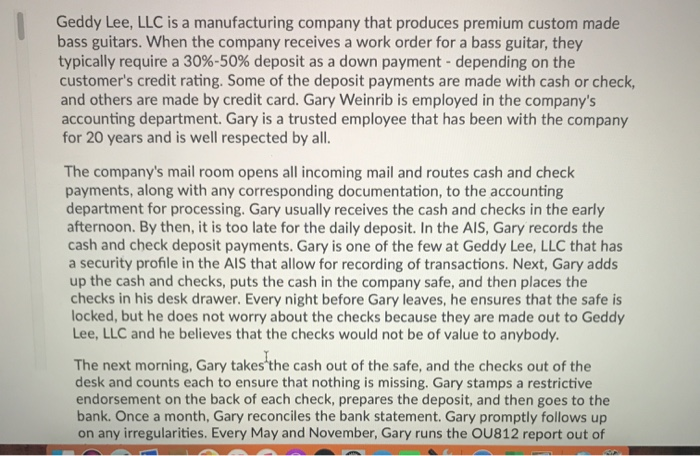

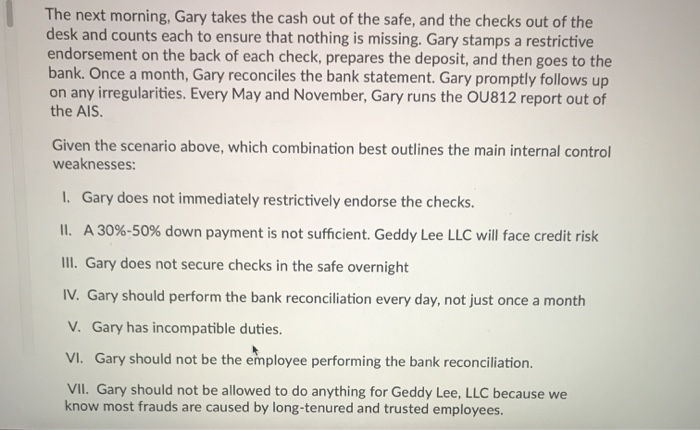

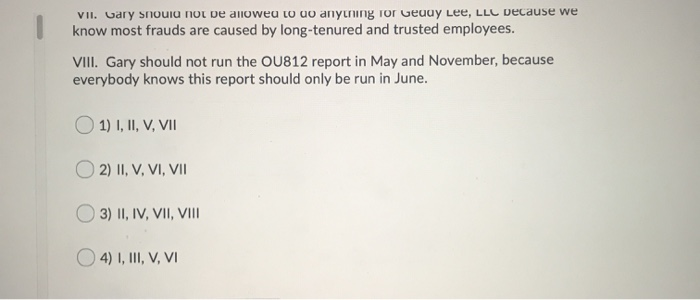

Geddy Lee, LLC is a manufacturing company that produces premium custom made bass guitars. When the company receives a work order for a bass guitar, they typically require a 30%-50% deposit as a down payment - depending on the customer's credit rating. Some of the deposit payments are made with cash or check, and others are made by credit card. Gary Weinrib is employed in the company's accounting department. Gary is a trusted employee that has been with the company for 20 years and is well respected by all. The company's mail room opens all incoming mail and routes cash and check payments, along with any corresponding documentation, to the accounting department for processing. Gary usually receives the cash and checks in the early afternoon. By then, it is too late for the daily deposit. In the AIS, Gary records the cash and check deposit payments. Gary is one of the few at Geddy Lee, LLC that has a security profile in the AIS that allow for recording of transactions. Next, Gary adds up the cash and checks, puts the cash in the company safe, and then places the checks in his desk drawer. Every night before Gary leaves, he ensures that the safe is locked, but he does not worry about the checks because they are made out to Geddy Lee, LLC and he believes that the checks would not be of value to anybody. The next morning, Gary takes the cash out of the safe, and the checks out of the desk and counts each to ensure that nothing is missing. Gary stamps a restrictive endorsement on the back of each check, prepares the deposit, and then goes to the bank. Once a month, Gary reconciles the bank statement. Gary promptly follows up on any irregularities. Every May and November, Gary runs the OU812 report out of The next morning, Gary takes the cash out of the safe, and the checks out of the desk and counts each to ensure that nothing is missing. Gary stamps a restrictive endorsement on the back of each check, prepares the deposit, and then goes to the bank. Once a month, Gary reconciles the bank statement. Gary promptly follows up on any irregularities. Every May and November, Gary runs the OU812 report out of the AIS. Given the scenario above, which combination best outlines the main internal control weaknesses: 1. Gary does not immediately restrictively endorse the checks. II. A 30%-50% down payment is not sufficient. Geddy Lee LLC will face credit risk III. Gary does not secure checks in the safe overnight IV. Gary should perform the bank reconciliation every day, not just once a month V. Gary has incompatible duties. VI. Gary should not be the employee performing the bank reconciliation VII. Gary should not be allowed to do anything for Geddy Lee, LLC because we know most frauds are caused by long-tenured and trusted employees. VII. Gary should not be allowed to uo anything for Geuuy Lee, LLC because we know most frauds are caused by long-tenured and trusted employees. VIII. Gary should not run the OU812 report in May and November, because everybody knows this report should only be run in June. 1) I, II, V, VII O2) II, V, VI, VII O 3) II, IV, VII, VIII 4) I, III, V, VI