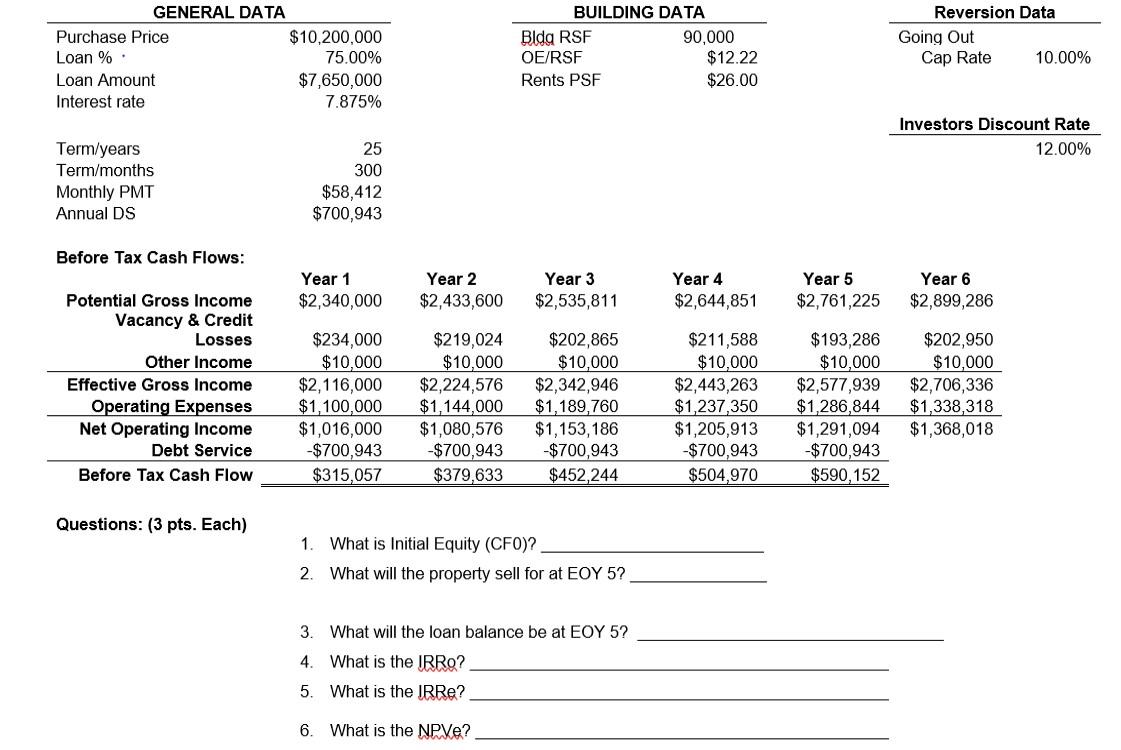

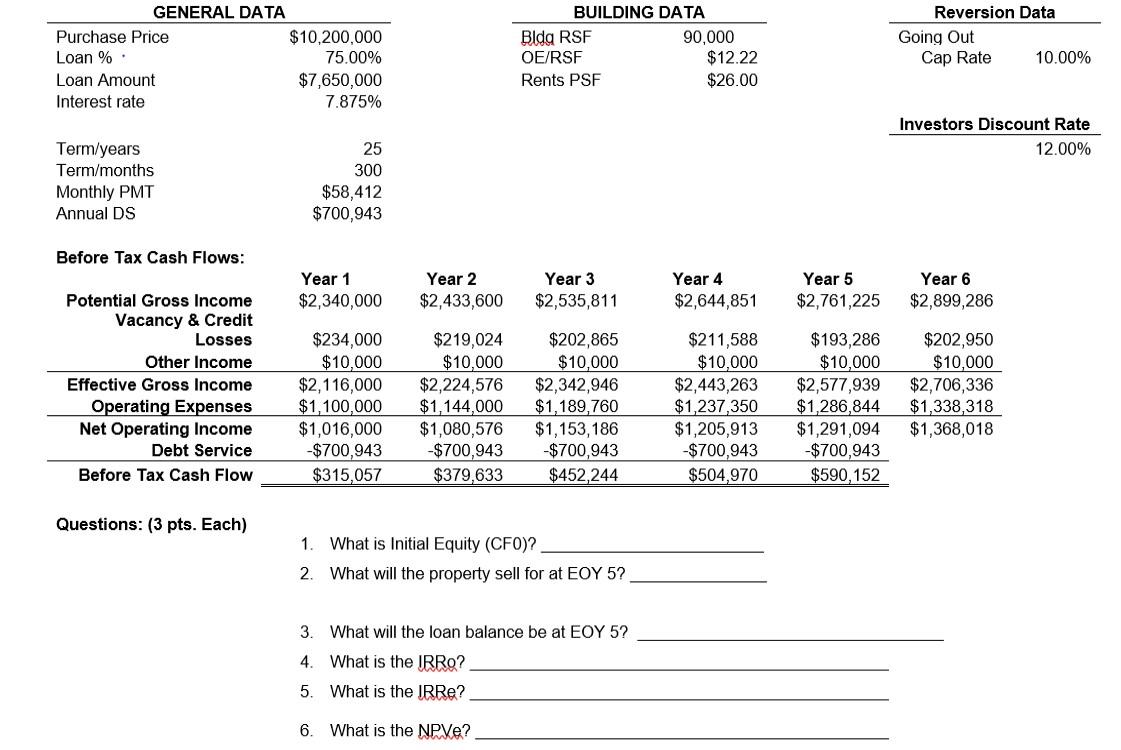

GENERAL DATA Purchase Price $10,200,000 Loan % 75.00% Loan Amount $7,650,000 Interest rate 7.875% BUILDING DATA Bldg RSF 90,000 OE/RSF $12.22 Rents PSF $26.00 Reversion Data Going Out Cap Rate 10.00% Investors Discount Rate 12.00% Term/years Term/months Monthly PMT Annual DS 25 300 $58,412 $700,943 Before Tax Cash Flows: Year 1 $2,340,000 Year 2 $2,433,600 Year 3 $2,535,811 Year 4 $2,644,851 Year 5 $2,761,225 Year 6 $2,899,286 Potential Gross Income Vacancy & Credit Losses Other Income Effective Gross Income Operating Expenses Net Operating Income Debt Service Before Tax Cash Flow $234,000 $10,000 $2,116,000 $1,100,000 $1,016,000 -$700,943 $315,057 $219,024 $10,000 $2,224,576 $1,144,000 $1,080,576 $700,943 $379,633 $202,865 $10,000 $2,342,946 $1,189,760 $1,153,186 $700,943 $452,244 $211,588 $10,000 $2,443,263 $1,237,350 $1,205,913 -$700,943 $504,970 $193,286 $10,000 $2,577,939 $1,286,844 $1,291,094 -$700,943 $590,152 $202,950 $10,000 $2,706,336 $1,338,318 $1,368,018 Questions: (3 pts. Each) 1. What is Initial Equity (CFO)? 2. What will the property sell for at EOY 5? 3. What will the loan balance be at EOY 5? 