| GENERAL JOURNAL |

| Date | Accounts/Explanation | PR | Debit | Credit |

| 20xx | | | | | | |

| June | 10 | Accounts Payable - Midwest Grain Distributors | 201 | 9,800.00 | |

| | | | Inventory - Grains | 119 | | 9,800.00 |

| | | (25% of June 5 purchase returned; must calculate discount lost) | | | |

| | | | | | | |

| | 26 | Sales Returns & Allowances | 403 | | |

| | | Sales TaxPayable | 213 | | |

| | | | Accounts Receivable - Wildwest Steakhouse | 115 | | |

| | 26 | Merchandise Inventory | 119 | | |

| | | | Cost of Goods Sold | 502 | | |

| | | | | | | |

| | | (1% discount not taken added to AR balance for return) | | | |

| | | | | | | |

| | 30 | Cost of Goods Sold | 502 | | |

| | | | Inventory | 119 | | |

| | | (inventory shrinkage adjustment) | | | |

| | | | | | | |

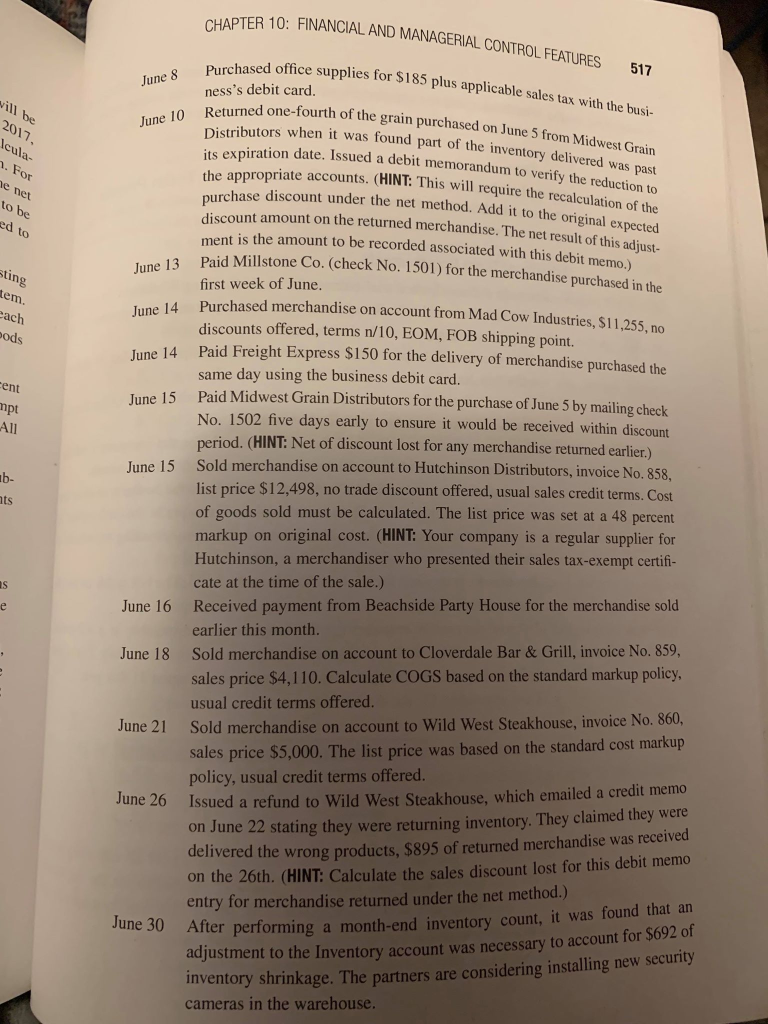

The business uses a simplified specific identifica Cost of Goods Sold: u policy by applying a 48 percent The sales price is provided for studen markup to arrive at the actual sales price tbe for ea entification costing sale based on this markup policy. (HINT: This method to calculate the cos sold was introduced in Chapter 4.) combined local and state Sales Tax rate.Consider when a merchandiser from paying Sales Tax on inventory purchases (review the Chapter Special Journals Posting Process: For any payables and rece sidiary ledgers immediately. Post to the Payable and Receivabie c OGS should be for each Sales Tax: All sales will require the additional collection of sales tax at a b other purchases will require the appropriate payment of Sales Tx in the General Ledger at month end by posting a summary total of sales tax at a 6.25 percent bles, post to the sub- controlling accounts Transactions June 3 Purchased merchandise on account from Millt5 added ise on account from Millstone Co., 56 FOB shipping point, 2/10, n/30 with prepaid freight of invoice. Remember, record this purc Sold merchandise on account to Beachside Party House, list pri invoice No. 856, trade discount 2 percent, usual hase net of expected discount. June 4 sales credit terms. The cos the merchandise sold must be calculated based on a standard 48 t of percent markup company policy used to set the sales price. Rem record this sale net of the expected sales discount. (HINT: Review the dif- ference between a trade discount and a cash discount offered in Chapter 4.) June 5 Purchased merchandise on account from Midwest Grain Distributors, $9,800, terms FOB destination, 1/15, n/30 June 7 rchandise to Dave Austin, the president of a fraternity at the local university, list price $2,500, invoice No. 857. Management decided not to offer any credit terms due to the higher risk of collectability with this cli- ent. Calculate the cost of goods sold based on the standard markup policy Sold me The purchase was paid with cash CHAPTER 10: FINANCIAL AND MANAGERIAL CONTROL FEATURES Purchased office supplies for $185 plus applicable sales tax wi ness's debit card 517 urned one-fourth of the grain purchased on June 5 from Midwest G th the busi- Distributors when it was found part of the inventory delivered was past iration date. Issued a debit memorandum to verify the reduction to ase discount under the net method. Add it to the original expected . The net result of this adjust rain he appropriate accounts. (HINT: This will require the recalculation of the discount amount on the returned