows: 1. Analyze each of the June transactions and prepare a joumal entry in the General Journal (use the template provided). Explanations are not required. Please number your joumal entries, and include the date. 2. Post the above journal entries to the General Ledger (T-Accounts). Use General Ledger account numbers as per the Chart of Accounts and fill in the beginning balances before posting the June transactions. 3. Joumalize and post the adjusting journal entries to the General Ledger. 4. Prepare the June 30, 2018 Adjusted Trial Balance (Includes ordinary business journal entries plus adjustment entries made). 5. Prepare the Income Statement for the month of June and the Statement of Financial Position/Balance Sheet as at June 30, 2018. (Amounts may be rounded to the nearest dollar) 6. Briefly comment on the financial health of Gear Out There (GOT) Inc.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Analyze and Record June Transactions Here are the journal entries for the June transactions of Gear Out There GOT Inc Each entry is numbered and Ive included the date 1 June 2 Accounts R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started