Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GEMMA is a resident taxpayer who runs a corner store in Melbourne. During the last financial year, GEMMA (who is married and has one child)

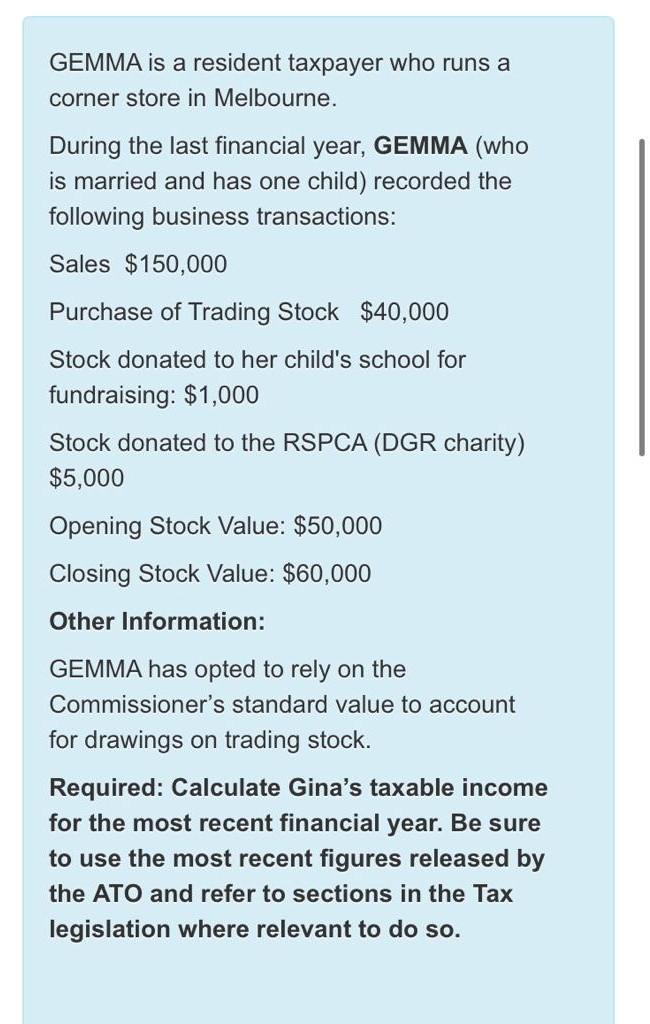

GEMMA is a resident taxpayer who runs a corner store in Melbourne. During the last financial year, GEMMA (who is married and has one child) recorded the following business transactions: Sales $150,000 Purchase of Trading Stock $40,000 Stock donated to her child's school for fundraising: $1,000 Stock donated to the RSPCA (DGR charity) $5,000 Opening Stock Value: $50,000 Closing Stock Value: $60,000 Other Information: GEMMA has opted to rely on the Commissioner's standard value to account for drawings on trading stock. Required: Calculate Gina's taxable income for the most recent financial year. Be sure to use the most recent figures released by the ATO and refer to sections in the Tax legislation where relevant to do so

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started