merchandise ment is the amount to be recorded associated with this debit mem 13 une 14 lune 14 e 15 Paid Millstone Co. (check No. 1501) for the merchandise purchased in the first week of June. Purchased merchandise on account from Mad Cow Industries, $11,255, no discounts offered, terms n/10, EOM, FOB shipping point. Paid Freight Express $150 for the delivery of merchandise purchased the same day using the business debit card er ac ods Paid Midwest Grain Distributors for the purchase of June 5 by mailing check une pt No. 1502 five days early to ensure it would be received within discount period. (HINT: Net of discount lost for any merchandise returned earlier.) Sold merchandise on account to Hutc list price $12,498, no trade discount offered, usual sales credit terms. Cost of goods sold must be calculated. The list price was set at a 48 percent markup on original cost. (HINT: Your company is a regular supplier for Hutchinson, a merchandiser who presented their sales tax-exempt certifi cate at the time of the sale.) Received payment from Beachside Party House for the merchandise sold earlier this month Sold merchandise on account to Cloverdale Bar & Grill, invoice No. 859, sales price $4,110. Calculate COGS based on the standard markup policy usual credit terms offered Sold merchandise on account to Wild West Steakhouse, invoice No. 8 sales price $5,000. The list price was based on the standard cost markup policy, usual credit terms offered June 15 hinson Distributors, invoice No. 858, b- its June 16 June 18 June 21 June 26 Issued a refund to Wild West Steakhouse, which emailed a cre n June 22 stating they were returning inventory. They claimed they were ivered the wrong products, $895 of returned merchandise was received on the 26th. (HINT: Calculate the sales discount lost for this debit memo entry for merchandise returned under the net method.) ter performing a month-end inventory count, it was found that an adjustment to the Inventory account was necessary to account for $692 of inventory shrinkage. The partners are considering installing new security June 30 Af cameras in the warehouse The business uses a simplified specific identifica Cost of Goods Sold: u policy by applying a 48 percent The sales price is provided for studen markup to arrive at the actual sales price tbe for ea entification costing sale based on this markup policy. (HINT: This method to calculate the cos sold was introduced in Chapter 4.) combined local and state Sales Tax rate.Consider when a merchandiser from paying Sales Tax on inventory purchases (review the Chapter Special Journals Posting Process: For any payables and rece sidiary ledgers immediately. Post to the Payable and Receivabie c OGS should be for each Sales Tax: All sales will require the additional collection of sales tax at a b other purchases will require the appropriate payment of Sales Tx in the General Ledger at month end by posting a summary total of sales tax at a 6.25 percent bles, post to the sub- controlling accounts Transactions June 3 Purchased merchandise on account from Millt5 added ise on account from Millstone Co., 56 FOB shipping point, 2/10, n/30 with prepaid freight of invoice. Remember, record this purc Sold merchandise on account to Beachside Party House, list pri invoice No. 856, trade discount 2 percent, usual hase net of expected discount. June 4 sales credit terms. The cos the merchandise