Question

Generally accepted accounting principles (GAAP) require organizations to prepare both an income statement and a balance sheet. Before the balance sheet can be prepared, the

Generally accepted accounting principles (GAAP) require organizations to prepare both an income statement and a balance sheet. Before the balance sheet can be prepared, the organization's net income must be determined. This requires the accountant to pull together data from numerous system accounts and other sources of information. In this part of the assessment, demonstrate your skill in putting together the necessary account data and preparing an income statement in good form.

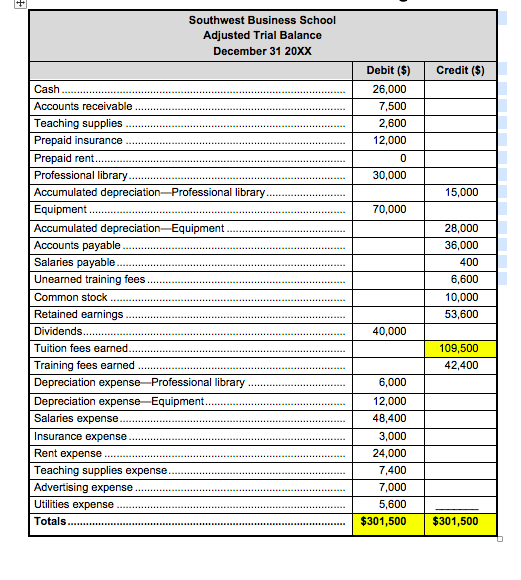

Use the Assessment 2, Part 3 Template to complete Part 3 of the assessment. On the first page of the template is financial data for Southwest Business School. On the second page is a blank income statement. Use the information provided on the first page to prepare the income statement on the second page.

assessment 2:

assignment 3:

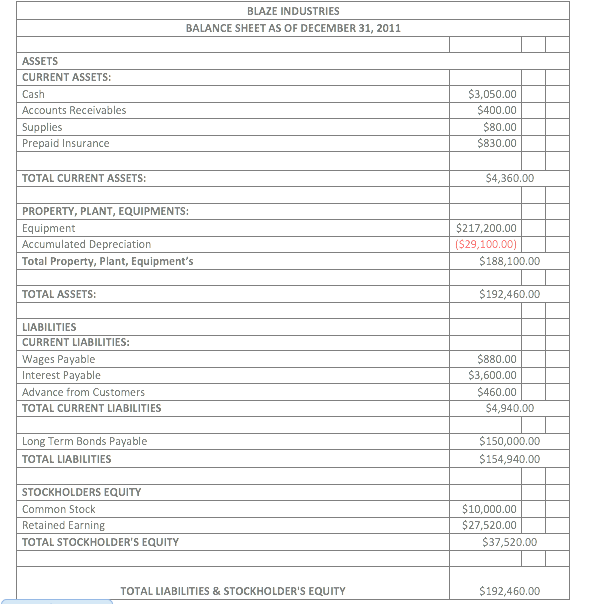

BLAZE INDUSTRIES BALANCE SHEET AS OF DECEMBER 31, 2011 ASSETS CURRENT ASSETS: Cash Accounts Receivables Supplies Prepaid Insurance $3,050.00 $400.00 $80.00 $830.00 TOTAL CURRENT ASSETS: $4,360.00 PROPERTY, PLANT, EQUIPMENTS: Equipment Accumulated Depreciation Total Property, plant, Equipment's $217,200.00 ($29,100.00) $188,100.00 TOTAL ASSETS: $192,460.00 LIABILITIES CURRENT LIABILITIES: Wages Payable Interest Payable Advance from Customers TOTAL CURRENT LIABILITIES $880.00 $3,600.00 $460.00 $4,940.00 Long Term Bonds Payable TOTAL LIABILITIES $150,000.00 $154,940,00 STOCKHOLDERS EQUITY Common Stock Retained Earning TOTAL STOCKHOLDER'S EQUITY $10,000.00 $27,520.00 $37,520.00 TOTAL LIABILITIES & STOCKHOLDER'S EQUITY $192,460.00 Southwest Business School Adjusted Trial Balance December 31 20XX Credit ($) Debit ($) 26,000 7,500 2,600 12,000 0 30,000 15,000 70,000 Cash Accounts receivable Teaching supplies Prepaid insurance Prepaid rent Professional library Accumulated depreciation-Professional library. Equipment Accumulated depreciation Equipment Accounts payable Salaries payable Unearned training fees. Common stock Retained earnings Dividends....... Tuition fees earned. Training fees earned Depreciation expense-Professional library Depreciation expense-Equipment. Salaries expense Insurance expense Rent expense Teaching supplies expense Advertising expense Utilities expense Totals...... 28,000 36,000 400 6,600 10,000 53,600 40,000 109,500 42,400 6,000 12,000 48,400 3,000 24,000 7,400 7,000 5,600 $301,500 $301,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started