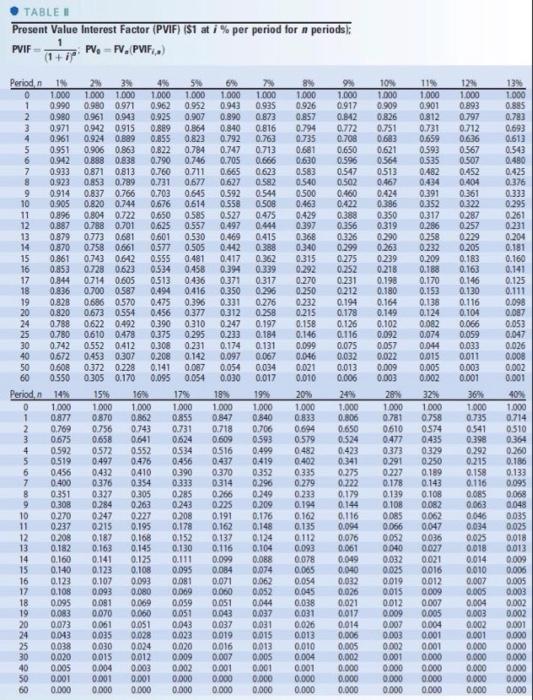

General Cereal common stock dividends have been growing at an annual rate of 6 percent per year over the past 10 years. Current dividends are $2 per share. What is the current value of a share of this stock to an investor who requires a 13 percent rate of return if the following conditions exist? Round your answers to the nearest cent. a. Dividends are expected to continue growing at the historic rate for the foreseeable future. b. The dividend growth rate is expected to increase to 8 percent per year. c. The dividend growth rate is expected to decrease to 5 percent per year. The Blinkelman Corporation has just announced that it plans to introduce a new solar panel that will greatly reduce the cost of solar energy. As a result, analysts now expect the company's earnings, currently (year 0) $1.30 per share to grow by 60 percent per year for the next three years, by 30 percent per year for the following 3 years, and by 9 percent per year thereafter. Blinkelman does not currently pay a dividend, but it expects to pay out 15 percent of its earnings beginning 2 years from now. The payout ratio is expected to become 40 percent in 5 years and to remain at that level. The company's marginal tax rate is 40 percent. If you require a 23 percent rate of return on a stock such as this, how much would you be willing to pay for it today? Use Table It to answer the question. Round your answer to the nearest cent. TABLE Present Value Interest Factor (PVIF) ($1 at i % per period for a periods PV, PV, PVIF..) (1+1 PVIF 99 1.000 0.917 0.890 0.842 1295 1.000 0.993 0.797 0.712 0636 0.567 0.507 0.452 0.404 0.361 0322 0.287 10% 1.000 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.102 0.092 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.276 0.258 0.197 0.184 0.131 0.067 0.034 0.017 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.126 0.116 0.469 0.075 0.057 0.032 0.013 0.006 Period 19 0 1.000 1 0.990 2 0.980 3 0.971 4 0.961 5 0.951 6 0.942 7 0.933 8 0.923 9 0.914 10 0.905 11 0.896 12 0.887 13 0.879 14 0.870 15 0.861 16 0.853 17 0.844 18 0.836 19 0.828 20 0.820 24 0.788 25 0.780 30 0.742 40 0.672 50 0.608 60 0.550 Perioda 14% 0 1.000 1 0.877 2 0.769 3 0.675 4 0.592 5 0.519 6 0456 7 0.400 8 0351 9 0.308 10 0.270 11 0.237 12 0.208 13 0.182 14 0.160 15 0.140 16 0.123 17 0.108 18 0.095 19 0.083 20 0.073 24 0.043 25 0.038 30 0.020 40 0.005 50 0.001 60 0.000 29 3% 4% 5 1.000 1.000 1.000 1.000 1.000 0.990 0.971 0.962 0.952 0.943 0961 0.943 0.925 0.907 0.942 0915 0.889 0.864 0.840 0.924 0.889 0.855 0.823 0.792 0.906 0.863 0.822 0.784 0.747 0.888 0.838 0.790 0.746 0.705 0.871 0.813 0.760 0.711 0.665 0.853 0.789 