Question

Question: Calculate the Weighted Average Cost of Capital (WACC) for McCormick and Company using the formula: WACC = WD RD (1-T) + WS Rs and

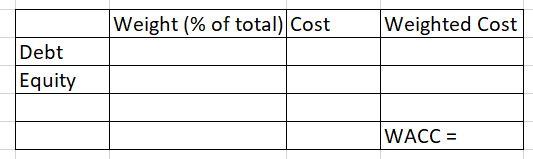

Question: Calculate the Weighted Average Cost of Capital (WACC) for McCormick and Company using the formula: WACC = WD RD (1-T) + WS Rs and WD = Value of debt / Value of debt plus value of equity; WS = Value of Stock Equity / Value of Debt Plus Value of Equity. For ease, the CFO says to use book value of Debt and the market Value of Equity. On February 26, 2019 the market Value of Equity (or Market Cap) in Yahoo was $17.5 billion. Use the 2018 10-K Financial Statements filed January 25, 2019 and look on the Balance sheet to see the total of Short term borrowings, Current portion of long term debt and Long term debt. Use 4% for the cost of debt. Use 27.5% as the tax rate - a combination of federal and state income tax. Fill in the grid below:

Interest rates have risen and the CFO plans to borrow $350 million using the 20 year bond that you recommended in Project 4. For most of the past 10 years the company has used 7% as the discount rate. This was based on study of the company's WACC in early 2010. Interest rates have risen since the last study when the McCormick & Co rate average interest rate was 3%. We will use 4% today. Also, there has been a change in the weights between debt and equity.

The most significant change was the acquisition of RB Foods. It is the main reason for this study. Here is what our MD&A reported about that acquisition.

On August 17, 2017, we completed the acquisition of Reckitt Benckiser's Food Division ("RB Foods") from Reckitt Benckiser Group plc. The purchase price was approximately $4.2 billion, net of acquired cash. The acquisition was funded through our issuance of approximately 6.35 million shares of common stock non-voting (see note 13 of the financial statements) and through new borrowings comprised of senior unsecured notes and pre-payable term loans (see note 6 of the financial statements). The acquired market-leading brands of RB Foods include Frenchs, Franks Red Hot and Cattlemens, which are a natural strategic fit with our robust global branded flavor portfolio. We believe that these additions move us to a leading position in the attractive U.S. condiments category and provide significant international growth opportunities for our consumer and industrial segments.

The RB Foods acquisition resulted in acquisitions contributing more than one-third of our sales growth in 2017 and is expected to result in acquisitions contributing more than one-third of our sales growth in 2018.

Weight (% of total) Cost Weighted Cost w Debt Equity WACC = Weight (% of total) Cost Weighted Cost w Debt Equity WACC =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started