Answered step by step

Verified Expert Solution

Question

1 Approved Answer

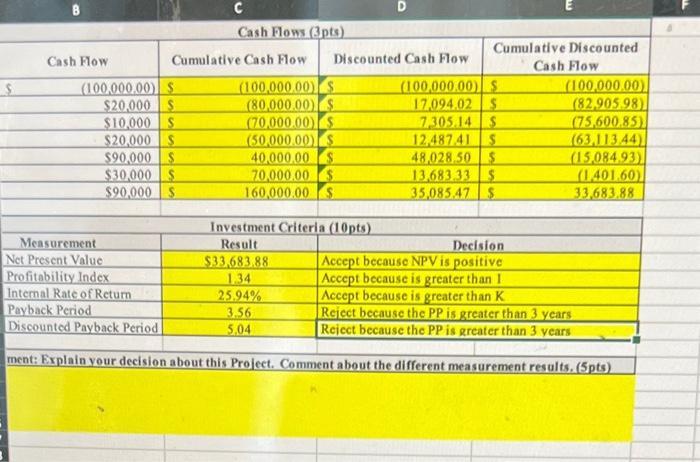

Explain the decision of this project and comment on the difference measurement results. Cash Flow C Cash Flows (3pts) Cumulative Cash Flow (100,000,00) S $20,000

Explain the decision of this project and comment on the difference measurement results.

Cash Flow C Cash Flows (3pts) Cumulative Cash Flow (100,000,00) S $20,000 $ $10,000 S $20,000 S $90,000 $ $30,000 $ $90,000 $ Discounted Cash Flow (100,000.00) S (80.000.00) S (70,000.00) $ (50,000.00) 40,000.00 $ 70,000.00 $ 160,000.00 S Investment Criteria (10pts) Result $33,683.88 1.34 25.94% 3.56 5.04 Cumulative Discounted Cash Flow (100,000.00) $ 17.094.02 $ 7,305.14 $ 12.487.41 S 48,028.50 $ 13.683.33 $ 35,085.47 $ (100,000.00) (82,905.98) (75,600.85) (63,11344) (15,084.93) (1.401.60) 33,683.88 Measurement Decision Net Present Value Accept because NPV is positive Profitability Index Accept because is greater than I Accept because is greater than K Internal Rate of Return Payback Period Reject because the PP is greater than 3 years Discounted Payback Period Reject because the PP is greater than 3 years ment: Explain your decision about this Project. Comment about the different measurement results. (5pts)

Step by Step Solution

★★★★★

3.52 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Ultimately the best way to measure project performance is to establish your goals ahead ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started