0.731 0.677 0.627 0.837 0.766 0.703 0.645 0.592 0.820 0.744 0.676 0.614 0.558 0.804 0722 0.650 0.585 0.527 0.788 0701 0.625 0.557 0.497 0.773 0.681 0.601 0.530 0.758 0.661 0.577 0.505 0.442 0.743 0.642 0.555 0.481 0.417 0.728 0.623 0.534 0.458 0.394 0.714 0.605 0.513 0.436 0371 0.700 0.587 0.494 0.416 0.350 0.686 0570 0.475 0.396 0.331 0.673 0.554 0.456 0.377 0312 0.622 0.492 0.390 0310 0.247 0.610 0.478 0.375 0.295 0.233 0.552 0.412 0.308 0.231 0.174 0.453 0.307 0.208 0.142 0.097 0.372 0.228 0.141 0.087 0.054 0305 0.170 0.095 0.054 0.030 15% 17% 189 1000 1.000 1.000 1.000 0.870 0.862 0.855 0.847 0.756 0743 0.731 0.718 0.658 0.641 0.624 0.609 0572 0552 0534 0.516 0.497 0.476 0.456 0.437 0.432 0410 0.390 0.370 0376 0354 0333 0.314 0327 0.305 0.285 0.266 0.284 0.263 0.243 0.225 0.247 0.227 0.208 0.191 0215 0.195 0.178 0.162 0.187 0.168 0.152 0.137 0.163 0.145 0.130 0.116 0.141 0.125 0.111 0.099 0.123 0.108 0.095 0.084 0.107 0.093 0.081 0.071 0.093 0.069 0.060 0.091 0.069 0.059 0.051 0.070 0.060 0.051 0.043 0.061 0.043 0.037 0.035 0.028 0.023 0.019 0.030 0.024 0.020 0.016 0.015 0.012 0.009 0.007 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 89 1.000 0.926 0.857 0.794 0735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0397 0.368 0340 0.315 0.292 0.270 0.250 0.232 0.215 0.158 0.146 0.099 0.046 0.021 0.010 20% 1.000 0.833 0.694 0.579 0482 0.402 0335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.013 0.010 0.004 0.001 0.000 0.000 119 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.082 0.074 0.044 0.015 0.005 0.002 324 1.000 0.758 0574 0435 0329 0.250 0.189 0.143 0.108 0.082 0.062 0.047 0.036 0027 0.021 0.016 0.012 0.009 0.007 0.005 0.004 0.001 0.001 0.000 0.000 0.000 0.000 13 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.053 0.047 0.026 0.008 0.002 0.001 40 1.000 0.714 0.510 0.354 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.005 0.005 0.003 0.002 0.002 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0,037 0.031 0.015 0.013 0.005 0.001 0.000 0.000 0.022 0.009 0.003 28 1.000 0.781 0610 0.477 0373 0.291 0.227 0.178 0.139 0.108 0.085 0.066 0.052 0.040 0.032 0.025 0.019 0.015 0.012 0.009 0.007 0.003 0.002 0.001 0.000 0.000 0.000 1.000 0.806 0.650 0.524 0.423 0.341 0.275 0.722 0.179 0.144 0.116 0.094 0.076 0.061 0.049 0.040 0.032 0.026 0.021 0.017 0.014 0.006 0.005 0.002 0.000 0.000 0.000 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.066 0.059 0.033 0.011 0.003 0.001 36% 1.000 0.735 0.541 0.398 0.292 0.215 0.158 0.116 0.085 0.063 0.046 0.034 0.025 0.018 0.014 0.010 0.007 0.005 0.004 0.003 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.080 0.051 0.001 0.000 0.000 0.000 0.000 0.000 0.000