4. What is the IRRo? 5. What is the IRRe? 6. What is the NPVe? GENERAL DATA Purchase Price $10,200,000 Loan % 75.00% Loan Amount $7,650,000 Interest rate 7.875% BUILDING DATA Bldg RSF 90,000 OE/RSF $12.22 Rents PSF $26.00 Reversion Data Going Out Cap Rate 10.00% Investors Discount Rate 12.00% Term/years Term/months Monthly PMT Annual DS 25 300 $58,412 $700,943 Before Tax Cash Flows: Year 1 $2,340,000 Year 2 $2,433,600 Year 3 $2,535,811 Year 4 $2,644,851 Year 5 $2,761,225 Year 6 $2,899,286 Potential Gross Income Vacancy & Credit Losses Other Income Effective Gross Income Operating Expenses Net Operating Income Debt Service Before Tax Cash Flow $234,000 $10,000 $2,116,000 $1,100,000 $1,016,000 -$700,943 $315,057 $219,024 $10,000 $2,224,576 $1,144,000 $1,080,576 $700,943 $379,633 $202,865 $10,000 $2,342,946 $1,189,760 $1,153,186 $700,943 $452,244 $211,588 $10,000 $2,443,263 $1,237,350 $1,205,913 -$700,943 $504,970 $193,286 $10,000 $2,577,939 $1,286,844 $1,291,094 -$700,943 $590,152 $202,950 $10,000 $2,706,336 $1,338,318 $1,368,018 Questions: (3 pts. Each) 1. What is Initial Equity (CFO)? 2. What will the property sell for at EOY 5? 3. What will the loan balance be at EOY 5? 4. What is the IRRo? 5. What is the IRRe? 6. What is the NPVe