sold must be calculated based on a standard 48 t of percent markup company policy used to set the sales price. Rem record this sale net of the expected sales discount. (HINT: Review the dif- ference between a trade discount and a cash discount offered in Chapter 4.) June 5 Purchased merchandise on account from Midwest Grain Distributors, $9,800, terms FOB destination, 1/15, n/30 June 7 rchandise to Dave Austin, the president of a fraternity at the local university, list price $2,500, invoice No. 857. Management decided not to offer any credit terms due to the higher risk of collectability with this cli- ent. Calculate the cost of goods sold based on the standard markup policy Sold me The purchase was paid with cash CHAPTER 10: FINANCIAL AND MANAGERIAL CONTROL FEATURES Purchased office supplies for $185 plus applicable sales tax wi ness's debit card 517 urned one-fourth of the grain purchased on June 5 from Midwest G th the busi- Distributors when it was found part of the inventory delivered was past iration date. Issued a debit memorandum to verify the reduction to ase discount under the net method. Add it to the original expected . The net result of this adjust rain he appropriate accounts. (HINT: This will require the recalculation of the discount amount on the returned merchandise ment is the amount to be recorded associated with this debit mem 13 une 14 lune 14 e 15 Paid Millstone Co. (check No. 1501) for the merchandise purchased in the first week of June. Purchased merchandise on account from Mad Cow Industries, $11,255, no discounts offered, terms n/10, EOM, FOB shipping point. Paid Freight Express $150 for the delivery of merchandise purchased the same day using the business debit card er ac ods Paid Midwest Grain Distributors for the purchase of June 5 by mailing check une pt No. 1502 five days early to ensure it would be received within discount period. (HINT: Net of discount lost for any merchandise returned earlier.) Sold merchandise on account to Hutc list price $12,498, no trade discount offered, usual sales credit terms. Cost of goods sold must be calculated. The list price was set at a 48 percent markup on original cost. (HINT: Your company is a regular supplier for Hutchinson, a merchandiser who presented their sales tax-exempt certifi cate at the time of the sale.) Received payment from Beachside Party House for the merchandise sold earlier this month Sold merchandise on account to Cloverdale Bar & Grill, invoice No. 859, sales price $4,110. Calculate COGS based on the standard markup policy usual credit terms offered Sold merchandise on account to Wild West Steakhouse, invoice No. 8 sales price $5,000. The list price was based on the standard cost markup policy, usual credit terms offered June 15 hinson Distributors, invoice No. 858, b- its June 16 June 18 June 21 June 26 Issued a refund to Wild West Steakhouse, which emailed a cre n June 22 stating they were returning inventory. They claimed they were ivered the wrong products, $895 of returned merchandise was received on the 26th. (HINT: Calculate the sales discount lost for this debit memo entry for merchandise returned under the net method.) ter performing a month-end inventory count, it was found that an adjustment to the Inventory account was necessary to account for $692 of inventory shrinkage. The partners are considering installing new security June 30 Af cameras in the warehouse